Cerence CRNC shares have returned 75.1% year to date, outperforming the broader Zacks Computer and Technology sector’s appreciation of 3.5% and the Zacks Computers - IT Services industry’s return of 1.3%.

Since the first-quarter fiscal 2025 results reported on Feb. 7, CRNC stock has returned 8%. The company reported impressive first-quarter fiscal 2025 results, with a non-GAAP loss of 3 cents per share, beating the Zacks Consensus Estimate by 88.89%. Revenues of $50.9 million surpassed the Zacks Consensus Estimate by 3.62%. However, the top line fell 63.2% year over year.

Cerence’s technology was used in 51% of auto production in the first quarter of fiscal 2025. The company shipped roughly 11 million cars with Cerence technology in the fiscal first quarter, up 2.6% sequentially but down 10.5% year over year. The number of cars produced using Cerence’s connected services increased 5.1% on a trailing 12-month basis year over year and 5.6% sequentially.

CRNC's AI technology powers more than 500 million cars globally, highlighting its extensive market reach and leadership in the automotive AI sector. The company is riding on the successful integration of generative AI (Gen AI) solutions, record platform launches and a robust partner network. Cerence’s solutions include conversational and Gen AI, and audio and communication AI. Collaborations with NVIDIA NVDA and Microsoft MSFT strengthen CRNC’s position in automotive AI.

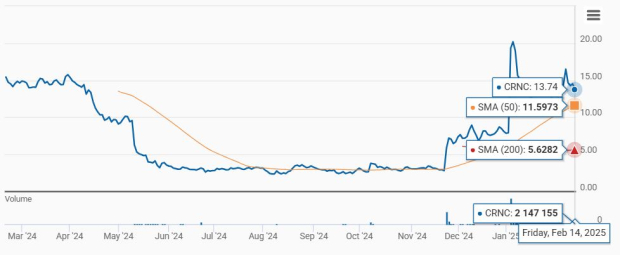

CRNC Stock’s Performance

Image Source: Zacks Investment Research

CRNC Offers Solid FY25 Top-Line Growth Guidance

For fiscal 2025, Cerence expects revenues between $236 million and $247 million.

Adjusted EBITDA is expected between $15 million and $26 million for fiscal 2025.

For the second quarter of fiscal 2025, CRNC expects revenues between $74 million and $77 million, including an estimated $20 million in fixed contracts.

The Zacks Consensus Estimate for second-quarter fiscal 2025 revenues is currently pegged at $76.57 million, indicating growth of 12.89% over the figure reported in the year-ago quarter.

The consensus mark for second-quarter fiscal 2025 earnings is currently pegged at 32 cents per share, up 30 cents over the past 30 days.

Cerence Inc. Price and Consensus

Cerence Inc. price-consensus-chart | Cerence Inc. Quote

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

CRNC’s Expanding Auto Clientele Boosts Prospects

Cerence’s prospects ride on an expanding automotive clientele. CRNC achieved 10 customer wins and launched six Gen AI programs in fiscal 2024, showcasing strong momentum in deploying advanced AI solutions.

Major automotive OEMs, including Volkswagen, BMW and Renault, have implemented Cerence's voice assistance systems to enhance in-car interactions.

The company set a record with 22 platform launches in 2024. It recently announced a multi-year agreement with JLR to develop the luxury automaker's next-generation in-car experience. Cerence’s Gen AI technology was chosen by Audi to enhance the capabilities of its in-car assistant.

Rich Partner Base Aids CRNC’s Top-Line Growth

The introduction of the Cerence Automotive Large Language Model (CaLLM), powered by NVIDIA, transforms in-car computing platforms by tackling automaker challenges and enhancing user experiences through advanced generative AI capabilities. CRNC plans to launch a next-generation product based on its CaLLM family of language models to market.

CRNC’s collaboration with Microsoft further amplifies its technological edge by integrating OpenAI’s ChatGPT model into vehicles via Microsoft Azure. This integration aims to enhance in-car user experiences by combining Cerence’s automotive technology with Microsoft’s cloud capabilities.

Tuya TUYA is partnering with Cerence to provide multilingual text-to-speech for its cloud developer platform designed specifically for two-wheeled vehicles, including motorcycles, e-bikes and more.

CRNC Shares are Overvalued

Cerence shares are overvalued, as suggested by the Value Score of D.

However, CRNC shares are trading above the 50-day and 200-day moving averages, indicating a bearish trend.

CRNC Shares Trade Above 50-Day & 200-day SMA

Image Source: Zacks Investment Research

Conclusion

CRNC’s shares have been suffering from intense competition across the automotive voice assistance domain from SoundHound AI, which also focuses on voice recognition and conversational AI solutions.

Sluggishness in the automotive production volume, slowdown in electric vehicle production, cost pressures and weakness in China are expected to hurt CRNC’s prospects. Its stretched valuation is a concern despite a growing partner base and an expanding clientele.

Cerence currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point to accumulate the stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Cerence Inc. (CRNC) : Free Stock Analysis Report

Tuya Inc. Sponsored ADR (TUYA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.