Roku, Inc. ROKU is set to release its fourth quarter fiscal 2021 financial results after the closing bell on Thursday, February 17. The pure-play streaming TV stock has been crushed for months alongside many other growth names and technology companies.

Despite the near-term market uncertainties and rising interest rates, some investors might want to consider buying Roku at its current levels.

Streaming & Digital Ads

Roku has come a long way from a tiny firm that made small streaming TV players into an industry standout with a $20 billion market cap. Roku and its array of devices and smart TV OS help make it one of the largest players in the somewhat crowded world of streaming devices that includes Amazon, Google, and Apple.

Roku’s streaming TV devices that allow people to watch their favorite services has come under pressure in the past year amid supply chain setbacks. These near-term setbacks will subside eventually. More importantly, Roku’s much larger advertising-heavy platform segment, which has driven growth in the past few years, continues to gain steam as companies of all shapes and sizes clamor to find consumers in the changing media landscape.

Roku allows marketers and advertisers to buy targeted ads, promote their streaming movies, shows, platforms, and whatever else they are selling. Roku has gone all-in on improving its appeal to advertisers. This includes buying Nielsen’s Advanced Video Advertising business, landing deals with Shopify, spending on its own content, and more.

Digital advertising is now bigger than legacy media spending. And streaming is one of the most important ad markets out there, especially as established social media companies compete for attention against upstarts. Plus, app-focused advertising is being disrupted by Apple’s privacy policies. And Roku will thrive even if a clear winner emerges in the wars between Netflix, Disney, HBO, and others.

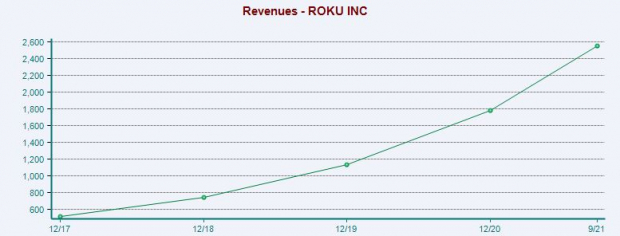

Image Source: Zacks Investment Research

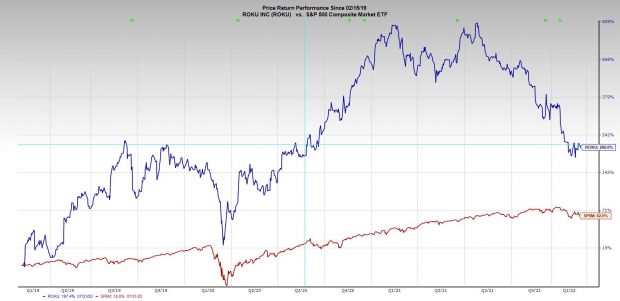

Image Source: Zacks Investment Research

Recent Performance and Outlook

Roku’s ad-focused platform revenue accounted for 85% of total Q3 sales and 71% in 2020. The unit jumped 82% last quarter, while its player segment fell 26% YoY amid supply chain disruptions and slowing TV sales.

Roku’s active accounts climbed 23% to 56.4 million and its average revenue per user surged 49% to $40.10. Plus, Roku’s investment in its streaming TV content via The Roku Channel has paid off, with it coming in as a “top 5 channel on the platform by active account reach.”

Looking ahead, Zacks estimates call for Roku’s FY21 revenue to surge 58% from $1.78 billion to $2.80 billion. The streaming TV firm’s sales are then set to climb another 38% or $1 billion higher in 2022. Wall Street has talked about “slowing growth,” yet these estimates would compare favorably against FY20’s 58% sales expansion, FY19’s 52%, and FY18’s 45%.

Roku is also projected to swing from an adjusted loss of -$0.14 a share to +$1.55 in FY21 and then pop slightly higher in FY22. Roku’s history of big bottom-line beats is extensive, including a 700% beat in Q3 ($0.48 vs. $0.06 projection). Despite its downturn and near-term setback fears, Roku’s FY21 and FY22 consensus earnings estimates are largely unchanged since its last report.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Taking into account its recent fall, Roku has soared 575% since its 2017 debut and 200% in the last three years. The stock started to show signs of cracking in February of 2021, alongside other pandemic winners and Cathie Wood stars. Roku, which currently lands a Zacks Rank #3 (Hold), did manage to make a brief comeback before it started to really tumble in July.

The stock closed regular trading Monday 66% below its records ($490 a share) at $159.02 per share. Roku has climbed out of oversold RSI territory since the end of January but it’s still far below neutral. And its current Zacks consensus price target represents 130% upside to Monday’s close.

Roku’s fall reset its valuation, with it trading at its lowest levels since the initial covid selloff and back where it was in the early part of 2019 at 5.5X forward 12-month sales—not too far above Netflix’s 5.1X. However, Roku is still trading at really high forward earnings multiples (92X). This alone could stop some investors in their tracks.

The firm’s earnings are being weighed down by its device business that’s suffering a substantial margin crunch amid ongoing supply chain disruptions. And Wall Street is still somewhat high on Roku stock, with 17 of the 23 brokerage recommendations Zacks has at “Strong Buys,” and only three below “Holds.”

Some investors might decide now is not the best time to take a chance on a pure growth stock, especially ahead of earnings. Others who can handle further downside potential might want to consider buying Roku as a long-term streaming TV play because Roku is prepared to thrive no matter who wins the streaming wars.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roku, Inc. (ROKU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.