Key Takeaways

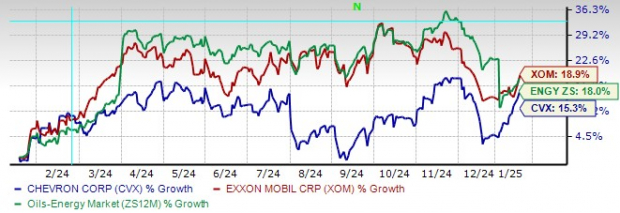

- Chevron stock has gained 15.3% this year, underperforming the wider industry growth of 18.0%.

- Chevron's earnings estimates for 2024 and 2025 have declined over the recent past, reflecting headwinds.

- Yet the company's strong fundamentals and reliable dividend yield provide downside protection.

Chevron Corporation (CVX) aims to achieve $6-$8 billion in free cash flow growth next year, fueled by strategic initiatives and operational enhancements. Key drivers include robust expansion in the Gulf of Mexico, the integration of Hess Corporation’s HES assets, and ongoing cost optimization efforts. Despite these positives, Chevron's stock has underperformed compared to ExxonMobil (XOMCVX) and the broader Oil/Energy sector over the past year. Coupled with declining earnings estimates for 2024 and 2025, Chevron presents a mixed investment case.

CVX, XOM 1-Year Stock Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Strength in Chevron’s Strategic Initiatives

Gulf of Mexico and Permian Expansion: Chevron’s Gulf of Mexico production is projected to increase from 200,000 barrels of oil equivalent per day (BOE/d) in 2023 to 300,000 BOE/d by 2026. Key projects include the Whale facility, expected to peak at 75,000 BOE/d, and the Anchor project, both of which have commenced production. These high-margin operations complement the company’s Permian Basin growth, where 80% of the acreage benefits from low or no royalty payments, enhancing cash flow.

Hess Merger and Portfolio Diversification: The pending $53 billion Hess acquisition positions Chevron for long-term growth, particularly through Hess' prolific Guyana assets. Once finalized, the merger could significantly boost Chevron’s upstream production and cash flow. However, the arbitration with ExxonMobil and China’s CNOOC over Guyana’s assets introduces uncertainty, with a resolution expected by mid-2025.

Financial Discipline and Shareholder Returns

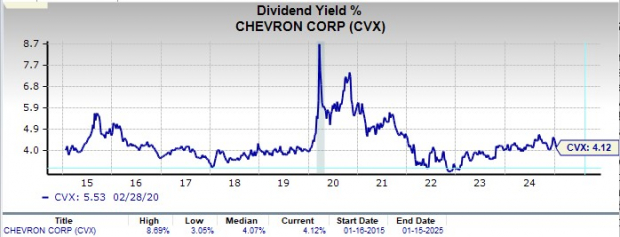

Chevron’s commitment to disciplined capital allocation is evident in its $14.5-$15.5 billion capex guidance for 2025, which aligns with its strategy to maintain financial resilience. The company’s robust balance sheet supports shareholder returns, evidenced by a record $7.7 billion returned in Q3 2024 through dividends and share repurchases. With a 4.1% dividend yield surpassing its 10-year average, Chevron continues to attract income-focused investors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

While Chevron’s appeal as an oil supermajor remains strong, a few critical risks still loom ahead for the stock, including:

Near-Term Headwinds for CVX

Declining Earnings and Sector Performance: Chevron’s earnings estimates for 2024 and 2025 have declined over the recent past, reflecting headwinds such as weaker downstream margins and fluctuating commodity prices. Additionally, the stock’s 15% gain over the past year trails its peers, raising concerns about its relative competitiveness.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Hess Integration Risks: The Hess merger, while promising, faces potential delays due to arbitration over Guyana’s assets. An unfavorable outcome could impact Chevron’s ability to fully capitalize on Guyana’s high-return projects, dampening the anticipated benefits of the acquisition.

Cost Pressures and Portfolio Restructuring: Chevron’s cost-reduction initiatives aim to save $2-$3 billion by 2026. However, the $6.5 billion sale of interests in the Athabasca Oil Sands Project and Duvernay Shale reduces near-term production by 84,000 barrels of oil equivalent per day. Although aimed at optimizing the portfolio, these divestments and associated restructuring efforts could temporarily elevate costs and weigh on revenues.

Conclusion: Hold Chevron

Chevron’s strategic focus on high-return projects and disciplined capital allocation underpins its growth potential. The Gulf of Mexico expansion, Permian Basin growth, and Hess merger are key catalysts for increased cash flow and shareholder value. However, challenges such as declining earnings estimates, integration risks, and production loss from divestments temper the bullish narrative.

Given these factors, the Chevron stock appears to be fairly valued at the current levels. While the company’s strong fundamentals and reliable dividend yield provide downside protection, near-term headwinds warrant a cautious approach. Investors may find better opportunities elsewhere within the energy sector. For now, CVX carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.