SoundHound AI SOUN recently partnered with Torchy’s Tacos to launch its Smart Ordering voice AI at the latter’s 130 locations. The system, trained on Torchy’s Tacos menu, handles 100% of calls, processes customized orders and answers menu or store-related queries. The innovation streamlines operations, letting the staff focus on food prep and in-store service.

The latest partnership will help SOUN strengthen its footprint in voice AI solutions for the restaurant and quick-service markets. The company has been benefiting from a strong portfolio, a rich partner base and an expanding clientele.

SOUN offers conversational intelligence through independent voice AI solutions in 25 languages in both cloud-enabled and hardware-embedded devices.

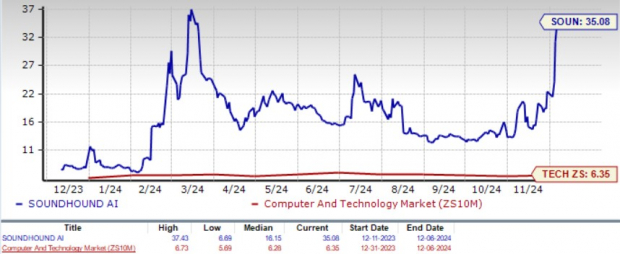

SOUN shares have skyrocketed 608% in the year-to-date (YTD) period, outperforming the Zacks Computer & Technology sector’s return of 33% and the Zacks Computers - IT Services industry’s return of 19.4%.

YTD Performance

Image Source: Zacks Investment Research

However, will SOUN shares sustain this momentum? Let’s dig deeper to find out.

SOUN Stock Overvalued

SOUN stock is overvalued at present, as its Value Score of F suggests.

The shares are trading at a significant premium with a forward 12-month Price/Sales of 35.08X compared with the sector’s 6.35X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Strong Portfolio Aids SOUN’s Prospects

SoundHound AI’s prospects benefit from its expanding footprint in industries like automotive and restaurants, driven by its innovative portfolio. It currently has more than 270 patents, with over 155 granted and 115 pending.

For restaurants, SOUN is expanding its offerings across drive-thru phone ordering and supporting their staff with Employee Assist. Its partner base in this domain includes popular names like Panda Express, Church’s Texas Chicken, White Castle, Firehouse Subs, Five Guys and Chipotle Mexican Grill CMG. In its partnership with Applebee’s, SOUN has now penetrated two-thirds of their locations.

A market leader in phone ordering solutions for restaurants, SOUN has surpassed the milestone of 100 million AI-handled customer interactions.

SOUN has strengthened its footprint in the automotive industry by introducing its advanced SoundHound Chat AI voice assistant, integrated with ChatGPT, into Peugeot, Opel, Vauxhall, Alfa Romeo, Citron and DS Automobiles vehicles across 11 European markets like Austria, France, Germany, Italy, Spain and the United Kingdom.

SOUN recently announced that the SoundHound Chat AI voice assistant has launched a new customization tool to help transform how automotive brands interact with their customers within the vehicle.

Rich Partner Base to Boost SOUN’s Top Line

SOUN’s collaborations with NVIDIA NVDA, ARM, Perplexity, Olo and Oracle are expanding its portfolio. SoundHound AI has launched an advanced in-vehicle voice assistant leveraging NVIDIA DRIVE, enabling real-time and generative AI capabilities for seamless, offline access to vehicle intelligence and personalized assistance.

SoundHound AI has partnered with Perplexity to enhance SoundHound Chat AI through the integration of Perplexity’s online Large Language Model capabilities for advanced and real-time voice assistant responses.

In India, it has entered into a partnership with VE Commercial trucks, a joint venture between Volvo and Eicher, to provide voice AI assistance. It has also expanded its partnership with Kia, adding additional Hindi language capabilities to several models.

SoundHound AI has had wins across diverse sectors with its AI agent solutions in the third quarter. Its partnerships with Telefonica TEF, MUSC Health, EXL, Truity Credit Union and Turret have been noteworthy. In government and military, SOUN has collaborated with General Dynamics Information Technology to renew a federal government contract within a branch of the U.S. Military.

SOUN’s Earnings Estimates Show Downward Trend

SoundHound AI now expects 2024 revenues to be between $82 million and $85 million. SOUN It is integrating acquisitions to drive revenue synergies and upsell opportunities, expecting 2025 revenues between $155 million and $175 million.

The Zacks Consensus Estimate for SOUN’s 2024 revenues is pegged at $83.63 million, indicating year-over-year growth of 82.3%. The consensus mark for 2024 loss is pegged at 38 cents per share, which has widened by 2 cents over the past 30 days.

For 2025, the consensus mark for revenues is pegged at $162.99 million, suggesting year-over-year growth of 94.91%. The Zacks Consensus Estimate for 2025 loss is pegged at 27 cents per share, which has widened by 28.57% over the past 30 days.

SOUN beat the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, the average earnings surprise being 1.25%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

SoundHound AI, Inc. Price and Consensus

SoundHound AI, Inc. price-consensus-chart | SoundHound AI, Inc. Quote

SOUN: Buy, Sell or Hold?

SOUN’s innovative AI-powered portfolio makes it well-positioned to benefit from strong demand across sectors like automotive, restaurants, banks and the military. This bodes well for long-term investors.

SOUN stock is currently trading above the 50-day and 200-day moving averages, indicating a bullish trend.

SOUN Stock Trading Above 50-Day & 200-Day SMA

Image Source: Zacks Investment Research

However, SoundHound AI currently has a Growth Score of F, which means it is a risky bet for growth-oriented investors. Its stretched valuation is also a concern.

SOUN currently carries a Zacks Rank #3 (Hold), suggesting that investors should wait for a better entry point to add the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Telefonica SA (TEF) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

SoundHound AI, Inc. (SOUN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.