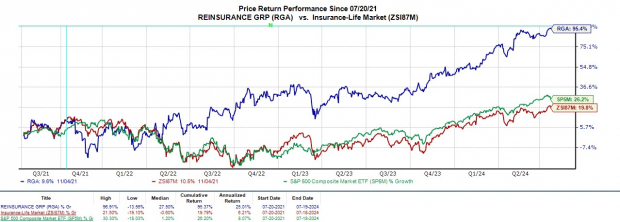

As one of the largest global life and health reinsurance companies, Reinsurance Group of America’s RGA stock has soared over +30% YTD and the rally could continue as its Q2 results approach on August 1st.

Boasting a Zacks Rank #1 (Strong Buy), RGA lands the Bull of the Day and has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Image Source: Zacks Investment Research

Growth in Asia

Notably, the United States is the world's largest reinsurance market, which fosters RGA’s robust top and bottom lines along with its presence as a market leader in the United Kingdom and Canada as well.

However, RGA’s expansion in Asia has led to a record quantity of new business that should continue fueling the company’s growth. Honk Kong, RGA’s largest Asian market has seen increased volumes of Mainland Chinese visitors buying life insurance.

Outside of China, RGA secured a $4.7 billion deal in Japan during the first quarter, stating it launched one of its prominent Japanese insurance products to a major insurer in Korea as well.

Q2 Expectations for RGA

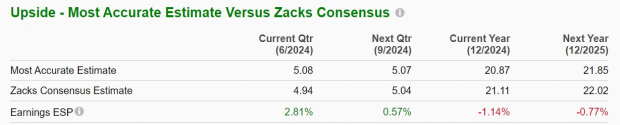

For the second quarter, RGA’s sales are thought to have spiked 15% year over year to $4.92 billion with Q2 EPS projected to rise 12% to $4.94. More intriguing, The Zacks ESP (Expected Surprise Prediction) also indicates RGA could surpass earnings expectations with the Most Accurate Estimate having Q2 EPS slated at $5.08 and roughly 3% above the Zacks Consensus.

Image Source: Zacks Investment Research

RGA has surpassed earnings expectations for five consecutive quarters posting an average earnings surprise of 19.48% in its last four quarterly reports. This comes as RGA posted record quarterly EPS of $6.02 in Q1.

Image Source: Zacks Investment Research

Attractive Growth & Valuation

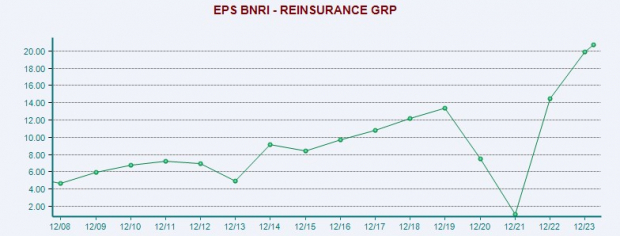

As shown in the EPS Before Non-Recurring Items (BNRI) chart below, RGA’s profitability has continued to reach new heights following the pandemic.

Overall, RGA’s annual earnings are now expected to be up 6% in fiscal 2024 and are forecasted to rise another 4% in FY25 to a whopping $22.02 per share. RGA’s top line has been at record levels as well and total sales are expected to expand another 13% this year and projected to be slightly higher in FY25 with projections north of $21 billion.

Image Source: Zacks Investment Research

Making RGA’s growth more attractive is that its stock trades at 10.1X forward earnings which is a lucrative discount to the S&P 500’s 23.2X, despite impressively outperforming the broader market in recent years.

Plus, RGA still trades 65% below its decade-long high of 29.1X forward earnings and offers a slight discount to the median of 11.2X.

Image Source: Zacks Investment Research

Bottom Line

Reinsurance Group of America’s dominance in various global markets has been very impressive and exhilarating to investors. Furthermore, the impeccable rally in RGA shares could very well continue considering its cheap P/E valuation and expansive EPS growth.

Free Report – 3 Stocks Sneaking Into Hydrogen Energy

Demand for clean hydrogen energy is projected to reach $500 billion by 2030 and grow 5-FOLD by 2050. No guarantees, but three companies are quietly getting the jump on their competition.

Zacks Investment Research is temporarily offering an urgent Special Report naming and explaining these emerging powerhouses primed to boom. Click below for Hydrogen Energy: 3 Industrial Giants to Ride the Next Renewable Energy Wave.

See Stocks Now >>Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.