In contrast to peers that have seen a drop in Stress Capital Buffer (“SCB”) requirement following the Federal Reserve’s 2023 stress test,Citigroup Inc. C announced that its SCB requirement increased to 4.3% from the current 4%.

With this, the bank’s preliminary standardized Common Equity Tier 1 (CET1) capital ratio regulatory requirement has also increased to 12.3% from the current 12%. The requirement will be effective from Oct 1, 2023, through Sep 30, 2024.

Notably, as of the first-quarter 2023 end, Citigroup reported a Standardized CET1 capital ratio of 13.44%. This includes a 100-basis-point management buffer and is above the new regulatory requirement.

Despite the stringent regulatory capital requirements, the wall street biggie’s board of directors approved a plan to increase the current quarterly dividend by 4% to 53 cents for third-quarter 2023. Moreover, the company repurchased shares worth $1 billion in second-quarter 2023.

Jane Fraser, CEO of C, said, “While we would have clearly preferred not to see an increase in our stress capital buffer, these results still demonstrate Citi’s financial resilience through all economic environments, including the severely adverse scenario envisioned in the Federal Reserve’s stress test. Our robust capital and liquidity position, as well as the diversification of our funding and our business model, allow Citi to continue to be a source of strength for our clients and navigate challenging macro environments securely.”

This aside, the bank started a discussion with the Federal Reserve to understand differences in non-interest income between the Federal Reserve’s stress results and Citigroup’s Dodd-Frank Act Stress Test results.

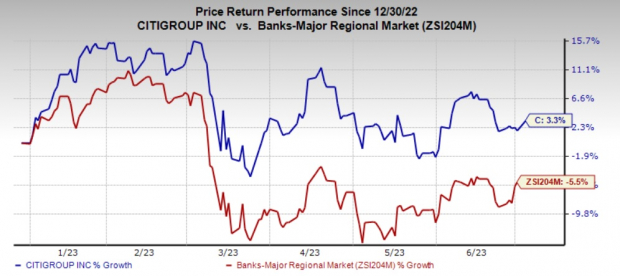

Shares of C have gained 3.3% in the year-to-date period against the industry’s fall of 5.5%.

Image Source: Zacks Investment Research

C currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Other Banks With Enhanced Capital Deployment Plans

Some other large U.S. banks, including JPMorgan JPM and The Goldman Sachs Group, Inc. GS, said on Friday that they would return more cash to shareholders after sailing through the 2023 stress test.

JPM, the largest U.S. bank, intends to raise the quarterly dividend by 5% to $1.05 per share. This follows no change in the last year’s dividend payout.

Likewise, GS announced plans to hike the dividend from the current $2.50 per share to $2.75. Notably, the stress test determined GS’ SCB at 5.5%, resulting in a minimum CET1 ratio requirement of 13%.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.