Jabil JBL is a manufacturing solutions provider and electronics maker. Jabil topped Zacks quarterly estimates on December 15 and raised its outlook once again to showcase its ongoing resilience as the wider economy and technology sector experience pullbacks.

Jabil stock has easily outperformed the S&P 500 and the Zacks Tech sector over the last decade and in 2022. And these are just a few of the reasons why JBL might be worth considering at the moment.

The JBL Basics

Jabil provides manufacturing services to companies in telecommunications and other industries. The firm’s client list includes the likes of Apple AAPL, SolarEdge SEDG, and other giants in critical and game-changing industries.

Jabil prides itself on operating in the background, working with hundreds of the biggest brands in the world to help make everything from smartphones and home appliances to healthcare technologies. Jabil boasts that it helps make its client’s “most complex ideas and products a reality.”

Jabil serves original equipment manufacturers and product companies across multiple industries and end markets. JBL’s laundry list of client areas and spaces includes compute & storage, appliances, automotive, healthcare, telecom, energy & industrial, and beyond.

JBL’s solutions include advanced assembly and automation, printed electronics, autonomous systems, and more. Meanwhile, its list of services spans from engineering and optics to supply chain, software, additive manufacturing, and others in between.

Image Source: Zacks Investment Research

Growth and Outlook

Jabil’s diversification has helped it grow steadily for years, including 14% growth in its fiscal 2022, which is highly impressive for a company that went public in the early 1990s and was founded long before that. JBL is also set to benefit from a broader onshoring/reshoring push from U.S. companies and the federal government.

Jabil on December 15 topped our Q1 FY23 earnings and revenue estimates, with its sales up 12% and adjusted EPS 20% higher. The growth was driven by 18% expansion in its Electronics Manufacturing Services segment. “I remain confident in our plan moving forward, which is supported by both strong secular tailwinds and continued refinement of our more traditional businesses,” CEO Mark Mondello said in prepared remarks.

Looking ahead, Zacks estimates call for JBL’s revenue to climb 3% in FY23 and another 3% in FY24 to reach $35.4 billion. This growth comes on top 12% average top line expansion over the last five years and roughly matches its YoY growth rates during a couple-year stretch prior to the recent run of outsized strength.

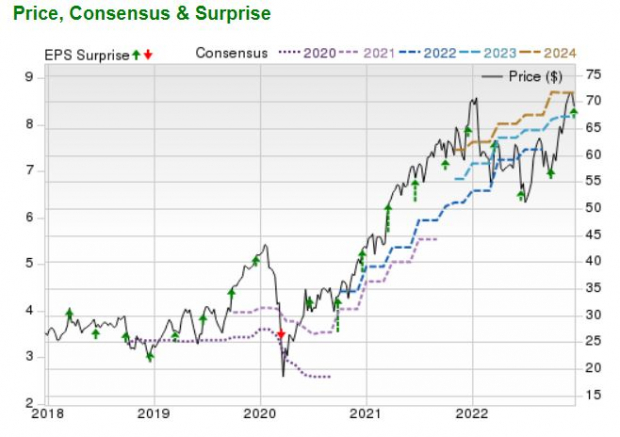

Jabil’s adjusted earnings are projected to climb by 9% in FY23 to hit $8.31 per share and another 6.3% in FY24. JBL has topped our EPS estimates by an average of 9% in the trailing four quarters and it’s beaten our bottom line estimates for five years running outside of one miss early in the pandemic.

Plus, Jabil’s earnings outlook has continued to improve for FY23 and FY24, which is no easy task as the overall outlook for S&P 500 earnings and the economy fade. JBL’s bottom-line positivity helps it land a Zacks Rank #1 (Strong Buy) right now.

Image Source: Zacks Investment Research

Other Fundamentals

Jabil is part of the Electronics - Manufacturing Services industry that currently ranks No. 1 out of over 250 Zacks industries. Being part of a top-ranked industry that’s showing strength in a difficult market is very important, and remember that studies have shown that 50% of a stock's price movement can be attributed to its industry.

Jabil lands “A” grades for Value and Momentum and a “B” for Growth in the Zacks Style Scores system. Plus, six of the seven brokerage recommendations Zacks has are “Strong Buys.” The company also pays a small dividend that’s yielding 0.5% at the moment.

JBL shares have only dipped -3% in 2022 vs. the Zacks Tech sector’s 35% drop. The stock has also experienced impressive second-half momentum, up 30% in the last six months to hit fresh highs on December 13.

Jabil has pulled back slightly from those highs and it trades 14% below its current average Zacks price target. And it sits below neutral RSI levels (50) at 47. Jabil’s recent performance is part of a 155% climb in the last five years vs. Tech’s 44% and a 350% jump during the past 15 years compared to 160% for the Zacks Tech sector.

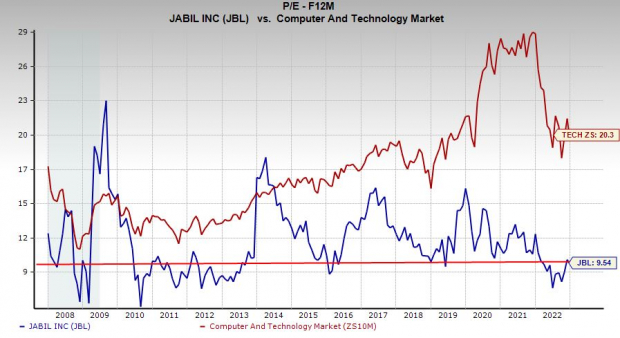

Despite its long-term and recent outperformance, Jabil trades at a 50% discount to the Zacks Tech sector at 9.5X forward 12-month earnings. This also represents a discount compared to its own 15-year median and well below its highs of 23X.

Image Source: Zacks Investment Research

Bottom Line

Jabil stands to grow for years to come as technologies of all shapes and sizes drive the world and the economy forward. Let’s also remember that the covid pandemic and other factors spurred companies and the U.S. government to start manufacturing more crucial tech in the U.S. such as semiconductors, solar panels, and countless other high-tech offerings.

Jabil appears to be a worthy stock to consider for 2023 given its valuation and resilience, alongside its ability to grow even as the U.S. and the global economy face recession fears.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Apple Inc. (AAPL) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.