PACCAR Inc. PCAR is a global leader in the design, manufacture, and customer support of high-quality premium trucks. In addition, PACCAR also offers finance and leasing services.

Analysts have taken their earnings expectations higher across the board for PACCAR as of late, helping land the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company resides within the Zacks Automotive – Domestic industry, which is currently ranked in the top 21% of all industries thanks to favorable earnings estimate revisions. As many know, roughly half of a stock’s movement can be attributed to its group, helping to clarify the importance of targeting industries seeing improved outlooks.

Outside of the favorable earnings outlook, let’s take a closer look at a few other characteristics of PACCAR.

Current Standing

The company is forecasted to witness notable growth in its current year, with the Zacks Consensus EPS Estimate of $8.54 implying 50% growth paired with a 20% revenue bump. Growth cools in FY24, with earnings and revenue forecasted to retreat by 20% and 9%, respectively.

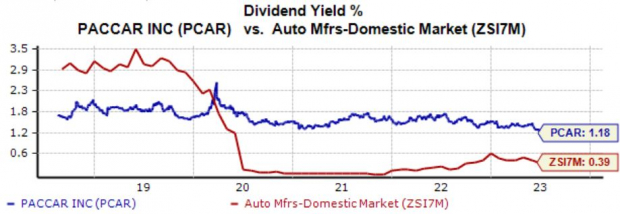

Shares could interest those who prefer income, as PCAR shares currently yield 1.2% annually paired with a sustainable payout ratio sitting at 13% of the company’s earnings. PCAR has displayed a shareholder-friendly nature, carrying a 5% five-year annualized dividend growth rate.

As shown below, the company’s current yield exceeds its Zacks industry average.

Image Source: Zacks Investment Research

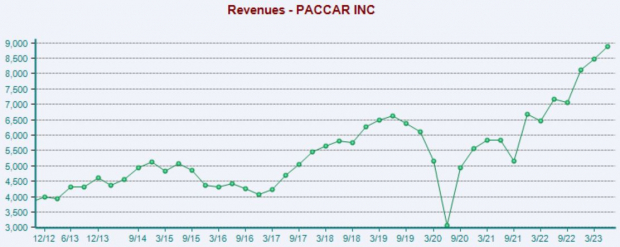

PACCAR has been firing on all cylinders as of late, exceeding both consensus revenue and EPS expectations in three consecutive quarters.

Just in its latest release on July 25th, the company penciled in a 9% EPS beat and reported revenue 2% ahead of the consensus. Undoubtedly a positive, revenue and net income reflected quarterly records, primarily driven by the company’s industry-leading logistics performance.

As we can see below, PACCAR’s revenue has recovered from 2020 lows, with sales now eclipsing pre-pandemic levels.

Image Source: Zacks Investment Research

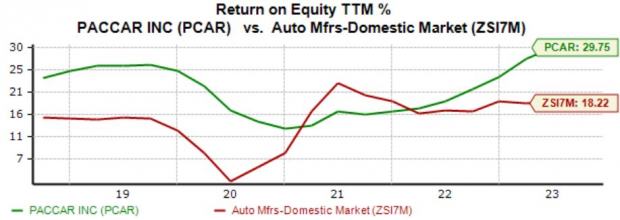

In addition, the company’s 29.8% return on equity (ROE) is worthy of a highlight, reflecting a higher efficiency level in generating profits from existing assets relative to peers.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

PACCAR Inc. PCAR would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.PACCAR Inc. (PCAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.