MasTec MTZ, a current Zacks Rank #1 (Strong Buy), is a national infrastructure construction company that operates mainly throughout the U.S. It builds, installs, maintains, and upgrades infrastructure for energy, communication, and utilities.

Analysts have taken their earnings expectations higher across the board.

Image Source: Zacks Investment Research

Let’s take a closer look at how the company stacks up.

MasTec

MasTec’s status as a market-leading critical infrastructure company sets it up nicely for exposure surrounding strong macro trends, with a diversified portfolio of services and offerings helping balance its risk profile nicely.

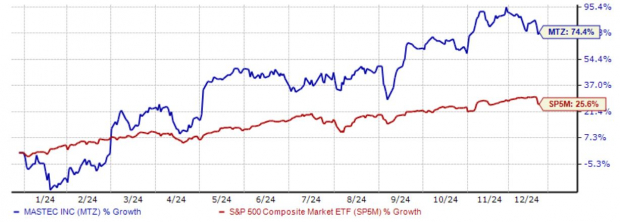

Shares have been big winners in 2024, up nearly 75%.

Image Source: Zacks Investment Research

Positive quarterly results have aided the outperformance, with the latest set pushing shares higher post-earnings. MasTec reported adjusted EPS of $1.63 and sales of $3.3 billion, with EPS soaring alongside a modest sales decline. The company’s margins also expanded nicely alongside strong cash generation.

Below is a chart illustrating MTZ’s sales on a quarterly basis.

Image Source: Zacks Investment Research

The company’s next set of quarterly results is expected in early March, with MasTec expected to post significant EPS growth on slightly higher sales. Top line revisions for the period have largely remained stable while EPS expectations have soared.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

MasTec MTZ would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>MasTec, Inc. (MTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.