Badger Meter BMI, a Zacks Rank #1 (Strong Buy), manufactures water meters and related technologies to the municipal water utilities market. The company has been benefitting from renewed strength in small- and mid-cap stocks. Badger Meter shares have begun to display relative strength, recently surging to 52-week highs. Increasing volume has attracted investor attention as buying pressure accumulates in this top-ranked stock.

The water instrument provider is part of the Zacks Instruments - Control industry group, which currently ranks in the top 15% out of more than 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months.

Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1.

It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

Badger Meter produces and sells flow measurement, quality, control, and communication solutions worldwide. The company provides “smart” water meters that enable more precise water use and monitoring. Badger Meter offers mechanical and static water meters, along with related radio and software technologies and services.

The Milwaukee, Wisconsin-based company serves water utilities, municipalities, and industrial industries. Its flow instrumentation products are used in wastewater, heating, ventilating and air conditioning markets. The provider of water solutions sells its products and software directly to its users as well as through resellers and representatives.

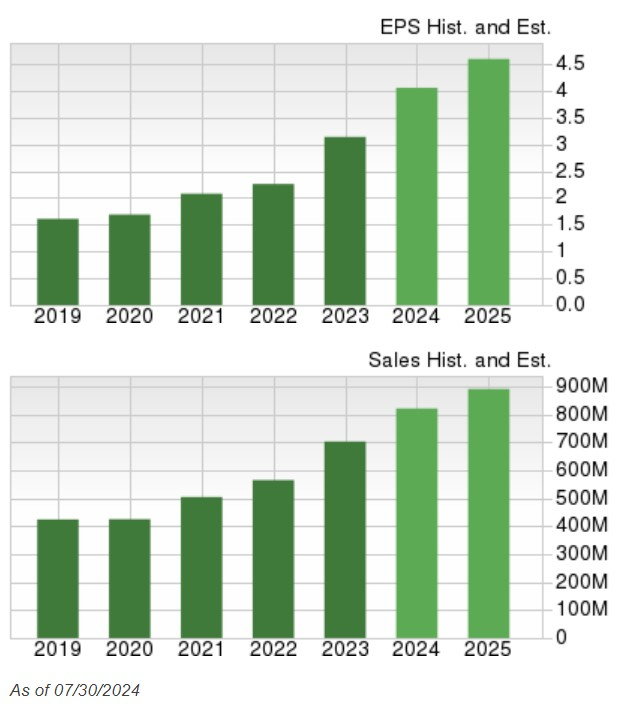

Earnings Trends and Future Estimates

Badger Meter has established an impressive earnings history, surpassing earnings estimates in each of the last nine quarters. Earlier in July, the company reported second-quarter earnings of $1.12/share, a 14.3% surprise over the $0.98/share consensus estimate. Badger Meter has delivered a trailing four-quarter average earnings surprise of 12.9%.

The recent quarterly performance benefitted from solid customer demand for the company’s unique water solutions and disciplined operational execution. An incremental customer backlog conversion also aided the results. Badger Meter is continuously prioritizing and enhancing its presence in select regional markets outside the U.S. that offer healthy growth potential.

Image Source: Zacks Investment Research

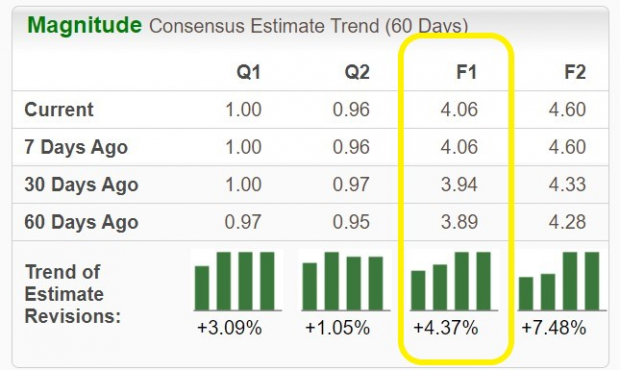

BMI stock received a boost as analysts covering the company have been increasing their 2024 earnings estimates lately. For the full year, earnings estimates have risen 4.37% in the past 60 days. The Zacks Consensus EPS Estimate now stands at $4.06/share, reflecting a potential growth rate of 29.3% relative to the prior year. Revenues are projected to climb 16.8% to $821.9 million.

Image Source: Zacks Investment Research

Let’s Get Technical

This leading company has seen its stock advance more than 30% in 2024 alone. Only stocks that are in extremely powerful uptrends are able to experience this type of outperformance. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of 52-week highs this year, widely outperforming the major indices. With positive fundamental and technical indicators, BMI stock is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Badger Meter has recently witnessed positive revisions. As long as this trend remains intact (and Badger Meter continues to deliver earnings beats), the stock will likely continue its bullish run this year.

Bottom Line

A debt-free balance sheet and frequent product launches bode well for this “smart” water meter provider. Badger Meter is likely to benefit by expanding its market share in water-related applications.

Backed by a top industry group and impressive history of earnings beats, it’s not difficult to see why this company is a compelling investment. Robust fundamentals combined with an appealing technical trend certainly justify adding shares to the mix. The future looks bright for this highly-ranked, leading stock.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpBadger Meter, Inc. (BMI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.