By Krishnan Raghunathan, Head – Finance & Accounting Practice, WNS

While Bill Gates had spoken years ago about the possibility of a pandemic of gargantuan proportions, the world had still not prepared itself for the kind of one that struck in early 2020. No business had a playbook for it. Therefore, how business leaders responded and continue to respond to such an event can be a defining moment for them personally, and the organization itself. Contrary to expectations, most CFOs did not go for a myopic view by doubling down on spending cuts and tighter controls. They are focusing on opportunity in this crisis to prepare the enterprise for longer term value creation for shareholders.

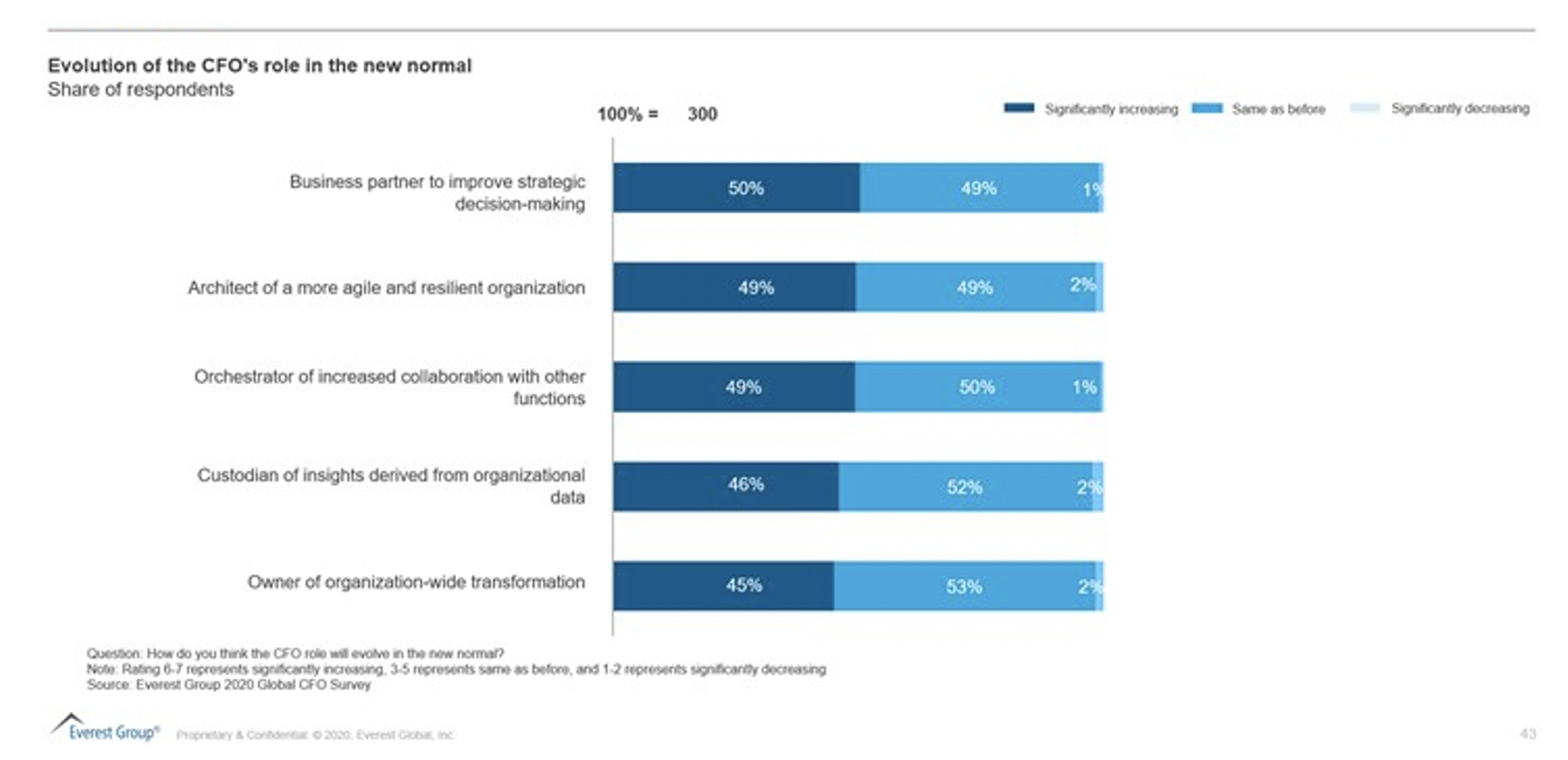

This was evident as a key finding in the “Global CFO Survey 2020” conducted by Everest Group, a leading consulting and research firm, supported by WNS. The survey that covered more than 300 CFOs and their direct reports from over 20 industry sectors across five continents, shows how CFOs see their roles evolving post COVID-19 (52 percent of respondents were either from North America or had significant business presence in North America; 81% of them were from billion dollar plus organizations).

As businesses work their way out of the current crisis and look for opportunities in the post-COVID world, we will see the CFO occupy near-equal screen time as the CEO. Over 49 percent of the CFOs in the survey said their role has increased significantly as the “architect of a more agile and resilient organization.”

The survey highlights that CFOs are playing a much larger role in creating business value from more informed insights upfront into business decisions (as against reports at the end of the process). They also need to play a key role in improving stakeholder (Customers, employees and vendors) experience by enabling cross-functional collaboration.

More than 55% of respondents said “Speed of decision-making” will be a key characteristic of future-ready organizations. Besides taking smart decisions using data analytics to find more cash flow, the CFO needs to embody the characteristics of a future-ready organization. It means agility in adapting to the changing environment, making quick decisions, being digitally savvy, and staying resilient in the face of business continuity challenges.

As the study shows, CFOs are looking at three key short-term priorities – implementing a work-from-home model, increasing the adoption of digital technologies, and addressing current liquidity concerns. In the long run, their top priorities are to ensure viability of the business through the downturn, addressing the liabilities and risks associated with the new modes of working, assessing the relevance of the current business model in the new normal and operational preparedness in the post-COVID world.

Top three business goals emerge from these priorities:

Business Goal #1 – Agility & Resilience: Businesses today face significant risks due to factors impacting the new normal business environment. Permanent changes in regulations and compliance, exposure from fundamental shifts in customer buying patterns, growing political instability, or supply chain stability are some of the key risks that CFOs are concerned about. 58 percent respondent felt that building agility in adapting to future changes will be the key characteristic of being future ready. More than 50 percent of the respondents want to:

- accelerate adoption of digital to improve agility & resilience

- embed more robust BCP plans

- re-evaluate organization’s current location strategies.

Business Goal #2: Insights-led Digital Finance: I see the emergence of what is being widely discussed as the “Finance OneOffice”, which is the integration of front, middle and back-office operations, supported by intelligent automation and analytics. The finance function needs access to real-time information and visibility across processes to be able to support the needs of internal and external customers. Survey respondents stressed on the need for increased use of data as fuel (upfront / input into processing) and not just exhaust (reporting at the end of process). CFOs also see themselves as orchestrators of increased collaboration with other functions in the future. This will mean enabling more upstream and downstream integration, convergence of systems and tools, and seamless data flow. While the Finance OneOffice could help achieve the integration and drive a better experience for customers, vendors and employees, the flip side could be that most CFOs and their teams might turn to a technology-led approach to achieve these goals. The technology-led approach has shown an overwhelming evidence of not living up to the promise. I believe a process-led approach backed by the right technology, in contrast, could be far more robust in delivering the desired change and impact.

Business Goal #3: Compliance, Controls and Policies: To protect the organization in this environment, CFOs need to work with the business to limit the exposure of its digital assets to increased online threats without disrupting business as usual. In addition to the above, continuity of digital assets and protecting data is extremely critical. Forty-seven percent of respondents highlighted that they were already providing significant support to the business in reviewing compliance and controls to mitigate risks in the new environment.

Surprisingly, despite the cost challenges that organizations are facing, CFOs rate supporting their businesses to reduce operational costs the lowest among key focus areas. With larger focus on preparing organization to be future ready, more than 45 percent respondents highlighted legacy systems and cultural inertia to change as top roadblocks to succeed in the new normal. However, only 21 percent had a large appetite to invest aggressively in the required transformation. More than 80 percent of the respondents said they would leverage providers or shared services to design and execute transformation. This could be a smart move, as future readiness does not have to be investment-heavy.

The future of finance is now. We see it as one that allows flexibility in terms of innovative, ‘as-a-service’ commercial models; the convergence of systems; data-driven processes; and improved management of risks and compliance. In that evolved finance function, the CFO needs to wear multiple hats. On the one hand, she or he needs to ensure stability and control of the finance function, and on the other, enable business agility and profitability.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.