Artificial intelligence and Nvidia were the talk of Wall Street throughout 2024. Yet, nuclear and energy transition powerhouse Vistra (VST) stock crushed Nvidia and every other S&P 500 stockout outside of one.

Vistra thrives as customers and Wall Street flock to the competitive power generator standout. VST has posted booming growth and its outlook is impressive as the U.S. invests in the energy transition and big technology companies such as Amazon and Meta go all-in on nuclear energy to power the AI age.

Vistra’s market-crushing performance includes a 15% pullback since mid-November. VST is finding support near its 50-day moving average.

Why Wall Street Loves Vistra Stock

Vistra is the largest competitive power generator in the U.S. VST’s growing portfolio spans nuclear, solar, battery storage, natural gas, and beyond. The Texas-based firm owns the second-largest competitive nuclear fleet and boasts the second-largest energy storage capacity in the country.

Vistra serves around 5 million residential, commercial, and industrial retail customers across 20 states, including every major competitive wholesale market.

Vistra operates in a vital area of the economy since tech companies and many other industries are turning to energy companies focused on nuclear and other non-fossil fuels for their power needs.

Image Source: Zacks Investment Research

VST bought Energy Harbor in March to boost its zero-carbon generation portfolio. Vistra added a 4,000-megawatt nuclear generation fleet and retail business.

The Energy Harbor deal transformed Vistra into one of the foremost integrated zero-carbon generation and retail electricity companies.

Vista’s growing and diverse portfolio also critically includes natural gas, which will remain vital to the U.S. economy for decades and continue to grow as coal plants shutter.

Vistra said earlier this year that the Inflation Reduction Act provides VST the chance to realize material benefits of its renewables and energy storage projects and provide strong price support via the nuclear production tax credit.

Vistra is also working on deals with big tech companies. VST said on its Q3earnings callthat it is “in discussions with two particular large companies about building new gas plants to support a data center project.”

Vistra’s chief strategy and sustainability officer Stacey Dore said “we might be able to pursue co-location deals at multiple sites and combine that with even building some new generation… We're in pretty detailed customer discussions at some of our nuclear sites."

Image Source: Zacks Investment Research

Wall Street giants like Goldman Sachs view the energy transition as one of the most important pillars of the U.S. economy in the back half of this decade and beyond. On top of that, nuclear energy will power the energy-hungry AI era. Amazon, Alphabet, Microsoft, and Meta all made significant nuclear energy deals in 2024.

The U.S. government is growing its support for nuclear energy as the world’s largest economy aims to triple its nuclear energy capacity by 2050 to help slowly wean itself off of fossil fuels.

The International Energy Agency estimates that $2 trillion was spent on clean energy technologies and infrastructure in 2024, across wind, solar, energy storage, nuclear, the electricity grid, and beyond.

Vistra’s Impressive Growth Outlook

Vistra posted a blowout beat-and-raise third quarter. VST’s 2024 consensus earnings estimate has jumped 13% since its Q3 release, with its FY25 outlook 7% higher, helping Vistra earn a Zacks Rank #1 (Strong Buy) right now.

Image Source: Zacks Investment Research

Vistra is projected to grow its adjusted earnings by 48% in 2024 and 19% next year, based on current Zacks estimates.

The power giant is expected to grow its revenue by 33% in 2024 to climb from $14.78 billion to $19.69 billion. VST is set to follow this performance up with another 14% sales expansion in 2025. This outlook follows Vistra’s 9% average revenue expansion in the past three years.

Time to Buy One of the Best Stocks of 2024?

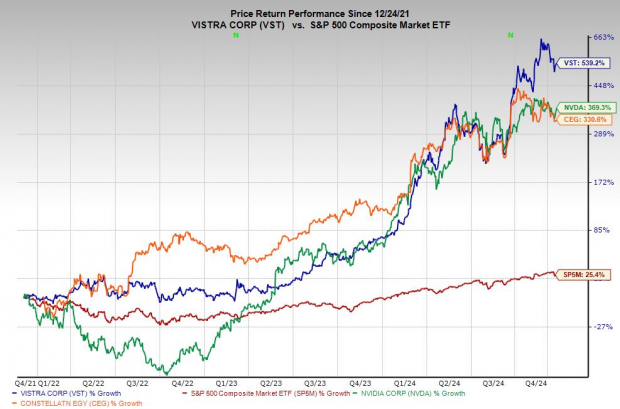

Vistra has soared 265% in 2024 to blow away Nvidia’s NVDA 185%, and fellow nuclear and energy transition stars Constellation Energy’s CEG 98% and GE Vernova’s GEV 145%.

VST has remained on strong footing to close out the year, up 25% in the past three months to outpace Nvidia, Constellation, and the S&P 500.

Vistra’s 2024 run is part of a 540% climb in the last three years, leaving its Utilities sector’s 1% and the S&P 500’s 25% run in the dust. Vistra’s three-year run also blew away Constellation’s 330% and Nvidia’s 370%.

Image Source: Zacks Investment Research

Despite Vistra’s stellar performance, it trades 15% below its November records and 19% below its average Zacks price target. VST is attempting to hold its ground at its 50-day moving average after finding buyers near its October highs.

The recent cooldown helped Vistra move from overbought RSI levels to below neutral. Vistra’s Price/Earnings-to-Growth (PEG) Ratio offers 33% value compared to the Zacks Utilities sector.

Why Investors Should Buy Vistra for 2025

Wall Street loves Vistra stock, with 11 of the 12 brokerage recommendations Zacks has at “Strong Buys.” The company pays a dividend and authorized an additional $1 billion of share repurchases in November.

Vistra stock helps investors gain exposure to the unstoppable energy transition and the nuclear energy revival. Both megatrends Vistra is riding are supported by two pillars of stability: technology titans such as Microsoft and the U.S. government.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Constellation Energy Corporation (CEG) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

GE Vernova Inc. (GEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.