Alcoa Corporation AA, a Zacks Rank #1 (Strong Buy), has surged nearly 1,400% since the March 2020 bottom after dropping to roughly $5/share at the trough of the pandemic-induced market plunge. Only the best companies that are experiencing stellar revenue and earnings growth are able to make this type of price move. AA stock is currently hitting all-time highs even as the market has taken a breather to kick off the new year.

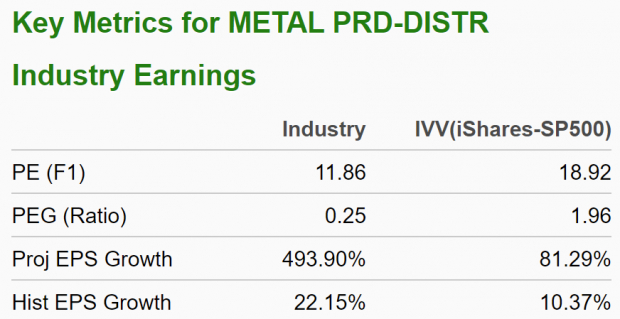

Alcoa boasts the highest Zacks Momentum Style Score of ‘A’. The company is a component of the Zacks Metal Products – Distribution industry, which ranks in the top 22% of all Zacks Ranked Industries. This industry holds several attractive characteristics as shown below:

Image Source: Zacks Investment Research

Quantitative research studies have repeatedly shown that roughly half of a stock’s future price appreciation is due to its industry grouping. By targeting stocks contained within top industry groups, investors can dramatically improve their rate of success. The Metal Products – Distribution industry is part of the Zacks Industrial Products sector, which ranks in the top 44% of all 16 Zacks Ranked Sectors.

Company Description

Alcoa produces and sells bauxite, alumina, and aluminum products globally. Its business segments revolve around these three materials. AA engages in mining operations, processing bauxite into alumina and selling it to industrial customers. The metals producer also offers primary aluminum to customers that are involved in the transportation, construction, and packaging markets. In addition, AA owns hydro power plants that produce and sell electricity.

Alcoa’s founding traces back to 1888 in Pittsburgh, PA where the company is currently headquartered. AA completed its separation from its parent company in November 2016 and subsequently began operating as an independent, publicly-traded company listed on the New York Stock Exchange.

Recent Earnings and Future Estimates

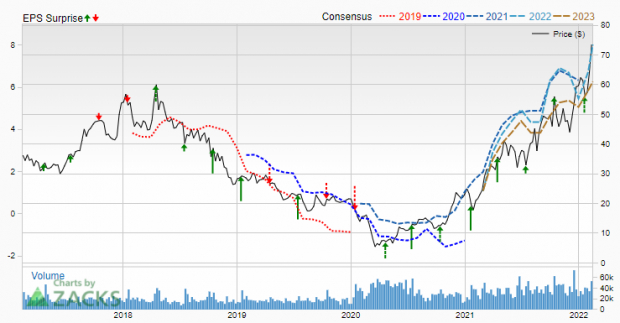

Alcoa has exceeded earnings estimates in each of the past eight quarters. AA’s most recent announcement came in January when the company reported Q4 EPS of $2.50, a +22.55% surprise over the $2.04 consensus. This compares quite favorably to EPS of $0.26 in the same quarter in 2020.

Despite the impressive performance, analysts are still raising earnings estimates for the company. Current quarter (Q1) estimates have been increased by 39.55% in the past 60 days to $2.47. If AA is able to simply match this estimate, the metals producer will have achieved year-over-year quarterly EPS growth of 212.66%. Sales are expected to climb 17.28% to $3.37 billion.

Analysts covering AA have also upped their ‘22 full-year EPS estimates by 47.34% in the past 60 days. The Zacks Consensus Estimate now stands at $8.03, translating to growth of 17.57% relative to last year. Alcoa’s next earnings announcement is slated for April 21st.

Charting the Course

Alcoa has delivered an average earnings surprise of +27.08% over the past four quarters, helping the stock advance nearly 250% in the past year. The price ascent has not slowed down in 2022, with shares advancing over 30% while the S&P 500 has fallen more than 6%.

Notice how both the 50 and 200-day moving averages are sloping up in the chart below, evidenced by the red and purple lines, respectively. The stock does appear extended in the short-term, and bullish investors may consider waiting for a slight pullback before initiating a new purchase.

Image Source: TradingView

However, empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. And as we know, Alcoa has seen a steady batch of positive revisions as of late. As long as this trend remains intact (and AA continues to post earnings beats), the stock should continue its bullish move this year.

Image Source: Zacks Investment Research

Near-Term Outlook

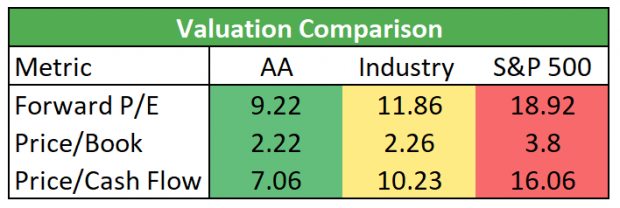

Despite the massive price run, AA currently trades at just a 9.22 forward P/E. Looking at a host of metrics, the valuation picture looks constructive for the bulls:

Image Source: Zacks Investment Research

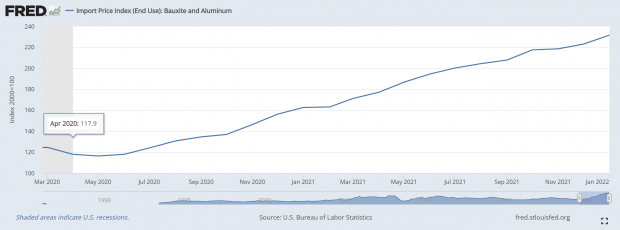

Bauxite, which is at the heart of Alcoa’s business, is the world’s main source of aluminum. AA is benefitting from an overall uptrend in bauxite and aluminum as we can see below:

Image Source: Federal Reserve Bank of St. Louis; U.S. Bureau of Labor Statistics

Inflation worries continue to persist as recent readings have come in well above expectations. There isn’t really an end in sight as the Fed will now need to play catchup in an attempt to halt the immense price increases. I think we can call agree that they’re playing from way behind at this point.

Bottom Line

With a maximum ‘A’ Zacks overall VGM score and a constant tailwind provided by a leading industry group and sector combination, it’s not difficult to see why AA is a compelling investment. Robust sales and earnings growth along with a strong technical trend certainly justify adding shares to the mix. Recent positive earnings estimate revisions should also serve to create a ‘floor’ regarding any sudden or unexpected downside moves. If you haven’t already done so, make sure to put AA on your shortlist.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alcoa (AA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.