GameStop Company Overview

Zacks Rank #1 (Strong Buy) stock GameStop (GME) is the leading brick-and-mortar video game and gaming console retailer. GameStop, the world’s largest video game retailer, has more than 4,000 locations internationally. The company also has an online presence with its GameStop.com and EBgames.com websites. Despite GME’s dominance in the gaming realm, digitization in the industry has led to hurdles for the company and sparked management close some GameStop locations and take portfolio optimization measures.

“WallStreetBets” Sparks Meme Mania

The Covid-19 era was truly unprecedented on Wall Street and let to the “meme stock” craze. As the unknown virus spread, most US citizens who were deemed “non-essential” workers, were told by their managers to work from home. With no sports on television, many gyms closed, and little in the way of activities to do, many people who previously never traded stocks began to take up interest in Wall Street and open Robinhood (HOOD) brokerage accounts.

These new investors, flush with stimulus checks from the government, took to social media platform Redditt (RDDT) to discuss stock ideas. Under the “subreddit” r/WallStreetBets, a large group of savvy retail investors banded together to orchestrate a short squeeze. The plan worked, and institutional investors who were heavily short the stock were “squeezed” sending GME shares soaring by more than 6,000%

Image Source: Zacks Investment Research

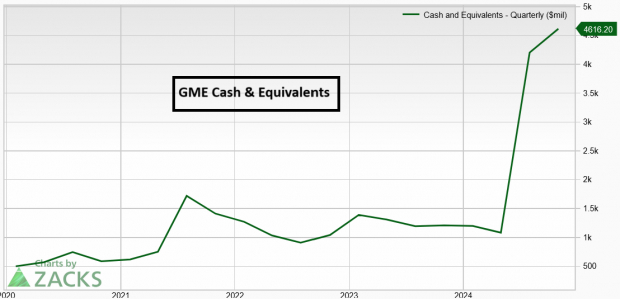

GME Parlay’s Meme Status into Giant Cash Hoard

Normally, most short squeeze stories would end with the stock crashing back to Earth and investors who failed to sell into the spike, out of luck. However, the GME story is different in that there have been multiple short squeezes, and each time management has made the prescient decision of raising cash through stock sales near the top, translating to a massive cash hoard for the company.

Image Source: Zacks Investment Research

GameStop enjoys more than $4 billion in cash reserves as a result of management’s prudent stock sales. This large cash hoard gives the company flexibility to make strategic investments, acquisitions, or pay a special dividend.

GME: A Breakout is Imminent

The recent price and volume action in GME suggests that a breakout may be imminent. GME shares threaten to breakout of a multi-week bullish pennant. Should the breakout occur, 8% of the share float remains short, a cocktail for yet another potential short squeeze.

Image Source: TradingView

Microsoft & GameStop Deal

GameStop has entered into a multi-year strategic deal with tech juggernaut Microsoft (MSFT) to provided customers with enhanced digital solutions. The deal, which leverages Microsoft Cloud, will help GameStop to establish a cohesive ecosystem that allows players to transfer “assets” seamlessly between games, augment the company’s back-end and in-store solutions, and expand its connection to the global gaming community.

Bottom Line

GameStop, the leading video game retailer, has parlayed it’s “meme stock” status into a giant cash hoard. Meanwhile, a strategic partnership and strong technical chart suggest that the stock has big potential into 2025.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

GameStop Corp. (GME) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

Reddit Inc. (RDDT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.