Celanese Corporation CE recently announced the completion of its earlier announced formation of Nutrinova Food Ingredients joint venture (JV) with Mitsui & Co., Ltd. Celanese provided assets, technology and staff from its Food Ingredients division while maintaining a 30% share in the JV. Mitsui paid $472.5 million for the remaining 70% ownership, representing an enterprise valuation of about 15 times 2022 EBITDA.

Celanese has monetized the majority of its Food Ingredients business while maintaining the demand benefits of raw material integration with the Acetyl Chain. Celanese will swiftly utilize transaction proceeds in the third quarter to execute its deleveraging strategy. It is on track to significantly surpass its full-year goal of reducing net debt by $1 billion in 2023.

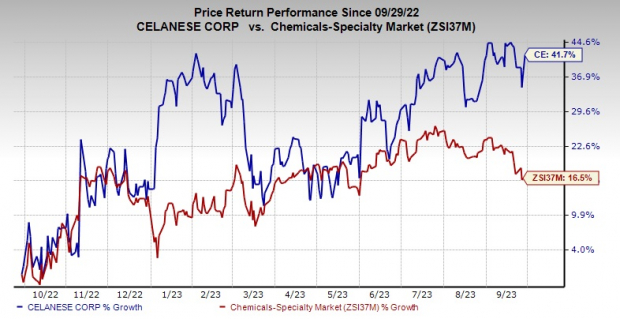

Shares of Celanese have gained 41.7% over the past year compared with a 16.5% rise of its industry.

Image Source: Zacks Investment Research

Celanese, on its second-quarter call, said that it sees adjusted earnings in the range of $2-$2.50 per share for the third quarter of 2023. The projection includes the expected roughly 30 cents impact from the M&M amortization. Moreover, for the full year, Celanese anticipates adjusted earnings in the range of $9-$10, which includes approximately $1.20 per share of M&M transaction amortization.

Recognizing the volatility and unpredictability of the current market landscape and competitive environment, the company is proactively implementing strategic initiatives. These actions involve strengthening its commercial teams, aligning production and inventory levels with prevailing demand, implementing cost-saving measures and optimizing cash flow. These endeavors are anticipated to result in robust cash generation throughout 2023 and a continuation of earnings growth during the second half of the year.

Zacks Rank & Key Picks

Celanese currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, The Andersons Inc. ANDE and Hawkins Inc. HWKN.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). The stock has rallied roughly 110.3% in the past year. CRS beat the Zacks Consensus Estimate in three of the last four quarters while meeting in one. It delivered a trailing four-quarter earnings surprise of 9.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Andersons currently carries a Zacks Rank #1. The stock has gained roughly 70.7% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Hawkins currently carries a Zacks Rank #1. The stock has rallied roughly 57.2% in the past year. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 25.6%, on average.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to "insane levels," and they're likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Download free today.The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.