Broadcom (NASDAQ: AVGO) shares were skyrocketing higher after the company reported record revenue in its fiscal fourth quarter, ended Nov. 3, and said it was developing custom artificial intelligence (AI) chips for a number of large customers. The surge in share price brought the stock's gains up to more than 100% for the year to date.

Let's take a closer look at the company's most recent results and commentary to see if the momentum in the stock can continue.

AI opportunity

More than its results, it was the commentary from Broadcom CEO Hock Tan that got investors excited and helped push the stock higher. He said each of its big-three "hyperscaler" customers (those owning massive data centers) was planning to deploy 1 million XPU (AI chip) clusters by 2027. Including XPUs and networking equipment, Broadcom's addressable market among these three customers could be between $60 billion to $90 billion in fiscal 2027 alone.

In addition, Tan said two additional hyperscaler customers were in advanced development of their own artificial intelligence (AI) chips, which could significantly increase the addressable market. Tan said that Broadcom plans to turn these companies into revenue-generating customers by fiscal 2027.

Apple could be one of these new customers as it was recently reported that the iPhone maker was working with Broadcom on a new AI server chip, code-named Baltra, to help run its AI applications in the cloud. According to the reports, the company is looking to have the chip design completed within the next year.

Turning to Broadcom's results, revenue surged 51% to $14.05 billion in the quarter, but was up just 11% when excluding the contributions from its acquisition of VMware, which it acquired in November 2023. That was actually just below analyst estimates looking for revenue of $14.09 billion, as compiled by the London Stock Exchange Group.

Semiconductor solutions revenue increased 12% year over year to $8.2 billion. Within the segment, networking revenue led the way, soaring 45% to $4.5 billion, with custom AI networking revenue surging 158%.

Wireless revenue rose 7% year over year to $2.2 billion due to higher content. It has been rumored that Apple will be moving away from Broadcom for its own in-house bluetooth and Wi-Fi chip although the company said it continues "to be very engaged with this customer in multi-year road maps across various technologies we have leadership in, including RF, Wi-Fi, bluetooth, sensing, and touch."

Broadcom said that server storage-connectivity revenue has risen 20% from the bottom it hit six months ago to $992 million and that it expects it to continue to grow. Broadband revenue plunged 51% to $465 million, but Broadcom thinks this area has now bottomed, as it saw some big orders in the quarter. Industrial sales, which sank 27%, is only about 1% of its revenue at $173 million. The company is looking for a recovery in the second half.

Moving to its infrastructure software segment, revenue climbed 196% to $5.8 billion largely due to the VMware acquisition. Revenue was flat sequentially, as the company said some deals slipped into the first quarter. As a result, it is looking for software revenue to rise 41% year over year and 11% sequentially in the first quarter.

Looking at profitability, adjusted earnings per share (EPS) in the quarter rose from $1.11 to $1.42, adjusting for its previous 10-for-1 stock split. That was ahead of the $1.38 analyst consensus. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) jumped 65% year over year to $9.1 billion.

Broadcom generated $5.6 billion in cash flow from operations and $5.5 billion in free cash flow in the quarter, while for the year it had $20 billion in operating cash flow and $19.4 billion in free cash flow. It finished its fiscal year with nearly $19.3 billion in cash and equivalents, and $67.6 billion in debt stemming from its earlier $69 billion acquisition of VMware.

On the guidance front, the company forecast fiscal Q1 revenue of approximately $14.6 billion -- just ahead of the $14.57 billion consensus -- and would represent about 22% growth. Management expects adjusted EBITDA to be about 66% of revenue, or about $9.6 billion.

Image source: Getty Images.

Can the stock's momentum continue?

Broadcom's fiscal Q4 results were solid but not spectacular, with revenue growth of just 11% when taking out the boost it got from its earlier VM acquisition.

Meanwhile, fiscal Q1 revenue guidance basically fell in line with analyst expectations. That is usually not the type of results that see a stock surge unless it was beaten down and expectations were low, which was clearly not the case with Broadcom, whose stock has been a strong performer this year ahead of the report.

However, investors are clearly excited about the custom AI opportunity in front of the company, which appears quite substantial as it draws in more customers. As companies are looking for alternatives to Nvidia's graphics processing units (GPUs) to help avoid the company becoming too powerful, developing custom chips through Broadcom seems to be becoming a preferred strategy.

That said, there also needs to be some caution when it comes to Broadcom's commentary. The first is that obviously some of the addressable market that Hock Tan talked about is still going to go toward Nvidia's GPUs. Second, one of these customers is presumably ByteDance, which is seeing the possibility that TikTok could be banned in the U.S. That puts a lot of doubt into how this customer may ramp up its AI chip spending.

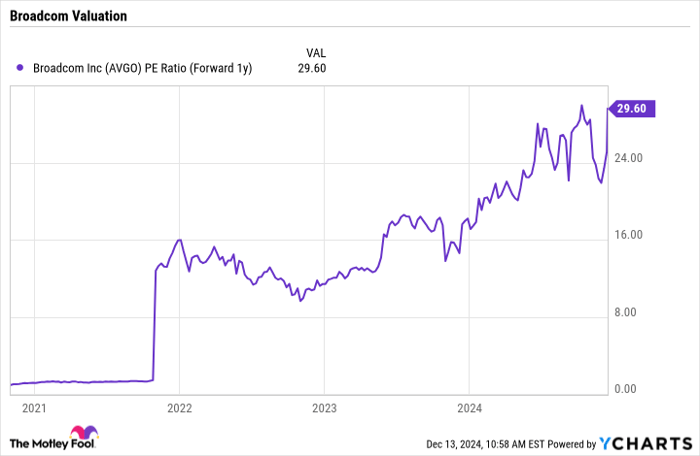

After the surge in its price, Broadcom now trades at a forward price-to-earnings (P/E) ratio of under 30. That's higher than where it has traded at in the past several years although investors are clearly baking in some future accelerated growth.

AVGO PE Ratio (Forward 1y) data by YCharts.

I continue to like Broadcom's AI opportunities, but after this latest big jump in in its stock price, I would consider holding back on chasing the stock. There are still questions around potentially losing some Apple business as well as what happens with TikTok, which could impact ByteDance and the ramp of its custom chips.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $342,278!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $47,543!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $496,731!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.