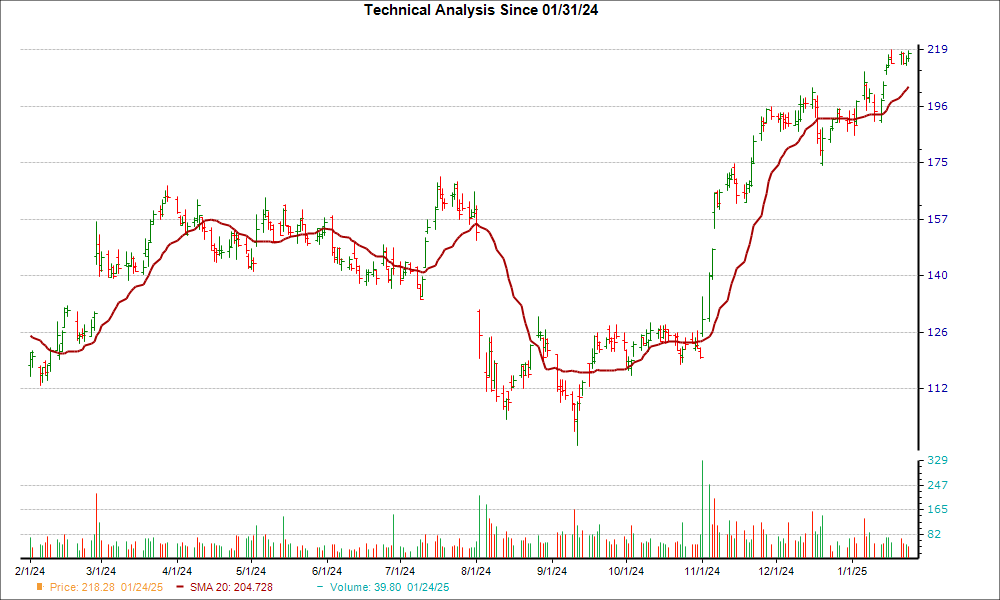

From a technical perspective, Chart Industries (GTLS) is looking like an interesting pick, as it just reached a key level of support. GTLS recently overtook the 20-day moving average, and this suggests a short-term bullish trend.

The 20-day simple moving average is a popular trading tool. It provides a look back at a stock's price over a 20-day period, and is beneficial to short-term traders since it smooths out price fluctuations and provides more trend reversal signals than longer-term moving averages.

Similar to other SMAs, if a stock's price moves above the 20-day, the trend is considered positive, while price falling below the moving average can signal a downward trend.

GTLS could be on the verge of another rally after moving 11.4% higher over the last four weeks. Plus, the company is currently a Zacks Rank #3 (Hold) stock.

Once investors consider GTLS's positive earnings estimate revisions, the bullish case only solidifies. No earnings estimate has been lowered in the past two months, compared to 1 raised estimates, for the current fiscal year, and the consensus estimate has increased as well.

Given this move in earnings estimate revisions and the positive technical factor, investors may want to keep their eye on GTLS for more gains in the near future.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpChart Industries, Inc. (GTLS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.