Builders FirstSource, Inc. BLDR has inked an all-cash deal to acquire a software solutions and services provider for the building products industry — WTS Paradigm, LLC. This move marks a step forward for Builders FirstSource in progressing toward a digital strategy in order to create major construction process efficiencies through prudent investments in innovative technologies.

Buyout Synergies

Headquartered in Middleton, WI, Paradigm emphasizes on technology, software development and consulting services, thereby aiding manufacturers, retailers as well as homebuilders in the building products industry to enhance sales, and slash costs.

The Paradigm acquisition will boost Builders FirstSource’s digital competences that will help the company in solving issues arising from the homebuilding process. Meanwhile, Builders FirstSource has plans to continue investing in the core Paradigm Omni configuration technology, which also powers a newer product: Paradigm Omni for Homebuilders, a virtual design technology that reduces friction and improves efficiency.

The acquisition — valued at $450 million — is expected to close in 2021, subject to customary closing conditions and antitrust approvals. Upon the transaction’s closure, Paradigm will operate as a subsidiary of Builders FirstSource and is expected to generate revenues of $50 million in 2021.

Digital Evolution: A Boon

Companies across the homebuilding industry have been consistently focusing on investing in modern technologies to enhance customer experience. The progress of the digital era will boost efficiencies in complex homebuilding projects. According to the company, an average residential construction project involves more than 60 material suppliers, 100 sub-contractors and many other service providers. There are several complications while managing a project. Here arises an excellent opportunity for digital technologies to drive the construction process efficiently. To serve customers and employees with better technologies, Builders FirstSource is continuously leveraging technology platforms.

Meanwhile, acquisitions have been one of the preferred modes of solidifying the company’s presence and product portfolio. In May 2021, Builders FirstSource has inked a deal to acquire Arizona’s largest independently operated supplier of building materials — Cornerstone Building Alliance SW, LLC (“Alliance”) — for approximately $400 million. The acquisition will be funded through a combination of existing cash and credit facilities, and is expected to close in second-quarter 2021, subject to customary closing conditions as well as approvals.

In the same month, Builders FirstSource has acquired a family-owned, leading supplier of lumber and other building materials company - John’s Lumber. The acquisition will improve Builders FirstSource’s product portfolio and expand reach within Michigan.

Importantly, on Jan 1, it completed the merger with BMC Stock Holdings — one of the nation’s leading providers of diversified building materials and solutions to new construction builders as well as professional remodelers. BMC’s distinct millwork capability, READY-FRAME offerings and other manufactured products complement Builders FirstSource’s strength in trusses as well as manufactured components, among other offerings. Also, it will now be able to invest more in innovation and develop targeted solutions that will be provided by highly-skilled team members. This enables the company to provide best-in-class service to customers and communities.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

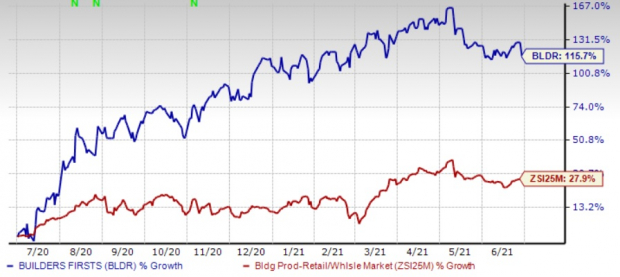

Shares of this largest supplier of building products, prefabricated components and value-added services company have gained 115.7% in the past year compared with the Zacks Building Products - Retail industry’s 27.9% rally.

Builders FirstSource — which shares space with Fastenal Company FAST, Lumber Liquidators Holdings, Inc. LL and Beacon Roofing Supply, Inc. BECN in the same industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST): Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN): Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR): Free Stock Analysis Report

Lumber Liquidators Holdings, Inc (LL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.