By Callie Cox for eToro

Holding a stack of cash always makes you feel some type of way. The crinkled paper in your hand, the smell wafting off the bills, the power of a stack of hundreds within your control. It’s the ultimate feeling of security.

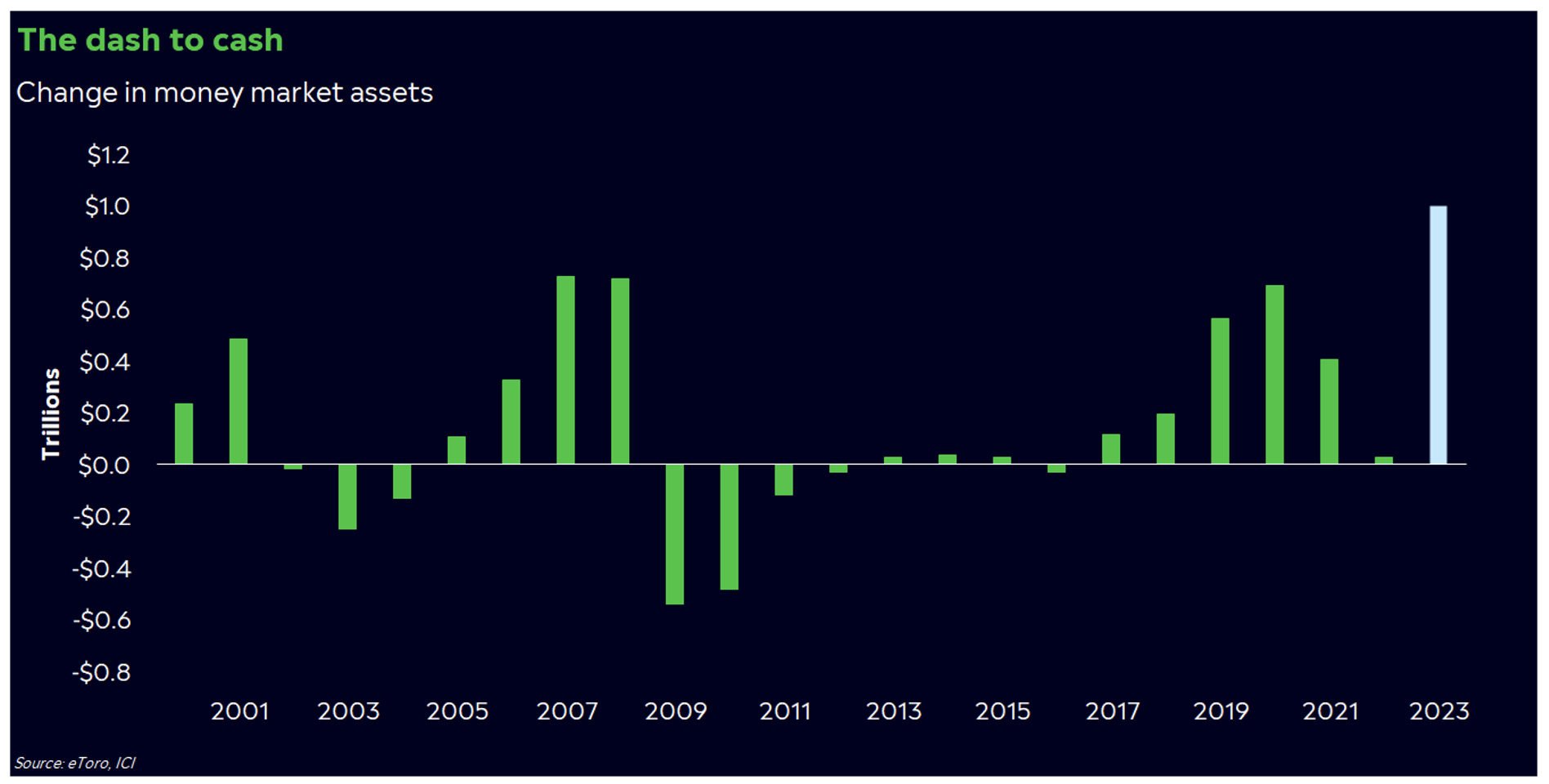

And lately, people have been opting for cash’s security instead of investing in stocks and crypto. Money market funds have grown by nearly $1 trillion this year, powered by people in search of a decent — and relatively risk-free — return. Piling into cash seems like an obvious move when rates are high and the economy feels tenuous. But the obsession with cash may have one major blind spot.

Why people are obsessed with cash

The S&P 500 is up 17% this year. Bitcoin has more than doubled. Even gold has posted a decent 9% return. Yet because of 5% interest rates, the hottest investment on Wall Street seems to be cash:

And suddenly, people who risked it all in meme stocks and speculative tech are talking about CDs, I-bonds, and Treasuries.

The change in risk appetite is enough to give you whiplash. But in a way, it makes sense. Short-term rates are at the highest in 17 years, thanks to 11 rate hikes from the Federal Reserve since March. Tack on the fact that Wall Street has been worrying about a recession all year, and you have a good argument to think about cash.

It’s not just rates and safety that are enticing people into cash, either. Americans have been spending money like crazy this year, and it’s not far-fetched to think that some are saving for short-term spending goals like a house or car. Baby Boomers are also getting older, so they may be stashing cash for retirement.

Plus, it’s easy to forget how appealing a risk-free 5% return could look in relation to the performance of some popular stocks. Nevertheless, there are a lot of people sitting on a lot of cash. But a lot of investors piling into cash have one big blind spot.

Cash isn’t meant to sit under your mattress forever.

Rates change, economies improve, people spend. Consumption and investment are what make the world go round.

You can see that on a chart of money market fund assets over time. Cash tends to build up as people become increasingly worried about the future — or they’re blindsided by a recession. But when the clouds clear and stocks enter a bull market, cash levels decline and other assets rise.

Interestingly enough, we’ve seen the opposite happen these past few years. Cash levels declined in 2022, even as the S&P 500 and Bitcoin endured vicious bear markets. This year, cash levels have risen, even though all signs point to bull markets in stocks and crypto.

From an analyst’s perspective, rising cash levels can be a good sign for other markets. People are actively putting money into cash, yet there’s still been enough investing to lead prices higher this year. That cash could eventually find its way back into stocks and crypto, leading to an even stronger bull market.

The question now, though, is what could cause people to move out of cash. That answer could boil down to interest rates and the economy. If people are moving into cash because of 5% rates, we could see that money start trickling back into markets soon. Inflation is coming under control, and that could allow the Fed to start cutting rates as soon as early next year.

But if people are moving into cash because they’re worried about a recession, we may see them stick to cash for a while. Rate hikes may disappear, but economic concerns may not. And yes, a recession can still happen.

Ultimately, it’s hard to know how sticky cash could be here. Money market data since 1950 shows that people tend to hold onto cash until an average of 13 months into a rate cut cycle, so I wouldn’t expect to see a major pivot out of cash any time soon.

Still, there could be some psychology wrapped up in this. If people are as rate sensitive as they’re acting in the stock market, a decrease in rates — which could happen to a variety of variable-rate savings and money market funds — could cause some to flee. Just don’t forget about the power of cash if rates come down and the economy stays resilient.

So what does this mean for me?

Prepare for a change. High rates are nice for your bank account, but they don’t last forever. This is important to understand, especially at this moment. If the economy slows and inflation retreats, the Fed could change from hikes to cuts, and those 5% rates could disappear. If you’re saving up for a short-term expense, it may make sense to lock in these rates while you can.

Count the costs. There are hefty opportunity costs that you accrue the longer you sit in cash. Stocks and bonds tend to beat cash over long periods of time, especially when rates reach enticing levels. If you’re somebody wrapped in the warm, fuzzy cash blanket, think about your long-term plans. Holding emergency cash in a savings account makes sense. Parking investing funds in cash for years on end doesn’t.

Get paid to wait. If you’re sitting in cash waiting for a good time to invest, well, I said what I said. But if you’re insistent on waiting, you should at least be getting paid to wait. According to Bankrate, the average rate for money market funds is just 0.61%. You can do better than that on eToro Options – we’re offering 4.9% interest on your uninvested cash with no minimum deposit. Learn more here.

If you want to read more research and analysis from eToro, check us out here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.