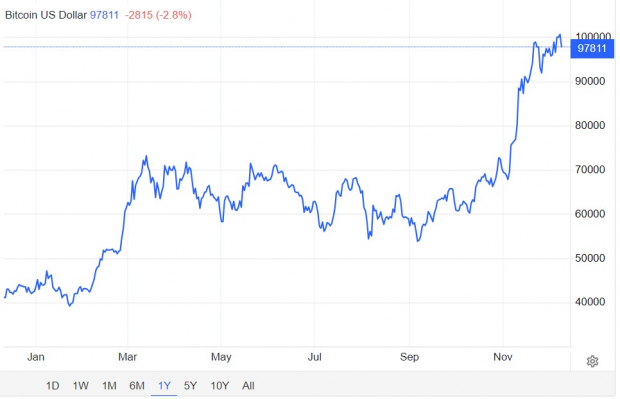

Despite the price of Bitcoin dipping below $100,000, the cryptocurrency has risen over +120% in 2024. Notably, this has led to an awe-inspiring price performance for Coinbase Global COIN which has seen its stock soar +80% year to date.

As the largest cryptocurrency exchange in the United States, investors may be eyeing Coinbase’s stock as a buy-the-dip target with COIN down -9% in Monday's trading session.

Image Source: Trading Economics

Coinbase’s Improved Financial Performance

Attributed to Bitcoin and the broader cryptocurrency rally, Coinbase has seen improved financial metrics. Most recently reporting Q3 results in late October, Coinbase’s quarterly sales climbed 100% to $1.2 billion versus $674.15 million in the comparative quarter.

Most importantly, Coinbase’s Q3 EPS soared to $0.62 on net income of $75 million compared to a loss of $2 million a year ago or -$0.01 per share. This also marked Coinbase’s fourth consecutive quarter of positive net income.

Furthermore, Coinbase has now reached or exceeded the Zacks EPS Consensus for seven straight quarters with a very impressive average earnings surprise of 341.36% in its last four quarterly reports.

Image Source: Zacks Investment Research

Revenue Growth & EPS Revisions

As stated by co-founder and CEO Brian Armstrong, Coinbase’s number one priority has been to drive revenue. Shifting away from more volatile transaction fee revenue, Coinbase has focused on subscription and services revenue.

Optimistically, Coinbase’s total sales are now projected at $5.61 billion in fiscal 2024 which would be an 80% increase from $3.11 billion last year. Following a tougher to-compete-against year, FY25 sales are expected to dip -2% to $5.48 billion.

On the bottom line, annual earnings are expected to skyrocket to $5.39 per share this year compared to EPS of $0.37 in 2023. While Coinbase’s EPS is expected to contract to $3.15 in FY25, it's noteworthy that earnings estimate revisions have soared over the last two months with estimates at $1.87 per share 60 days ago. Plus, FY24 EPS estimates are up 4% during this period.

Image Source: Zacks Investment Research

Diversification & Regulation

Outside of revenue growth, Coinbase’s main priorities have been on driving the utility (usage) and regulatory clarity of cryptocurrency. In regards to utility and regulation, Coinbase wants to keep increasing the economic freedom crypto offers to innovate the financial system and people’s daily lives.

Digital/Smart wallets along with payment solutions that make crypto more accessible have been at the forefront of Coinbase’s initiatives. The rally in Coinbase’s stock and Bitcoin, in particular, has been enhanced by the notion that President-elect Donald Trump is viewed as more supportive of cryptocurrency. Deeming himself as the pro-crypto candidate, Trump pledged to create a friendly regulatory environment for cryptocurrencies which should assist Coinbase’s initiatives.

Balance Sheet & Valuation

At 67.3X forward earnings, Coinbase stock trades at a noticeable premium to the benchmark S&P 500 although this is near fellow crypto broker Robinhood Financials’ (HOOD) 54.4X. Even better, positive earnings estimate revisions are helping to justify Coinbase’s P/E premium along with its strengthening balance sheet.

To that point, Coinbase’s cash & equivalents ballooned to $8.62 billion at the end of Q3 2024 from $5.52 billion in the prior-year quarter. Coinbase currently has $290.55 billion in total assets which is above its total liabilities of $281.83 billion.

Image Source: Zacks Investment Research

Bottom Line

Coinbase appears to be taking advantage of the growing optimism and support for Bitcoin among other cryptocurrencies. This could certainly make Coinbase’s stock an ideal buy-the-dip candidate, as COIN was added to the Zacks Rank #1 (Strong Buy) list today and is shaping up to be a viable investment for 2024 and beyond.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.