International Business Machines Corporation IBM has inked an agreement to acquire Applications Software Technology (“AST”) LLC, a global Oracle consultancy firm. The transaction builds on IBM's previous acquisition of Accelalpha in 2024, further enhancing its capabilities to assist clients in deploying, managing and maximizing the value of Oracle cloud solutions. The transaction, subject to customary closing conditions and certain regulatory approvals, is expected to close in the first quarter of 2025.

IBM to Enhance Oracle Expertise With the Buyout

IBM has been partnering with Oracle for nearly four decades to help clients navigate their cloud journeys and maximize their business transformations in a complex hybrid cloud environment while delivering speed to value. AST has been covering areas like business process redesign and Oracle Cloud deployment for local government and K-12 education for more than two decades. In addition to its strong public sector presence, the company also serves commercial clients in the manufacturing, energy and consumer packaged goods industries.

AST’s highly experienced team of consultants have expertise in diverse Oracle Cloud Applications Suite, focusing on Oracle Fusion Cloud Enterprise Resource Management, including Enterprise Performance Management, Oracle Cloud Human Capital Management, and Oracle Fusion Configure, Price, Quote, as well as Oracle Cloud Infrastructure, JD Edwards, and NetSuite. By combining the expertise of both organizations, IBM will be better positioned to support its public sector clients in North America, the UK and Ireland. These clients often face challenges in transitioning from legacy systems, managing skill shortages and meeting strict security and compliance requirements. The acquisition will likely enable IBM to navigate business transformations more effectively with Oracle Cloud Applications.

This acquisition further supports IBM's open ecosystem strategy, enabling it to bring together diverse technologies and expertise from its expanding partner network to meet client needs. It will offer new opportunities for AST’s employees and enhance IBM's ability to deliver transformative solutions that drive digital transformations. This advancement is anticipated to improve IBM’s productivity and deliver increased competitive advantages to its clients through Oracle’s Cloud applications and technology.

Likely IBM Payouts

IBM has evolved as a leading provider of cloud and data platforms and is poised to benefit from strong demand for hybrid cloud and artificial intelligence (AI), driving growth in Software and Consulting. The company’s growth is expected to be driven primarily by analytics, cloud computing, and security in the long haul.

With this acquisition, IBM aims to further enhance its service offerings across different regions globally. This will likely strengthen IBM’s reputation for delivering innovative solutions across the hybrid cloud, AI and consulting services and improve its revenues in the upcoming quarters.

IBM Stock Price Performance

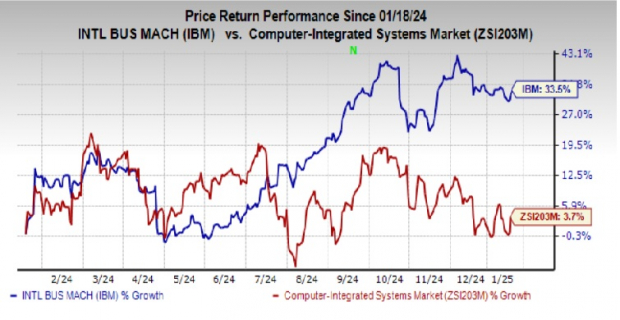

Shares of IBM have gained 33.5% over the past year compared with the industry’s growth of 3.7%.

Image Source: Zacks Investment Research

IBM’s Zacks Rank and Stocks to Consider

IBM currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader industry have been discussed below.

Ubiquiti Inc. UI presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s highly flexible global business model adapts to changing market dynamics, enabling it to overcome challenges while maximizing growth. Its effective management of a strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques. In the last reported quarter, Ubiquiti delivered an earnings surprise of 20.9%.

InterDigital, Inc. IDCC sports a Zacks Rank of 1 at present. It has a long-term growth expectation of 17.44%.

IDCC pioneered advanced mobile technologies that enable wireless communications and capabilities. The company designs and develops various advanced technology solutions for digital cellular, wireless 3G, 4G and IEEE 802-related products and networks.

Workday Inc. WDAY carries a Zacks Rank #2 (Buy) at present. In the last reported quarter, it delivered an earnings surprise of 7.36%.

WDAY is a top supplier of enterprise-level software solutions for the fields of human resources and finance management. The company's cloud-based platform makes it simpler for businesses to offer analytical insights and decision support by integrating finance and human resources into a single system.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpInternational Business Machines Corporation (IBM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.