Research Brief from Senior Quant, Vishnu Patel

Studying Zero-Cost Buffer Strategies and the Importance of the Upper Strike

The historical performance of Zero-Cost Buffer strategies range significantly based on an investor’s desired downside protection. The simplest approach to implement a Zero-Cost Buffer consists of the following three-leg structure:

- Selling a 6-month out-of-the-money (OTM) put options at the strike price that equates to appropriate buffer level.

- Buying a 6-month at-the-money (ATM) call option.

- Selling a 6-month call option at the highest strike price available that fully funds the long call spread.

Buffer strategies have seen massive adoption since the beginning of COVID and have continued to gather ~$6 billion in assets during this current market correction. Buffer have many key benefits including:

- Selling an OTM put option protects investor’s initial downside, only suffering drawdowns when the underlying asset’s spot price falls below the buffer level.

- Buffer strategies are highly cash efficient. Zero-Cost Buffer in particular use the proceeds from the short put position to fully fund the long call spread (Legs 2&3).

- Buffer strategies are well positioned within the asset allocation given their ability to provide market exposure with reduced volatility.

Using Volos’ Strategy Engine, a no-code backtesting web application where investors can seamlessly build, analyze, and implement customized options strategies, we study the differences in historical performance of Zero-Cost Buffer strategies using Nasdaq-100 Index options and a range of buffer levels between between 70-100% (i.e. 30% OTM short put versus ATM short put respectively).

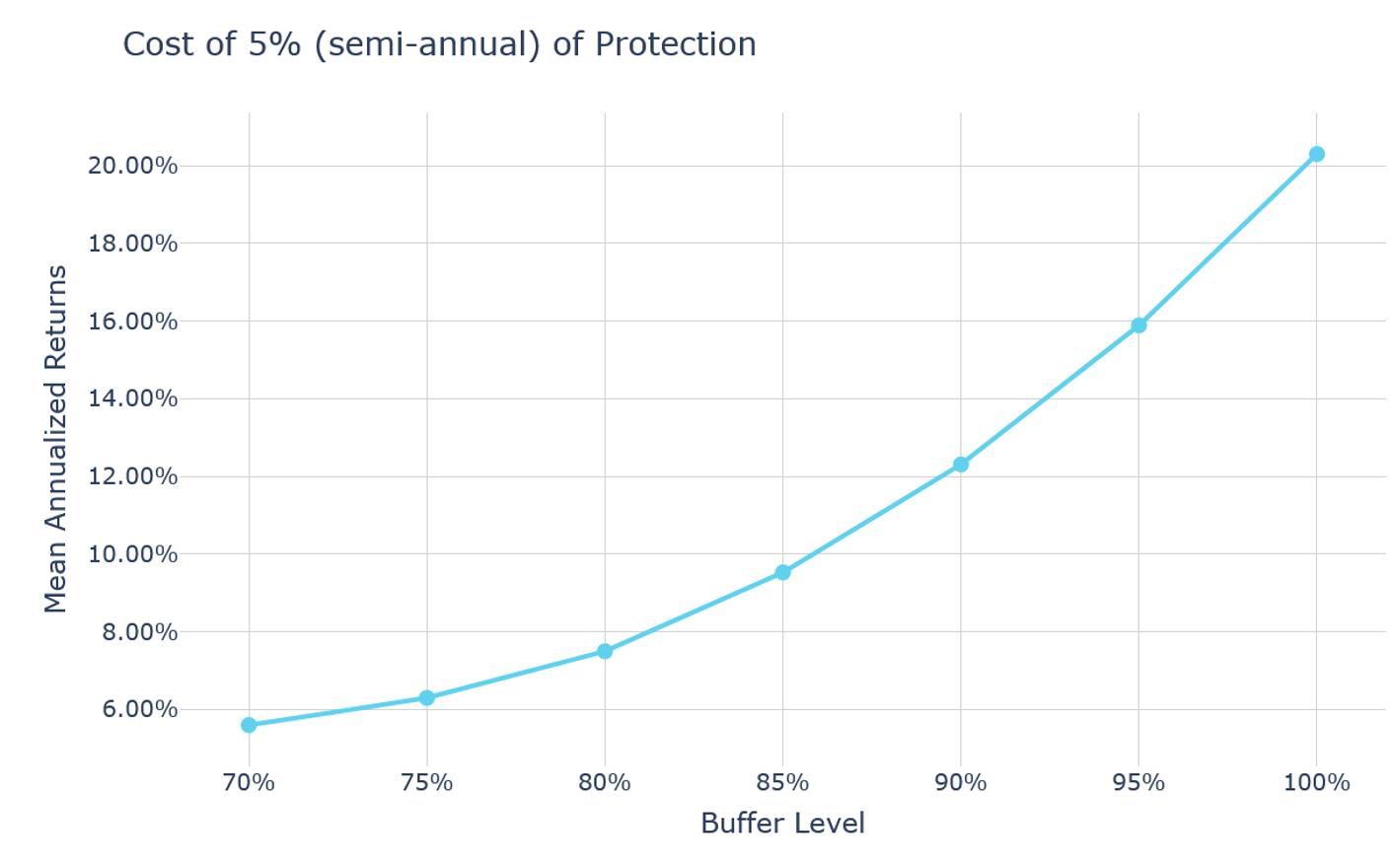

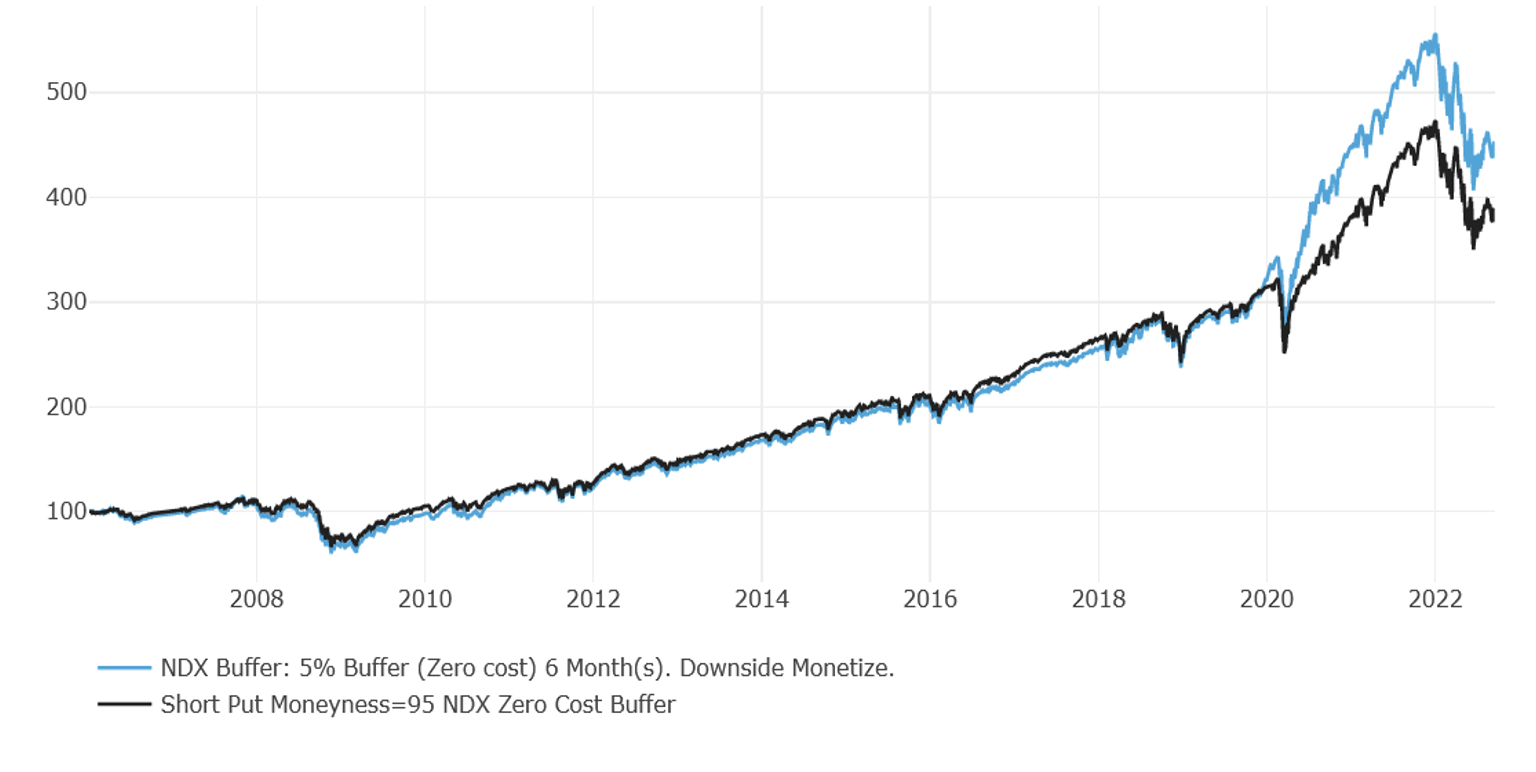

Our results were definitive in illustrating the trade-offs of Buffer strategies which produce significantly higher returns (albeit with higher volatility) as investors reduce their downside protection. Annualized returns varied widely with the 30% OTM Short Put strategy exhibiting >1400 bps lower annualized returns that the ATM Short Put strategy. While Buffer strategies have become popular due to their ability to provide upside exposure to the market at ranging risk tolerance levels, it is worth evaluating whether dynamic rules could be employed to reduce drawdowns in the higher performing strategies selling puts closer to the money and enable risk averse investors greater upside participation.

Summary of Performance (View Interactive)

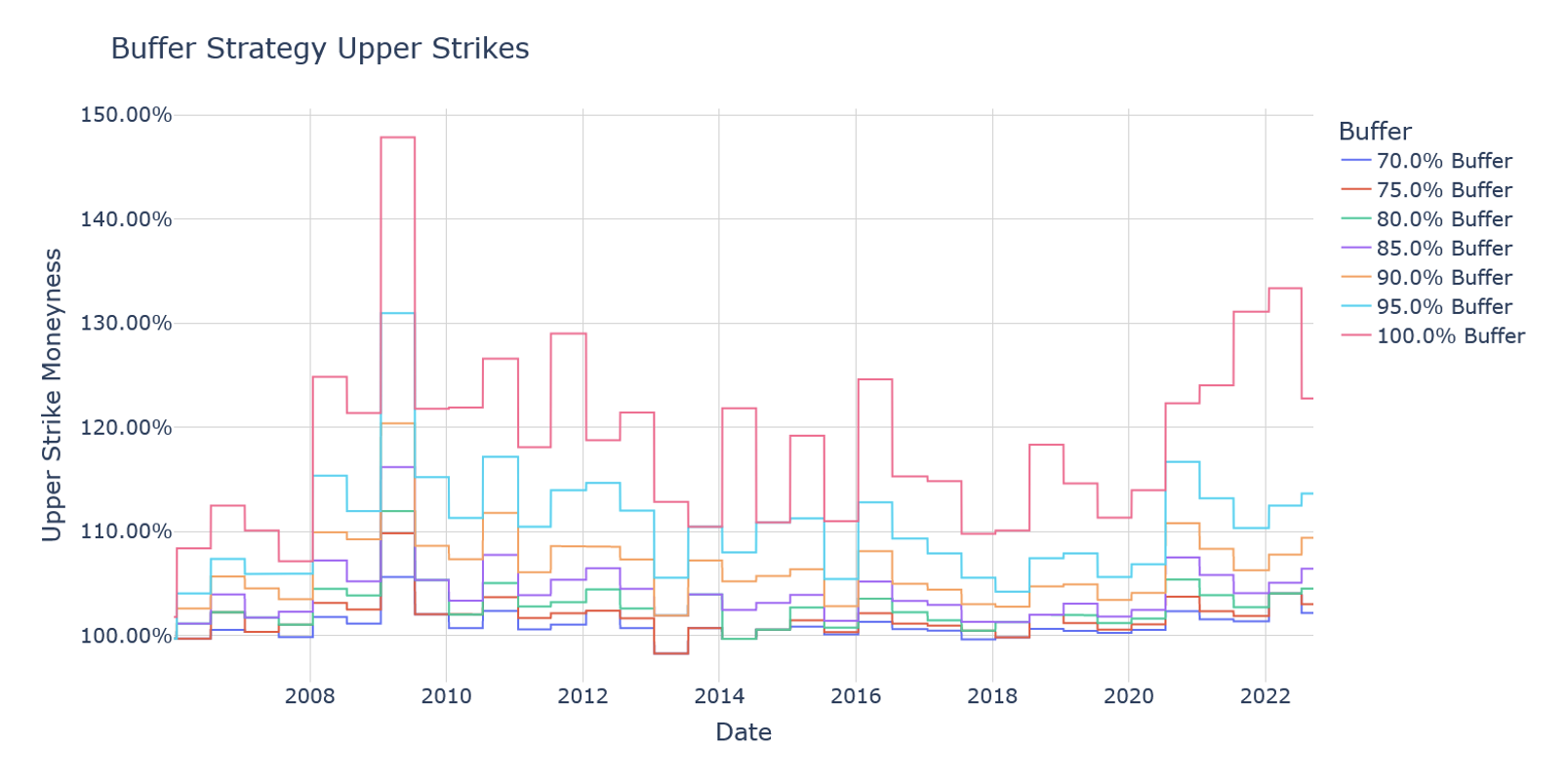

Historical Upper Strike Levels by Buffer Level

Annualized Returns by Buffer Level

Design Alpha using Volos’ Strategy Engine

Allocators, investment managers, and advisors use Volos’ Strategy Engine to tailor options programs to meet their organization or end client’s investment objective. Volos’ Strategy Engine enables the design of both simple passive and sophisticated active options strategies.

Please visit https://www.nasdaq.com/solutions/ndx-connect to learn more about how Volos and Nasdaq have partnered to provide unprecedented transparency and access to tailored Nasdaq-100 index options strategies.

Historical and simulated index performance is not necessarily indicative of future results. These products do not offer investment advice. The company is not an investment advisor. The company accepts no responsibility whatsoever for any loss or damage of any kind arising out of the use of all or any part of the company products and the information contained therein.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.