Willdan Group, Inc.’s WLDN pitch to clients across utilities, government agencies, and private industry is more compelling than ever, and Wall Street is catching on.

Willdan helps “transition communities to clean energy and a sustainable future,” with offerings spanning electric grid solutions, energy efficiency, and beyond.

Willdan is ready to ride the multi-decade, multi-trillion-dollar energy transition. The small-cap consulting firm has landed deals with state governments and tech giants such as Meta.

Willdan stock has soared 90% during the last 12 months alongside WLDN’s surging earnings estimates. On top of that, Willdan shares are trading 30% below their 2021 peaks.

The Basic Bull Case for Willdan Stock

Willdan is a small-cap consulting firm that’s been in business for 60 years. Willdan provides professional, technical, and consulting services centered around grid solutions, energy efficiency and sustainability, engineering, financial and economic planning, research and development, and more.

Willdan works with companies and entities throughout utilities, government agencies, healthcare, hospitality, data centers, industrials, education, multifamily housing, and beyond. WLDN helps its clients in key areas such as grid optimization, energy efficiency, microgrids, smart cities, and other growth areas.

Image Source: Zacks Investment Research

Willdan is ready to thrive as every pocket of the economy spends heavily to thrive as the U.S. undergoes a large-scale energy transition. The U.S. is attempting to cut back its reliance on fossil fuels and become more sustainable, while also growing the economy as energy demand soars in the AI-age.

The energy transition is part of a wide-scale infrastructure boom that’s underway. The infrastructure megatrend spans everything from AI data centers and next-generation nuclear reactors to revamped and expanded electricity grids, water systems, and other more traditional infrastructure projects.

“The electric load growth macrotrend strengthened over the quarter, fueled by growth in electricity demand at data centers from artificial intelligence,” Willdan CEO Mike Bieber said in prepared Q2 remarks.

“Given the results for the first half of 2024 and the current momentum, we are raising our full year targets for fiscal 2024.”

Image Source: Zacks Investment Research

Willdan’s diverse client list includes The City College of New York, the state of Virginia, and technology superpower Meta. WLDN landed its deal with the parent company of Facebook and Instagram during the first half of 2024.

Willdan is helping Meta META “study emissions related to voluntary clean energy procurement.” Meanwhile, Willdan is exploring how increased energy demand is impacting the grid across Virginia.

Willdan most recently earned a contract to deliver energy savings for the fifth-largest school district in the U.S. Clark County School District in Neveda selected Willdan for a “$102 million contract to deliver energy-saving projects across 204 schools.”

Willdan's Recent Growth and Strong Outlook

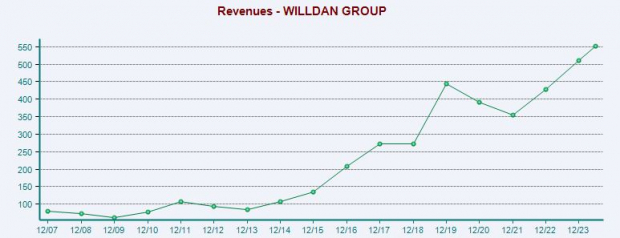

Willdan grew its revenue by 19% in 2023 and 21% in 2022, expanding its sales from $350 million in 2021 to $510 million last year. Willdan also nearly doubled its adjusted earnings last year, soaring from $0.88 to $1.75 a share.

WLDN has crushed our bottom-line estimate by an average of 110% in the past three quarters, including a 90% second quarter beat.

Image Source: Zacks Investment Research

Willdan’s earnings outlook has also climbed steadily over the last year and the past several months. WLDN’s FY25 consensus estimate has climbed 18% since its Q2 release, with its third quarter 2024 estimates 28% higher. Willdan’s improving EPS estimates help it capture a Zacks Rank #1 (Strong Buy).

Willdan is projected to expand its adjusted EPS by 20% in 2024 and another 12% next year to $2.35 a share. Willdan is expected to grow its revenue by 10% this year and 6% in 2025 to reach nearly $600 million.

Breaking Down Willdan’s Performance, Technical Levels, and Valuation

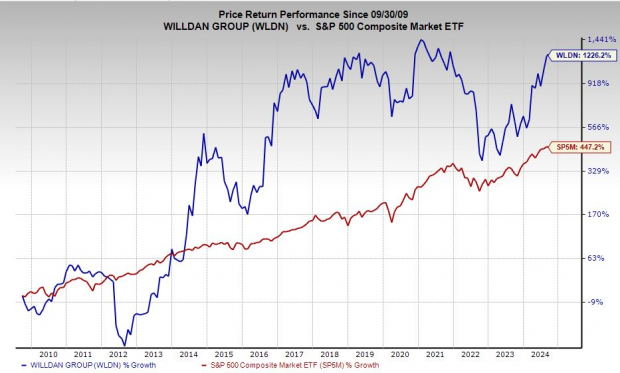

WLDN stock has nearly tripled the S&P 500 over the past 15 years, climbing 1,226% vs. 447%. The stock has been more volatile than the benchmark over that stretch, with it currently neck-and-neck with the S&P 500 during the trailing 10 years, having jumped 190%.

Willdan shares have soared 90% in the last 12 months to blow away its Zacks sector’s 24% run and the S&P 500’s 26%. WLDN’s recent strength is highlighted by a 30% surge over the past three months.

Image Source: Zacks Investment Research

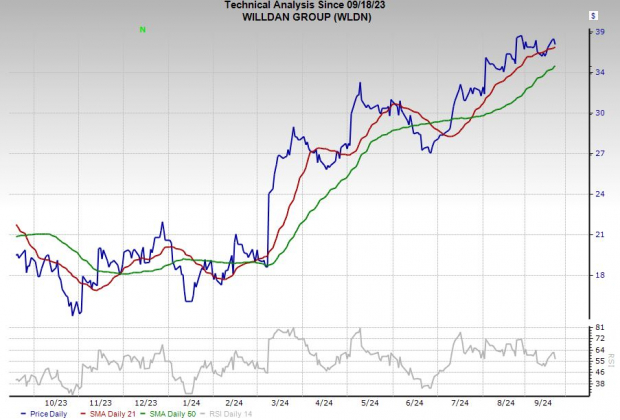

Despite Willdan soaring well over 200% off its 2022 lows, WLDN stock trades 30% below its 2021 peaks. Willdan stock climbed back above its 50-month moving average at the end of the first quarter.

WLDN recently found support near its 21-day moving average. Willdan is also far from overheated, trading just above neutral RSI levels.

Valuation-wise, Willdan trades near its 10-year median (19.1X) at 20.4X forward 12-month earnings and at an 18% discount to its Zacks sector despite its long-term and near-term outperformance.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.