I have said many times that anybody who makes investment decisions based on their own partisan political bias is a fool. It is a folly practiced by both sides of the political divide. There were plenty of people who sold after Barack Obama’s election, based on the image of him as a “radical socialist” that was so popular in the right-wing media. They missed out on one of the greatest eight-year periods in the history of the stock market.

There were also people who sold when Trump was elected, believing what they heard in their own echo chambers that he was a serial bankrupter who would run America into the ground just as he had so many of his own businesses. They missed out too, as stocks showed historic gains from 2017-2019.

Even more damaging than partisanship is basing trades on what politicians say they will do, or what commentators say politicians will do. There are those, for example, who bought big oil stocks when Donald Trump was elected because he was pro-fossil fuels. They got killed: XOM went from around $84 after the 2016 election to around $32 when the 2020 election rolled around, a loss of 62% in a period where the S&P 500 gained over 60%. Since the “anti-oil” Biden was elected, on the other hand, that stock has gained over 160%.

In short, no matter how you align politically, it's unwise to invest based on that.

However, that doesn’t mean you should completely ignore politics. When politicians move from talking about something to actually passing legislation, it can have a powerful influence on specific industries. Free market purists might argue that any law that distorts market influences is harmful in the long run, but government favor (and, of course, government money) can give industries a boost that lasts a decade or more.

So, with that in mind, the question becomes: Why are U.S. chip stocks still languishing?

Two weeks ago, President Biden signed the CHIPS Act into law, legislation that attempts to address the fact that only around ten percent of semiconductors are made in the United States. In an increasingly tech-dependent world, that represents a security risk as well as a missed economic opportunity, which is presumably why the bill received bipartisan support.

One could, of course, argue that handing $10-15 billion to companies like Intel (INTC) and Micron (MU), which made profits of $43.8 billion and $5.9 billion respectively last year, when there is real poverty in America or a massive government debt, is not the best use of resources. But that is a discussion for another time and place, and indeed, speaks to my earlier point about investing based on your political outlook.

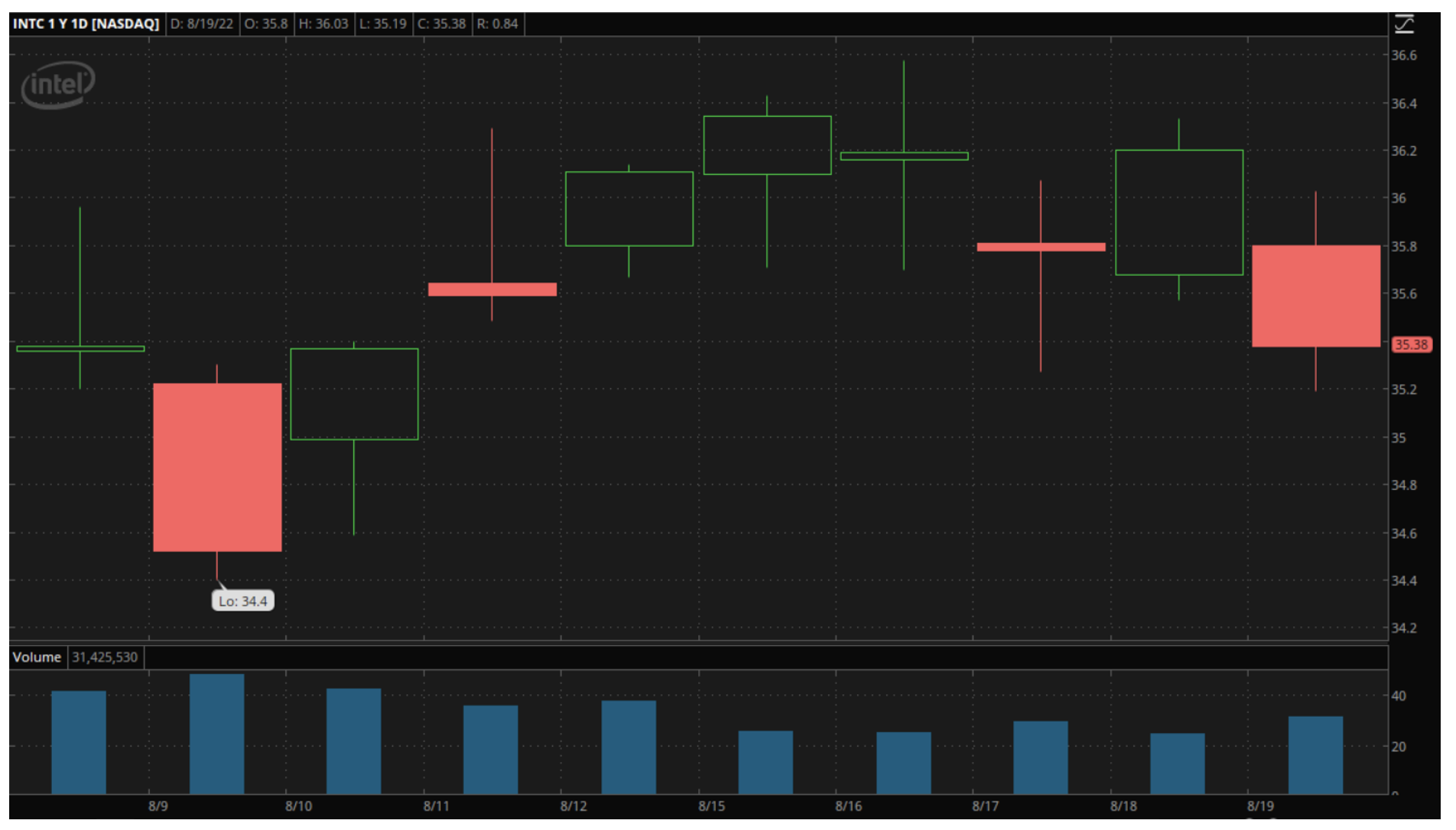

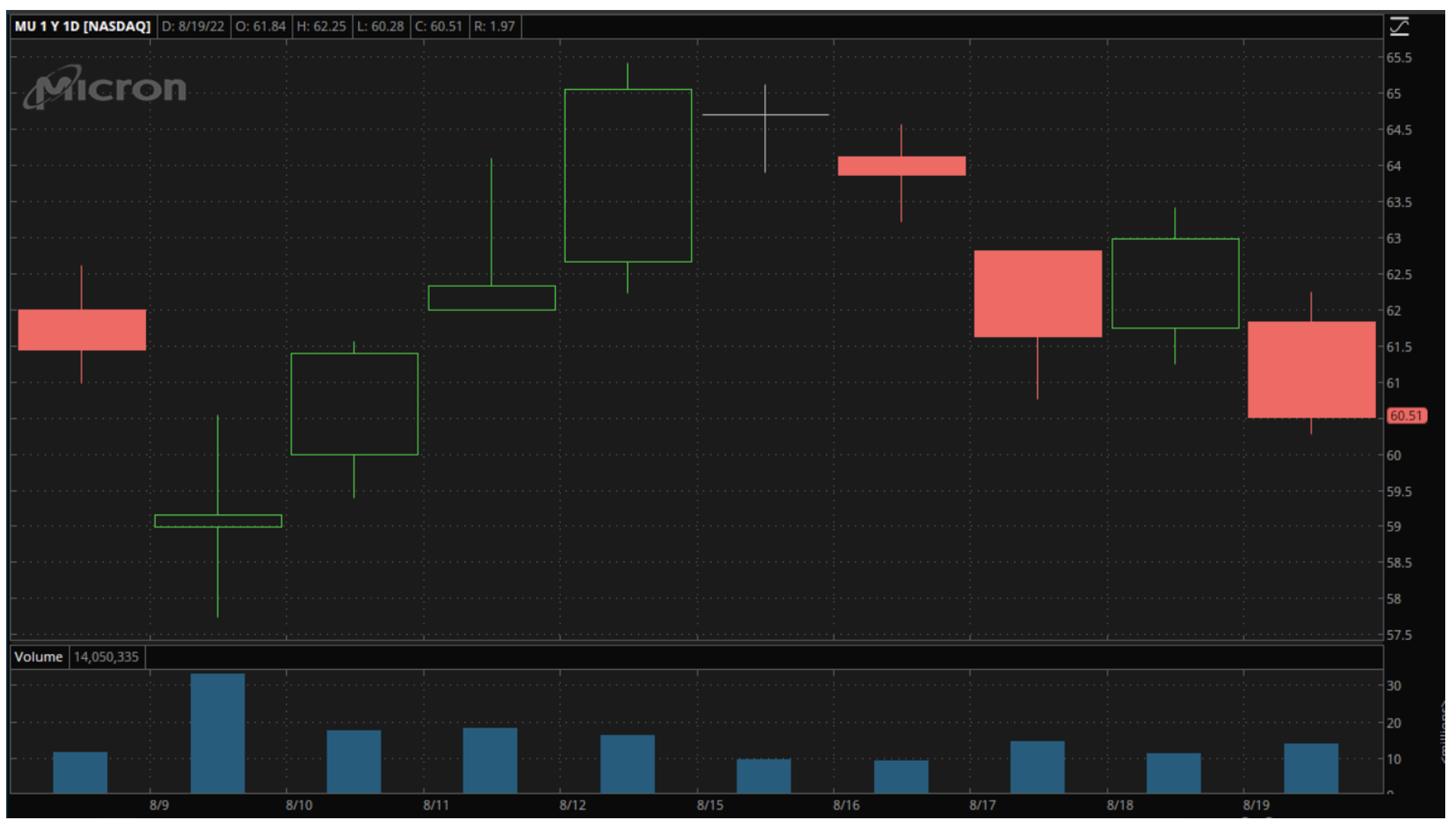

Instead, my job is to look at how this kind of thing specifically impacts stocks. From that perspective, it has created a big opportunity in both of the above-mentioned companies; analysts at Bank of America and Piper Sandler, among others, see MU and INTC as two of the biggest beneficiaries of the CHIPS Act. Since the Act was signed into law on August 9, however, both stocks have barely moved, underperforming the S&P 500 as they did so:

I understand that these are growth-sensitive stocks and that the global outlook isn’t too great right now, but they have been handed a big competitive advantage, and the stocks just don’t reflect that at these levels. And by the way, if you think the subsidies in the CHIPS Act are way too high now that the industry has been recognized as having strategic importance, or that all they're getting is that initial sum, think again. If you doubt me, keep in mind that the energy business, according to an IMF report, received $5.9 trillion in subsidies in 2020!

History tells us that once the dam is broken and industries get government subsidies, the amount of money they get tends to grow. With such huge room for expansion in market share and with the government money tap turned on, buying stocks like INTC and MU at what could well be near the bottom of the cycle in a very cyclical industry looks like a good long-term play for investors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.