If you're an outdoor enthusiast, angler, runner, or golfer, you’re likely familiar with Garmin (GRMN), the industry leader renowned for producing high-quality navigation and communication equipment. Garmin offers an extensive portfolio of GPS-enabled devices across five key segments: Outdoor, Fitness, Marine, Auto, and Aviation. These segments contributed 32.5%, 25.8%, 17.4%, 8.1%, and 16.2% of the company’s revenue, respectively, showcasing its diversified and resilient business model.

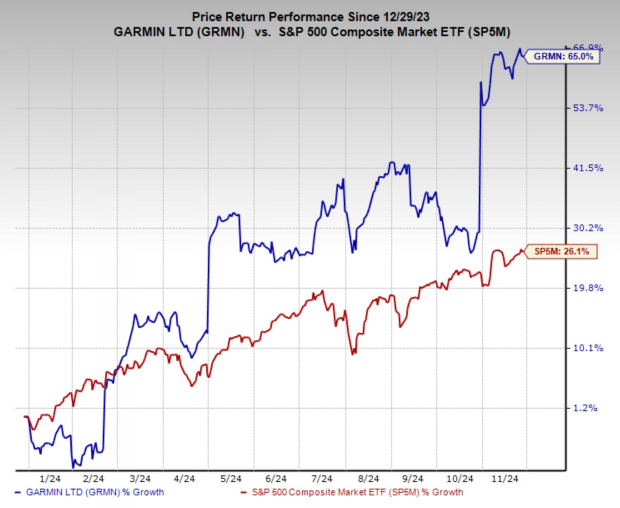

Garmin’s stock has been on an impressive run in 2024, surging 65% year-to-date (YTD) and significantly outperforming the broader market. This stellar performance is underpinned by a top Zacks Rank, reflecting upward-trending earnings revisions. Coupled with an attractive technical chart setup, Garmin is positioned as a standout stock in the current market environment.

Image Source: Zacks Investment Research

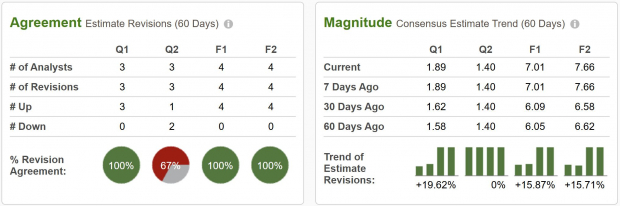

Analysts Boost Garmin’s Earnings Estimates

Driving its recent and continued strong performance in GRMN stock is the significant upgrades to its earnings estimates, giving it a Zacks Rank #1 (Strong Buy) rating. Over the last two months, analysts have nearly unanimously revised earnings projections higher, with FY24 climbing by 15.9% and FY25 by 15.7%.

One standout driver of Garmin’s growth is its Fitness segment, which accounts for 25% of total sales. The company dominates the market for wearable devices used by runners, cyclists, and fitness enthusiasts, making its products nearly ubiquitous among those who track their performance. With a reputation for high-quality, data-rich devices, Garmin continues to strengthen its leadership in the fast-growing fitness space, complementing its success across other segments.

Image Source: Zacks Investment Research

Garmin Stock on the Verge of a Breakout

The technical setup on Garmin stock really caught my eye, especially heading into the holiday season. After gapping massively higher following its most recent earnings report, the stock has been consolidating into a bull flag.

If the price action can clear the upper level of resistance at $215, it would signal a breakout and potentially draw in more buyers and send the stock on another bull run.

Image Source: TradingView

Should Investors Buy Shares in GRMN?

For investors looking to capitalize on a momentum stock with both solid fundamentals and a technical setup, Garmin presents a compelling opportunity. Its leadership across multiple markets, strong financial trajectory, and promising chart setup make it a standout choice in today’s market.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpGarmin Ltd. (GRMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.