Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- With more than two-thirds of the Q4 earnings results already in, we can safely say that it has been a good reporting cycle, with the growth pace showing a notable accelerating trend and companies comfortably beating consensus estimates.

- Total earnings for the 345 S&P 500 companies that have reported results are up +12.7% from the same period last year on +5.8% higher revenues, with 78.0% beating EPS estimates and 65.5% beating revenue estimates.

- Q4 earnings for the ‘Magnificent 7’ group of companies are expected to be up +29.6% from the same period last year on +12.5% higher revenues. Excluding the ‘Mag 7’ contribution, Q4 earnings for the rest of the index would be up +8.4% (vs. +13.3%).

- Looking at the calendar year picture, total S&P 500 earnings are expected to grow by +13.5% in 2025, with nearly all sectors contributing to the growth pace. Sectors with double-digit earnings growth this year include Aerospace (+80.8%), Consumer Discretionary (+27.5%), Medical (+20.7%), Tech (+17.2%), Retail (+10.8%), Business Services (+11.0%), and Transportation (+13.9%).

Recent Standout Reports

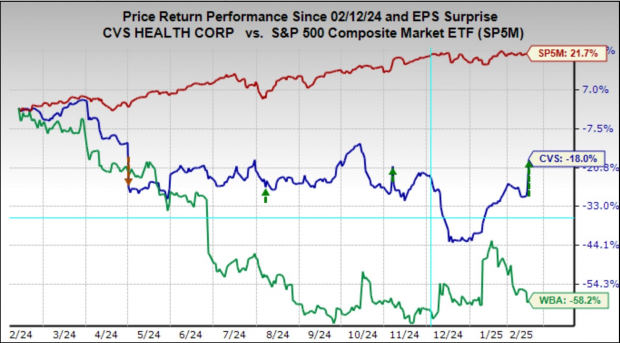

The Coca-Cola KO and CVS CVS quarterly releases are good examples of ‘staply’ businesses that can surprise to the upside in the current environment. Coke and CVS shares have lagged the market over the past year, but they have nevertheless done better than their nearest rivals: Pepsi PEP in the case of Coke and Walgreens Boots Alliance WBA in the case of CVS.

Coca-Cola had strong organic revenue numbers, with overall Q4 revenues up +11.8% from the same period last year despite significant foreign exchange headwinds. Guidance from both companies was in line with consensus expectations, but that still counts as a win in the challenged macro backdrop for Coke and CVS.

CVS shares were up big on the earnings beat, further increasing the performance gap with Walgreens, as the chart below shows.

Image Source: Zacks Investment Research

Is The Tech Sector’s Earnings Outlook Starting to Shift?

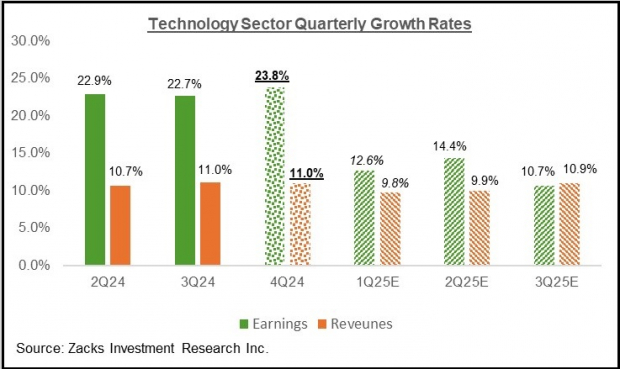

The Tech sector has been a significant growth driver in recent quarters, and the trend is expected to continue in 2024 Q4 and beyond. For Q4, Tech sector earnings are expected to be up +23.8% from the same period last year on +11.0% higher revenues, the 6th quarter in a row of double-digit earnings growth.

This would follow the sector’s +22.7% earnings growth on +11% higher revenues in 2024 Q3. As the chart below shows, the sector’s growth trajectory is expected to continue in the coming quarters.

Image Source: Zacks Investment Research

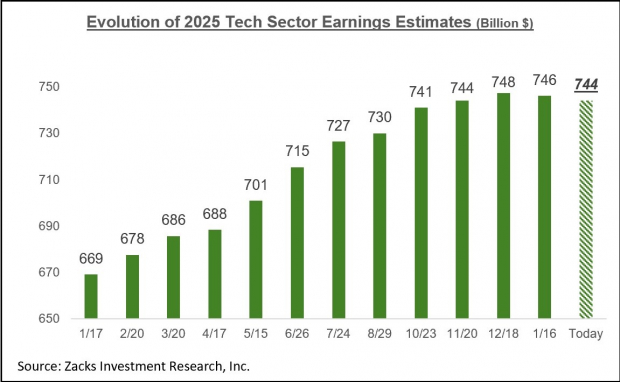

The Tech sector has also been among those few sectors that have steadily enjoyed an improving earnings outlook, with estimates steadily increasing. However, the more recent data on this count appears to show a shift in the revisions trend, as the chart below of aggregate 2025 earnings estimates for the sector shows.

Image Source: Zacks Investment Research

The Earnings Big Picture

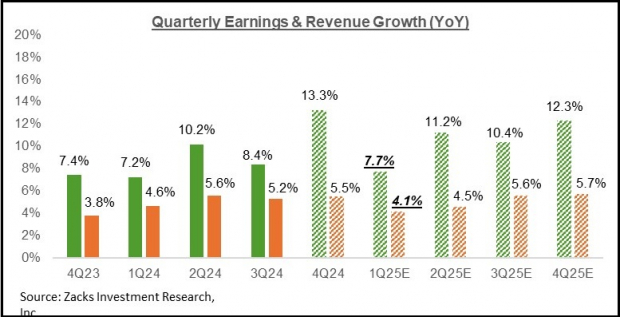

The chart below shows expectations for 2024 Q4 in terms of what was achieved in the preceding four periods and what is currently expected for the next four quarters.

Image Source: Zacks Investment Research

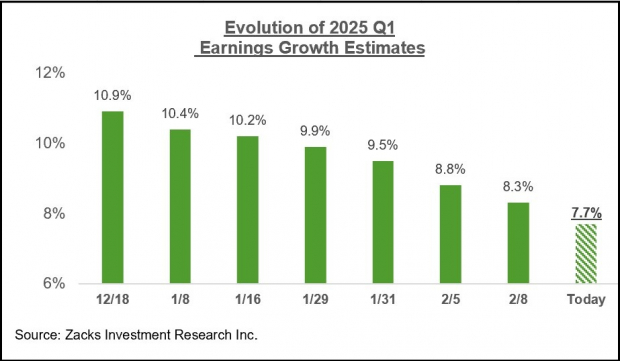

As you can see in the above chart, total S&P 500 earnings for the current period (2025 Q1) are currently expected to be up +7.7% from the same period last year on +4.1% high revenues.

Estimates for the period have been coming down since the quarter got underway, as the chart below shows.

Image Source: Zacks Investment Research

The revisions trend is broad-based, with estimates for 15 of the 16 sectors down since the start of January (Medical is the only sector whose estimates have increased). Sectors suffering the most significant cuts to estimates include Conglomerates, Aerospace, Construction, Basic Materials, Autos, and others. Unlike other recent periods, estimates for the Tech sector have also been under pressure.

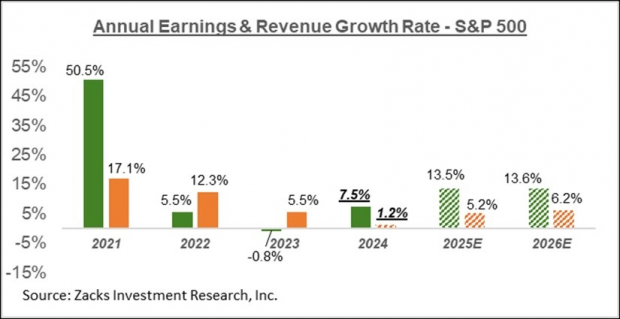

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As you can see, the expectation is for double-digit earnings growth in each of the next two years, with the number of sectors enjoying strong growth notably expanding from the narrow base we have been seeing lately.

In fact, 2025 is expected to have nearly all Zacks sectors enjoy earnings growth, with 7 of the 16 Zacks sectors expected to produce double-digit earnings growth. Unlike the last two years, when the Mag 7 group drove all or most of the aggregate earnings growth, we will have double-digit S&P 500 earnings growth in 2025, even without the contribution from this mega-cap group.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>CocaCola Company (The) (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.