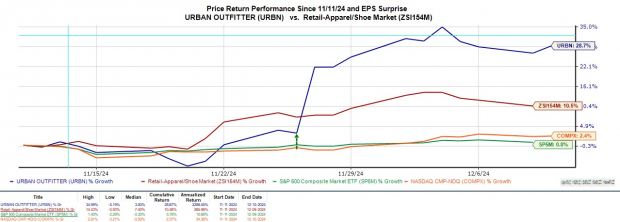

Urban Outfitters URBN has been a stock to watch after impressively exceeding its third quarter earnings expectations in late November.

Spiking 25% since reporting strong Q3 results, Urban Outfitters stock could continue rallying based on a pleasant trend of earnings estimate revisions. This has earned URBN a Zacks Rank #1 (Strong Buy) and the Bull of the Day.

Image Source: Zacks Investment Research

Urban Outfitters Brand Expansion

The rally in Urban Outfitters stock comes as the popular fashion apparel retailer reported record third quarter sales and profits. Speaking to Urban Outfitters' growing popularity, each of its four retail brands outside of its namesake brand achieved record Q3 revenue.

Nuuly stood out in particular, which is a subscription-based rental service that offers a rotating selection of clothing and accessories and saw double-digit revenue growth thanks to a 51% increase in average active subscribers.

Q3 Top and Bottom Line Beat

Overall, Urban Outfitters' Q3 sales rose 6% year over year to $1.36 billion which topped Zacks estimates of $1.33 billion. More impressive, Q3 net income spiked 24% to $103 million or $1.10 per share. This crushed the Zacks EPS Consensus of $0.85 by 29%. Furthermore, Urban Outfitters has exceeded earnings expectations in three of its last four quarterly reports with an average EPS surprise of 22.82%.

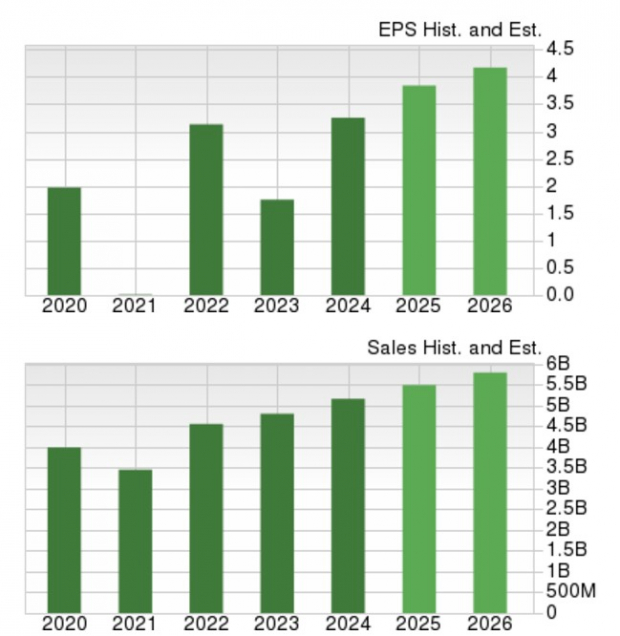

Image Source: Zacks Investment Research

Urban Outfitters Growth Trajectory

Shaping up to be a viable long-term investment, Urban Outfitters' total sales are now expected to increase over 5% in its current fiscal 2025 and FY26 with projections edging toward $6 billion. Even better, FY25 EPS is expected to increase 18% to $3.84 versus $3.25 in FY24. Plus, FY26 EPS is projected to expand another 8%.

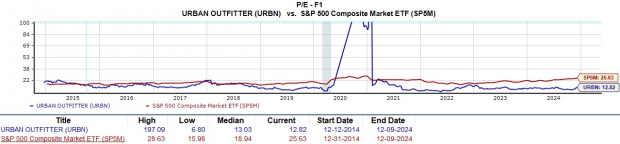

Image Source: Zacks Investment Research

URBN EPS Revisions

Peaking short-term interest in Urban Outfitters stock is that FY25 and FY26 EPS estimates have risen over 6% in the last 30 days respectively.

Image Source: Zacks Investment Research

Urban Outfitters Attractive Valuation

Adding to the alluring trend of positive EPS revisions is that Urban Outfitters stock trades at a very reasonable 12.8X forward earnings multiple.

This is still a pleasant discount to the benchmark S&P 500 and its Zacks Retail-Apparel and Shoes Industry average of 17X with some noteworthy peers being Abercrombie & Fitch ANF and The Gap GAP.

Interestingly enough, URBN is also near its decade-long median of 13X forward earnings and well below a high of 197X during this period.

Image Source: Zacks Investment Research

Bottom Line

Sitting on gains of over +40% year to date and hovering near its 52-week peaks, higher highs could be in store for Urban Outfitters stock. To that point, in addition to its strong buy rating, URBN has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GAP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.