The Zacks Financial – Investment Bank industry is currently ranked in the top 22% (54 out of 249) of all Zacks Industries.

As we’re all aware, 50% of a stock's price movement can be attributed to its group, making it clear why it’s critical for investors to target stocks in a thriving industry.

A stock residing within the industry and a part of the Zacks Finance sector, Interactive Brokers IBKR, has seen its earnings outlook shift positively over the last several months, pushing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Interactive Brokers Group operates as an automated global electronic market maker and broker. The company strives to provide customers with advantageous execution prices and trading, risk and portfolio management tools, research facilities, and investment products all at low prices.

Let’s take a closer look at how the company currently stacks up.

Share Performance & Valuation

IBKR shares have been notably strong over the last six months, up nearly 40% and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

The picture remains the same when shrinking the timeframe to encompass just 2023; year-to-date, IBKR shares have outperformed the S&P 500, up 7.4%.

Image Source: Zacks Investment Research

Clearly, buyers have been present.

Further, IBKR shares currently trade at a 14.3X forward earnings multiple, a fraction of the 22.1X five-year median and nearly in line with the Zacks Finance sector average.

Image Source: Zacks Investment Research

Quarterly Performance

Interactive Brokers has posted better-than-expected quarterly results as of late, exceeding the Zacks Consensus EPS Estimate in back-to-back quarters.

Just in its latest release, IBKR reported earnings more than 12% above expectations and posted a 5.3% revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

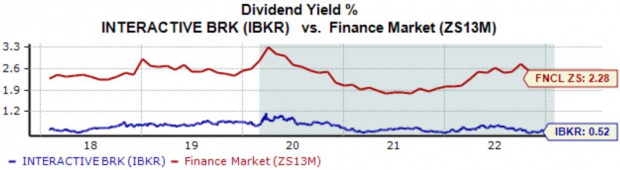

Dividends

Who doesn’t enjoy getting paid?

Fortunately for those who seek income, Interactive Brokers has that covered; the company’s annual dividend currently yields a modest 0.5%, below the Zacks Finance sector by a fair margin.

In addition, the company’s 10% payout ratio is definitely sustainable.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

Additionally, the top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Interactive Brokers IBKR would be an excellent stock for investors to keep on their watchlists, as displayed by its Zack Rank #1 (Strong Buy).

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don't miss your chance to download Zacks' top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.