Cryptocurrency prices have been reaching new heights over the past few weeks, and many investors are trying to get in on the action.

Investing in crypto can potentially be lucrative -- especially if you invest at the right time. If you had invested $1,000 in Bitcoin (CRYPTO: BTC) a decade ago, for example, you'd have more than $15 million today -- assuming you held your investments and didn't sell during that time period.

While it is possible to become a millionaire with cryptocurrency, that doesn't mean all investors will achieve that goal. So just how likely is it you'll get rich with crypto?

Image source: Getty Images.

Understanding risk versus reward

It's easy to get caught up in crypto's monumental gains. Bitcoin has surged 372% in the past year. Its competitor Ethereum is up more than 1,500% in the same time period, and Dogecoin has soared by more than 19,000%.

Based on those numbers alone, it seems hard not to get rich with cryptocurrency. But it's important to remember that past returns don't necessarily equate to future earnings, and crypto is still a very high-risk investment.

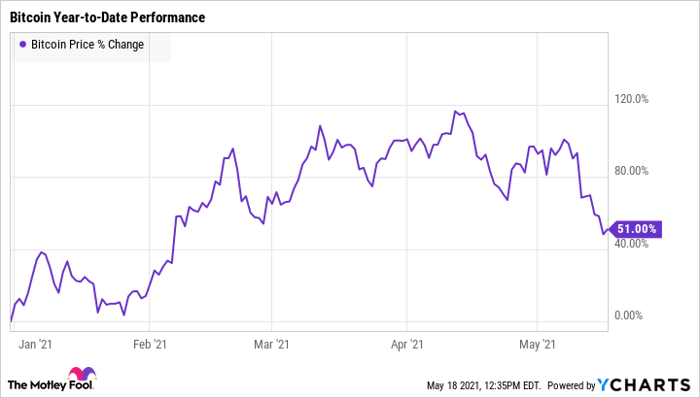

Crypto prices could continue to rise, but they could just as easily plummet. In fact, Bitcoin's price has already dropped by more than 26% over the past month, proving that cryptocurrency is incredibly volatile.

Bitcoin Price data by YCharts

Part of the reason crypto experiences so much turbulence is that it's a highly speculative investment. Nobody knows what the future holds for cryptocurrency. Whether it becomes a runaway success or a massive failure is anyone's guess. If it succeeds, you could make a lot of money by investing now. But if it crashes and burns, you could lose everything.

Should you invest in cryptocurrency?

It's hard to ignore the allure of crypto. It's a shiny new thing that promises to change the world, and if prices continue on their upward trajectory, you could make a serious amount of money.

However, think about your risk tolerance before you invest. If you're a relatively risk-averse investor, buying crypto could lead to many sleepless nights during periods of volatility.

Bitcoin regularly drops by at least 20%, and it's lost up to 80% of its value in the past. If you're starting to sweat just thinking about your investments plummeting by 80%, crypto may not be the best option.

Also, be sure your financial situation is in good shape before you even consider investing in crypto. Only invest money you can afford to lose, and double-check that you have a solid emergency fund with at least three to six months' worth of savings. This is so that you won't need to sell your crypto investments if you face an unexpected expense.

Finally, make sure you have a strong, diversified portfolio . Because cryptocurrency is so risky, you'll want a solid core portfolio that you can fall back on if your crypto investments take a turn for the worse.

Cryptocurrency can be a lucrative investment, but it's also one of the riskiest investments out there. By weighing the risks and rewards, it will be easier to decide whether cryptocurrency is the right choice for you.

10 stocks we like better than Bitcoin

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Bitcoin wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of May 11, 2021

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Bitcoin. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.