Bill Holdings Company Overview

Zacks Rank #1 (Strong Buy) stock Bill Holdings (BILL) is a cloud-based software firm that leverages AI to help customers automate and streamline back-office financial operations for small and medium-sized businesses (SMBs). The California-based company’s vast umbrella of products includes software-as-as-service solutions for accounts payable, accounts receivable, supply management, and client management.

BILL Bolsters Offering through M&A

Bill Holdings is growing organically and through acquisition. In 2022, Bill Acquired Finmark, “a leading financial planning software provider that simplifies financial planning and cash flow insights for SMBs.” Bill also made strategic acquisitions in Divvy (spend & expense software) and Invoice2go.

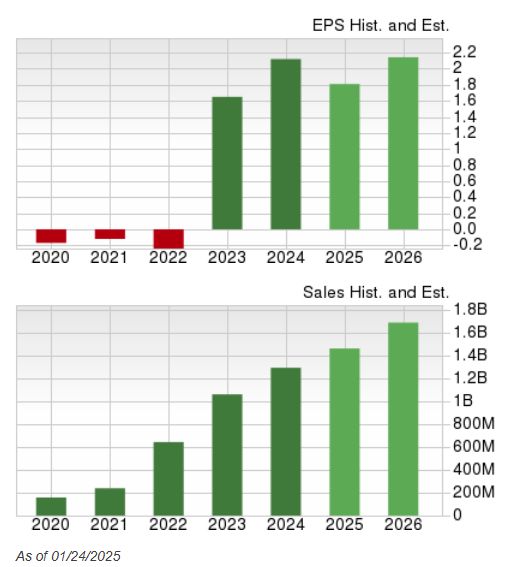

Robust Sales & Earnings Growth History

BILL’s niche market, a vast array of products, and aggressive acquisition strategy are working. The company has achieved double-digit top-and-bottom-line growth for five consecutive quarters.

Image Source: Zacks Investment Research

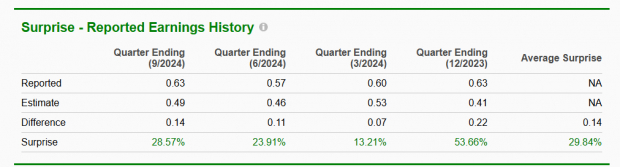

In addition, BILL tends to smash Wall Street EPS expectations. The company has delivered positive earnings surprises in past four quarters, with an average EPS surprise of 29.84% (versus Zacks Consensus Estimates).

Image Source: Zacks Investment Research

DeepSeek Rattles US Equity Markets, but is it Bullish for Software?

“DeepSeek,” an open-source Chinese AI model, is the buzzword currently among Wall Street circles. According to DeepSeek, its “DeepSeek-R1” model can outperform the most popular large language models (LLMs), such as Meta Platform’s (META) “Llama” and OpenAI and Microsoft’s (MSFT) ChatGPT. In addition, DeepSeek claims that its large language model was could be trained with a fraction of the expensive Nvidia (NVDA) GPUs used in other LLMs, sending shockwaves through Wall Street.

Though investors are still analyzing the fallout from DeepSeek and waiting for the smoke to clear, many wonder if AI will be commoditized. Software companies that leverage AI, like Bill Holdings, should benefit dramatically if this is the case. Currently, the software group ranks an impressive 47 out of the 250 industries tracked by Zacks (top 19%). Meanwhile, software stocks such as Twilio (TWLO) and Snowflake (SNOW) exhibited standout relative strength during Monday’s equity bloodbath – a bullish sign.

Bullish Chart Pattern

In addition to robust relative strength, BILL shares are breaking out of a bull flag pattern after finding support at the rising 50-day moving average.

Image Source: Zacks Investment Research

Bottom Line

Software is a rare bright spot in an otherwise weak tech sector. As a result, stocks like BILL Holdings may benefit as money flows out of chip stocks.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

BILL Holdings, Inc. (BILL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.