Key Takeaways

- Pet care player Chewy Inc. has seen its stock value grow 6% in the past month.

- Chewy stock closed at $37.01 during Friday's trading session, sitting 5.3% below its 52-week high of $39.10.

- With CHWY stock trading at elevated levels, has the margin of safety for new investors widened or grown slim?

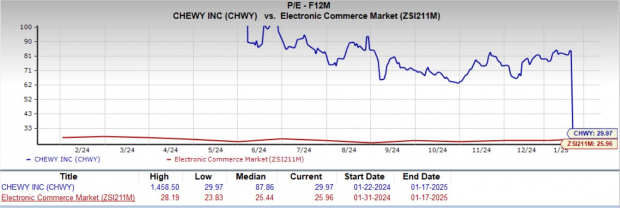

Chewy Inc. CHWY is a prominent player in the pet care industry, leveraging its e-commerce platform to cater to a growing base of pet owners. CHWY is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 29.97X, which positions it at a premium compared to the industry’s average of 25.96X. The critical question for investors is whether the best opportunity to buy CHWY stock has passed.

CHWY Trading at Premium

Image Source: Zacks Investment Research

CHWY stock's 6% jump in the past month may have contributed to its premium trading status. While the rally reflects optimism about the company's operational efficiency and strategic initiatives, the question is whether the current valuation leaves room for further upside.

CHWY Stock’s Past One-Month Performance

Image Source: Zacks Investment Research

A thorough analysis is essential for making an informed investment decision on whether to buy, hold or sell the stock. It is crucial to examine Chewy's fundamental drivers and strategic initiatives.

Chewy stock closed at $37.01 during Friday’s trading session, sitting 5.3% below its 52-week high of $39.10, reached on June 27, 2024. However, CHWY is trading above its 50-day moving average, suggesting a bullish trend. With that in mind, let’s dive into CHWY’s prospects and determine the best course of action for your portfolio.

CHWY Trades Above 50-Day Moving Average

Image Source: Zacks Investment Research

Chewy’s Autoship Program Powers Revenue Growth

Chewy has firmly established itself as a leader in the online pet retail industry, capitalizing on innovative strategies and a customer-focused approach. With an expanding customer base, a recurring revenue model and diversified service offerings, including veterinary clinics and pharmacy services, Chewy has laid a robust foundation for sustained growth. For fiscal 2024, the company projects net sales between $11.79 billion and $11.81 billion, indicating an approximate 6% year-over-year increase.

A cornerstone of Chewy’s success is its Autoship program, which generated $2.3 billion in sales during the third quarter, accounting for 80% of net sales and achieving an 8.7% year-over-year increase. This highlights the program’s vital role in fostering predictable, recurring revenue streams. Furthermore, nondiscretionary categories such as consumables and healthcare products comprised 85% of net sales, demonstrating the company’s focus on stable demand segments that are less susceptible to economic fluctuations.

Chewy’s active customer base grew sequentially in the third quarter, adding 160,000 customers to reach 20.2 million, a promising indicator of strong customer engagement and effective marketing strategies. Chewy expects modest year-over-year growth in active customers by the end of fiscal 2024, a trend likely to strengthen in 2025. The net sales per active customer (NSPAC) rose 4.2% year over year to reach $567, marking an increase in wallet share.

The company’s entry into the veterinary services market through Chewy Vet Care has unlocked access to a $25 billion total addressable market. By the third quarter, Chewy was operating six veterinary clinics and is on track to meet the high end of its fiscal 2024 target of four to eight clinics. These clinics serve as effective entry points for attracting new customers and integrating them into Chewy’s broader ecosystem. The Chewy+ Membership Program has also shown encouraging early results, signaling potential for enhanced customer retention.

Chewy’s sponsored ads business is on track to meet the low end of its long-term target range of 1-3% of net sales by fiscal 2024. This high-margin revenue stream supports the company’s efforts to improve gross margins and diversify income sources. Chewy’s expansion into the Canadian market continues to gain traction, with notable improvements in metrics such as Autoship penetration, net sales growth and profitability.

Factors That May Lead to a Pullback in CHWY Stock

Chewy has consistently captured the attention of investors, thanks to its strong market presence and solid financial performance. Yet, despite its successes, the stock isn't immune to challenges that could lead to a pullback. While Chewy's growth trajectory appears promising, there are several factors — both market-driven and company-specific — that could impact the stock’s performance. Slowing growth, potential customer acquisition saturation and rising cost pressures are critical areas that investors should monitor.

Despite the third-quarter adjusted EBITDA margin expanding to 4.8%, Chewy’s fourth-quarter margin guidance signals a sequential decline to 3.4%. This contraction is attributed to higher seasonal marketing costs and promotional activity during the holiday season.

Chewy also operates in a highly price-sensitive market, where competitors such as Petco Health and Wellness Company, Inc. WOOF, Central Garden & Pet Company CENT and BARK, Inc. BARK quickly adjust their pricing strategies to attract customers. In addition, underlying inflationary pressures, especially in logistics, labor and raw materials, could squeeze margins.

The company’s elevated advertising and marketing expenses, which reached $191.8 million or 6.7% of sales in the third quarter, reflect an aggressive push to acquire and retain customers. These expenses are projected to reach the high end of the 6% to 7% guidance range for the full year. This may strain profitability if revenue growth does not pick up.

How Consensus Estimates Stack Up for CHWY

The Zacks Consensus Estimate for earnings per share has seen downward revisions. Over the past 60 days, analysts have lowered their estimates by 3 cents to 20 cents per share for the final quarter and by 7 cents to $1.08 for fiscal 2024.

Image Source: Zacks Investment Research

See the Zacks Earnings Calendar to stay ahead of market-making news.

Conclusion: Is the Best Buying Window Closed?

Chewy stock has had an impressive run, and its premium valuation signals investor confidence in the company’s growth story. However, with the stock trading at elevated levels, the margin of safety for new investors appears slim. For those with a long-term horizon, Chewy’s innovative initiatives and strong financial position make it a promising candidate. However, cautious investors may prefer to wait for a pullback before committing to new positions. In conclusion, while the best buying window may have passed, Chewy remains a stock worth monitoring for future opportunities. CHWY currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Central Garden & Pet Company (CENT) : Free Stock Analysis Report

Petco Health and Wellness Company, Inc. (WOOF) : Free Stock Analysis Report

Chewy (CHWY) : Free Stock Analysis Report

BARK Inc. (BARK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.