Bristol-Myers Squibb Company BMY announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (“CHMP”) has rendered a positive opinion on, and recommended the approval of its sphingosine-1-phosphate (S1P) receptor modulator Zeposia (ozanimod) for the treatment of moderate-to-severe active ulcerative colitis (“UC”) in adult patients who have had an inadequate response, lost response, or were intolerant to either conventional therapy or a biologic agent. The opinion will now be reviewed by the European Commission.

The positive CHMP opinion was based on data from the pivotal phase III True North study, which evaluated Zeposia as an induction and maintenance therapy versus placebo in the given patient population. Data from the same showed that treatment with Zeposia led to clinically meaningful improvements in key clinical, endoscopic and mucosal healing endpoints.

Per the company, if approved, Zeposia will become the first and only oral S1P receptor modulator to be approved for treating UC in the European Union.

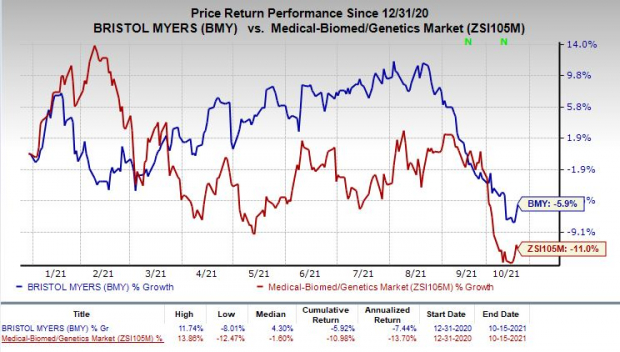

Shares of Bristol Myers have declined 5.9% so far this year compared with the industry’s decrease of 11%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In May 2021, the FDA approved Zeposia for the treatment of adult patients with moderate-to-severe active UC, a chronic inflammatory bowel disease.

We note that Zeposia is already approved in the United States for the treatment of adults with relapsing forms of multiple sclerosis or RMS. The European Commission also approved Zeposia for the treatment of adult patients with relapsing remitting multiple sclerosis or RRMS in May 2020.

Bristol Myers is currently evaluating Zeposia in an open-label extension study to assess the longer-term profile of the drug for the treatment of moderate-to-severe active UC.

Zeposia is also being evaluated for the treatment of moderately to severely active Crohn’s disease in the ongoing phase III YELLOWSTONE study.

In the first six months of 2021, Zeposia generated sales worth $46 million. Potential label expansion of the drug is likely to boost sales in 2021 and beyond.

Zacks Rank & Stocks to Consider

Bristol Myers currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include Intercept Pharmaceuticals, Inc. ICPT, Athenex, Inc. ATNX and Amicus Therapeutics, Inc. FOLD, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intercept Pharmaceuticals’ loss per share estimates have narrowed 2.6% for 2021 and 8.3% for 2022, over the past 60 days.

Athenex’s loss per share estimates have narrowed 9% for 2021 and 9.2% for 2022, over the past 60 days.

Amicus Therapeutics’ loss per share estimates have narrowed 1.3% for 2021 and 37.5% for 2022, over the past 60 days.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY): Free Stock Analysis Report

Amicus Therapeutics, Inc. (FOLD): Free Stock Analysis Report

Intercept Pharmaceuticals, Inc. (ICPT): Free Stock Analysis Report

Athenex, Inc. (ATNX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.