Company Overview

Zacks Rank #3 (Hold) stock MicroStrategy Incorporated (MSTR) is a software company that specializes in business intelligence (BI) and analytics. MicroStrategy provides a comprehensive platform that enables organizations to analyze and visualize their data to make informed business decisions. The company’s tools allow for data discovery and exploration, interactive dashboards, data visualization, and reporting capabilities. Before its initial public offering (IPO) in 1998, MicroStrategy signed its most prominent client, the fast-food giant McDonald’s (MCD).

Adopting the “Bitcoin Standard”

For years, Michael Saylor had been concerned that the monetary system has been expanding by approximately 7% per year while inflation tends to rise at a clip of about 2% annually. In late 2020, Michael Saylor, MSTR’s founder and CEO at the time (now Executive Chairman), decided to take action and adopt what he refers to as the “Bitcoin Standard.” Michael Saylor, who is an eccentric MIT graduate, entrepreneur, and business executive, became fascinated with the uniqueness of Bitcoin and saw it as an alternative to the current monetary system. During an interview, Saylor reasoned, “What we (MSTR) were doing was that we were inverting the balance sheet such that we’re floating on a Bitcoin sail, on a crypto sail, if you will, and as the liquidity and the monetary system gets pumped up, we want it to float, rather than sink, on that pool of liquidity”.

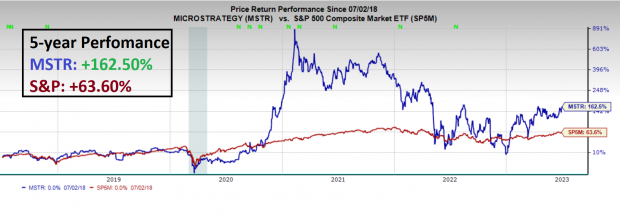

A lot has changed since Saylor’s initial Bitcoin-inspired epiphany. MSTR now owns more than 140,000 Bitcoin worth roughly $4 billion. In other words, MSTR has morphed into a Bitcoin proxy – which is not necessarily a bad thing. Despite Bitcoin being well off its all-time highs and the “crypto winter”, MSTR has outperformed the S&P 500 handsomely in the past five years.

Image Source: Zacks Investment Research

The Narrative is Changing

Like any new idea, Bitcoin has been criticized. In recent years, investors have shown skepticism that Bitcoin had little to no real-world use, institutional adoption, or regulatory clarity. In recent weeks, many of these concerns are diminishing, including:

Real-world use: More international citizens in countries like Argentina and Turkey are using Bitcoin to stave off hyper-inflation than ever before. The proof? While Bitcoin remains well off its highs domestically, BTC recently hit new highs versus Argentina and Turkey’s currencies – a sign that global, real-world adoption is real.

Image Source: TradingView

Institutional Adoption: In just the last month, some of the largest asset managers in the world (BlackRock, Fidelity, and others) announced their plans to enter the industry.

Regulatory Clarity: Though the SEC’s lawsuit against Coinbase (COIN) is a short-term hurdle for the company, the outcome may be bullish for Bitcoin over the long term because it will provide the industry with some much-needed regulatory guardrails.

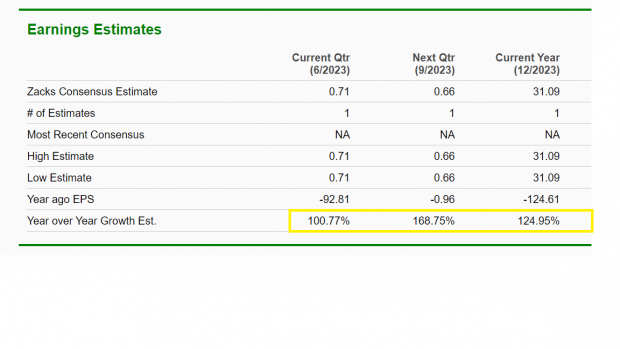

Healthy Earnings Estimates

Wall Street expects EPS to grow at a triple-digit clip over the next three quarters.

Image Source: Zacks Investment Research

Bullish Technical Pattern

On Friday, a negative headline from the SEC about inadequate Bitcoin ETF filings hit crypto-related stocks. However, MSTR shook off the news and rebounded quickly – a sign of resilience. MSTR is about to break out of a nearly one-year long base structure. As the old saying goes, “The longer the base, the higher in space.”

Image Source: TradingView

Conclusion

The bullish Bitcoin catalysts and big EPS estimates set up a dynamic duo for MSTR into year-end. If MSTR can clear the $350 level on a closing basis over the next few days, the stock has explosive potential.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpMcDonald's Corporation (MCD) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.