Canadian Solar Inc. CSIQ recently introduced EP Cube Lite at RE+ in Las Vegas, NV, to expand its residential battery storage offerings. EP Cube Lite is an advanced version of EP Cube, ensuring more savings on electricity bills for homeowners and allowing them to optimize their energy storage capacity to match their requirements.

Such enhancements in product offerings will assist the company in gaining more orders for battery storage solutions and thereby boost its revenue generation prospects.

Significance of EP Cube Lite

EP Cube Lite is a compact and efficient grid-tied energy storage solution of Canadian Solar. It enables homeowners to reduce their electricity expenses by utilizing cheaper daytime energy during evening peak-rate hours. EP Cube Lite also boasts the ability to scale from 6.6 kilowatt-hours (kWh) to 19.9 kWh capacities and is compatible with most existing PV systems, allowing homeowners to rightsize their energy storage to their needs.

EP Cube Lite also features an integrated hybrid inverter with stackable, easy-to-install storage modules. The lightweight, easy installation process leads to reduced costs of installation for both installers and homeowners. This surely entails significant financial benefits for homeowners, which will attract homeowners looking for Canadian Solar’s integrated solar and battery storage systems.

Canadian Solar’s Growth Prospects in Battery Storage

The increased penetration of the global solar market is fueling the growth of the battery storage market. Per the latest report from the U.S. Energy Information Administration, developers plan to add 7.8 gigawatts of new storage capacity in the second half of 2023. This unfolds new opportunities for companies like Canadian Solar, which is significantly expanding its presence in the battery storage market.

As of Jun 30, 2023, Canadian Solar’s total battery storage project development pipeline was 51.7 GWh, including 1.7 GWh under construction and in the backlog, and 50 GWh of projects in advanced and early-stage pipelines.

The company also continues to build momentum in this fast-growing business, with its e-STORAGE platform now having a contracted backlog of $2.1 billion, including approximately $630 million in new bookings signed in the second quarter of 2023. Such efforts by CSIQ will fetch meaningful gains and strengthen its footprint in the battery storage market.

Peers to Benefit

Other solar players that are likely to gain from the expanding battery storage market are as follows:

Enphase Energy ENPH enjoys a valuable position in the solar market by manufacturing fully integrated solar-plus-storage solutions. Its next-generation battery in North America is Enphase Encharge 3 and Encharge 10 storage systems, with a usable and scalable capacity of 3.4 kWh and 10.1 kWh, respectively. The company shipped 82.3 MWhof IQ batteries in the second quarter and expects to ship between 80 and 100 MWhof batteries in the third quarter.

Enphase’s long-term earnings growth rate is 23.2%. The Zacks Consensus Estimate for 2023 sales suggests a growth rate of 15.8% from the prior-year reported figure.

SunPower’s SPWR SunVault advanced battery technology stores solar energy for maximum efficiency. In 2022, the company announced a product-line extension in the battery-storage segment of its business by introducing 19.5 kWh and 39 kWh SunVault battery-storage products. SunPower has also begun engineering and design work on the second version of its SunVault energy storage system.

SunPower’s long-term earnings growth rate is pegged at 7.5%. The Zacks Consensus Estimate for 2023 sales calls for a growth rate of 4.3% from the prior-year reported figure.

In May 2022, SolarEdge SEDG announced the opening of Sella 2, a 2 GWh battery cell manufacturing facility. Sella 2 enables the company to have its supply of lithium-ion batteries and the infrastructure to develop new battery cell chemistries and technologies.

SolarEdge’s long-term earnings growth rate is pegged at 24.4%. The Zacks Consensus Estimate for SEDG’s 2023 sales implies a growth rate of 22.9% from the prior-year reported figure.

Price Movement

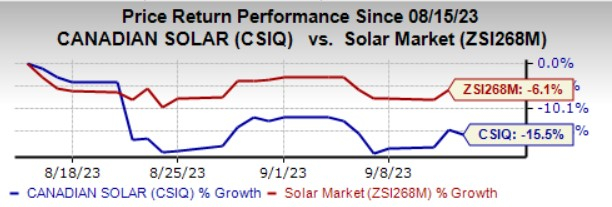

In the past month, shares of Canadian Solar have declined 15.5% compared with the industry’s fall of 6.1%.

Image Source: Zacks Investment Research

Zacks Rank

Canadian Solar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof... and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with "black gold."

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you'll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don't want to miss these recommendations.

Download your free report now to see them.Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.