Building the SIP Autobahn

Last weekend, with the weather just starting to warm up, my daughter and I rode our bikes across a bridge over the Hudson River.

Beside us were cars and trucks, traveling 65 (or more) miles an hour, having paid a hefty toll for the slick multilane expressway with industrial strength barriers.

Of course, we were also benefiting from the costs to build the bridge. And although there were no potholes, the bike path shook as large trucks went by and there was just a fence to stop us falling into the river.

But importantly, the bike path was working just fine for us. It was cheaper, too!

Which reminded me of the persistent narrative that the Securities Information Processor (SIP) is a dysfunctional public road, costing investors much more than the proprietary autobahns fast traders get to use. For most investors, that’s not true.

Just how many potholes does the SIP have to fix?

First is the big misconception about the SIP being too slow for most users.

Data suggest the opposite.

Even 10 years ago, the SIP could compile a consolidated quote in less than 6 milliseconds. That was around 50 times faster than the human eye can blink.

Since then, investments have improved the SIP to be almost 400 times faster and able to process 33 times as many messages. In fact, all tapes can now compile a consolidated quote in less than 20 microseconds.

Chart 1: SIP capacity and latency over time (humans react in around 250ms, the speed of light in New Jersey adds around 0.200ms)

To put that in perspective, the speed that light travels between the trading centers in different parts of New Jersey is much slower. In fact, light takes up to 200 microseconds to travel to the primary exchange to update the consolidated quote.

Importantly, that means that the competing consolidators introduced by the NMS II proposals (or distributed SIPs), with feeds coming directly from each venue, will still have this latency on quote updates from any exchange (although they would not affect the travel time for quote updates from non-primary exchanges).

However, competing consolidators don’t come without cost. The NMS II proposals peg the total fixed costs at around $12 million per consolidator for approximately six competing consolidators, likely adding to around $70 million in total. That results in an increase in industry fixed costs above the two current SIP processors (not including additional fees from the new competing consolidators).

Who notices?

Anyone working at eyeball speed won’t even notice the impact of these additional costs.

In our recent study of SIP accounting, we discovered that there are actually a variety of different users for the SIP. Very few of them are economically impacted by current SIP latency.

Chart 2: Only a small fraction of SIP users can benefit from sub-millisecond latency

A retail investor isn’t waiting for the futures price in Chicago to tick in order to trade. Even if they were, the speed of their internet connection and where they live matters much more than the latency of the SIP.

Professional advisors also work at human speed while they talk to investors.

Given that quotes are stable around 99.9% of the time, it’s unlikely that any human trade (or even many algo slices) has an economic cost from SIP quotes being late to update. Even on those that do, the market was already changing at the same time as their order was sent.

However, firms invested in doing electronic trading for clients, market making or arbitrage would be economically affected by changes in sub-millisecond time.

How much do latency-sensitive traders trade?

Chart 2 shows that latency-sensitive traders, or “non-display” users, represent a very small fraction of SIP users.

However, in a recent study of ours, we estimated that latency-sensitive traders, arbitrageurs and market makers may do 70% or more of all trading (Chart 3).

Chart 3: The fraction of latency-sensitive SIP users do the majority of trading

Who pays now for latency improvements?

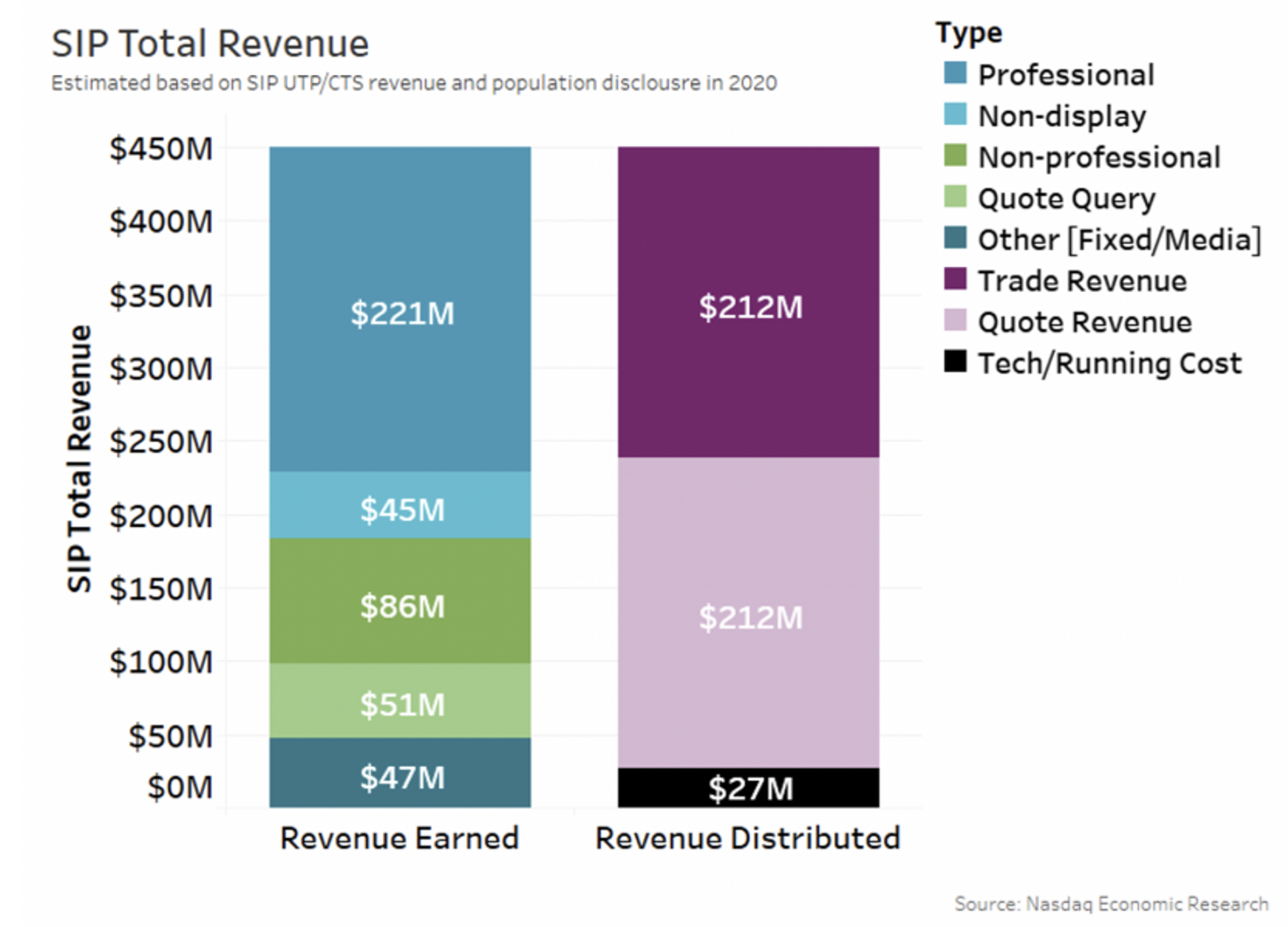

We recently looked at who pays for the SIP. Interestingly, the total revenues from “non-display” users, who can act electronically on a stream of all quotes in near real time, add to just 10% of the total SIP.

In contrast, professional investors, who work at human speed while they talk to investors accounting for the majority of invested assets (Chart 3), pay for around half of the SIP each year (Chart 4). We also estimate retail traders made up just 6% of all buying and selling (gross trading by value) in 2019. Despite that, they paid for around one-third of the SIP.

That also means human users have paid for most of the speed enhancements made in the past 10 years. Arguably, these are the users who needed the improvements the least.

On an autobahn, heavier users and those that create more potholes usually pay higher tolls.

Chart 4: Automated users pay for around 10% of the SIP

Should all users pay the same?

This all raises lots of questions about the new SIP plan.

What is fair? What will make markets more efficient?

We’ve shown before that free isn’t fair or economically efficient. It is an additional disincentive for lit orders in a market that is already trading around 57% of volume away from lit orders.

In fact, speed bumps, dark pools and other off-exchange traders already earn far more from the lit data they use than what they pay for that same data.

Chart 5: Less than half of the market trading is based on lit quotes already

All investors paying an equal amount per trade isn’t efficient either. It ignores fixed costs as well as the economic benefits to all provided by those who contribute to good market quality.

Similarly, charging nothing to users who do no trading isn’t fair. This is especially true in the case of companies that profit from products based on the quotes of others, as it results in higher costs for everyone else who is trading.

Even the current SIP rates account for the fact that there are many different users, some of which do no trading.

Chart 6: There are many users of consolidated data, from those who don’t trade to others who use data to make profitable products

Should all users be forced to take the autobahn?

The NMS II plan to add depth to the SIP is akin to adding multiple HOV lanes to the road. It requires a lot of dedicated new lanes and off-ramps, but not everyone can use them.

It’s not fair or efficient to make all users pay for these upgrades and increases in core data.

That fact was clear in the NMS II rule approval, which discusses in detail the conjecture that most Competing Consolidators would (or should?) offer different “non-NBBO" products, not required to comply with vendor display or trade-through rules, in an a-la-carte style menu.

That means customers who don’t need depth data don’t need to buy it.

It also means the SIP plan has no idea what its customer base is likely to look like when it is setting prices designed to reasonably cover costs. And without a known number of customers, it’s difficult to work out what the average price needs to be.

That’s especially important given the fact that we already see some institutions opt-out of taking proprietary feeds from the smallest venues, even though that data is free.

Why does this matter?

The new SIP plan is about to consider how to fairly and efficiently charge users for SIP data.

This is an opportunity to more efficiently allocate SIP resources. We could create a fairer structure where low-latency customers aren’t paying for high-latency technology. But even that creates economic distortions.

Just like my ride across the Hudson. I didn’t need the expensive autobahn bridge. But what I paid didn’t reflect the cost of the bike path either.

Accounting for fairness is hard. It’s up to regulators and the industry to find a fair way.