BlackBerry Limited (BB) is somewhat of an enigma in the investment world, full of great promise but at the same time, it has let shareholders down time and again. The company is armed with a huge patent portfolio, and offers several cutting-edge products in cybersecurity, Internet-of-Things (IoT), and automotive technology.

What’s more, shares have surged 32% in the last two sessions after BlackBerry announced that it has sold 90 smartphone technology patents to Huawei, as part of its shift away from the mobile phone space.

But while BlackBerry gushes with potential, it also disappoints quarter after quarter. In the most recent quarter, BlackBerry missed on revenue and GAAP EPS. Most concerning were the drop in revenue, down 20% year-over-year, and the sizeable increase in GAAP operating loss of $127 million, up from the $29 million loss one year ago.

To be fair, some of the performance issues were pandemic-related, particularly with regards to the auto sector where plant shutdowns have translated to fewer automobile deliveries, and hence, lower QNX licensing fees. However, the company’s revenue has been shrinking for several years before the pandemic. The five-year growth rate for example is -20.8%.

Company Transformation

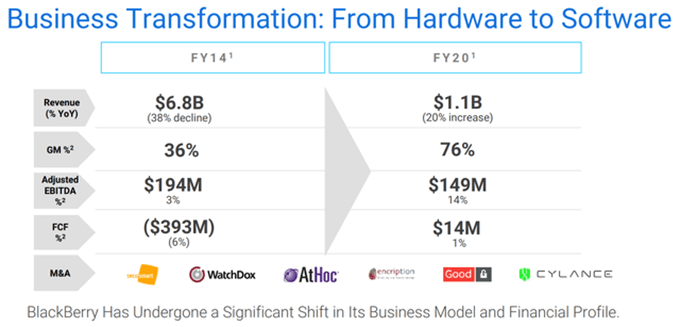

The story is not all bad. Glimmers of hope are emerging in what may yet shape up to be a multi-year turnaround story that started in 2013, the year that John Chen took the reigns of BlackBerry as CEO. At that time, BlackBerry was a $6 billion Titanic, immersed in red ink after hitting an iceberg called the Apple iPhone. After taking charge, John Chen proceeded to monetize the company’s patent portfolio, and transform the mobile phone manufacturer into a much more modest $1 billion software company.

The transformation has taken place over several years, with half a dozen acquisitions along the way, including Cylance, Good, and AtHoc. These companies have been assimilated and worked into BlackBerry's product streams, but also have resulted in a significant write down of goodwill, including $500 million earlier in 2020.

BlackBerry has at least stabilized its financial situation, and now has positive free cash flow and adjusted EBITDA. That said, the turmoil surrounding the company has affected its stock price and resulted in an attractive valuation. BlackBerry also boasts some promising technologies that could lead to strong revenue growth down the road.

This may be a great time to invest in BlackBerry.

Valuation Metrics

BlackBerry’s low valuation should come as no surprise given its past troubles. The company has superior metrics versus the software industry on a number of fronts, summarized in the table below.

| Metric | BlackBerry | Industry |

| Price/Sales Ratio | 5.85 | 11.31 |

| Price/Book Ratio | 3.07 | 11.44 |

| Gross Margin | 74.2% | 70.9% |

| Operating Margin | -9.2% | -23.6% |

| Current Ratio | 2.27 | 1.57 |

| Total Debt/Equity | 0.33 | 0.55 |

Metrics such as price/sales and price/book ratio suggest that BlackBerry is quite undervalued, with a strong likelihood that the stock will outperform once the company’s future potential is recognized by the market. It is not at all unreasonable to expect a 2x - 3x stock price increase from its current level.

BlackBerry IVY

BlackBerry’s recent announcement regarding its strategic alliance with Amazon Web Services (AWS) may be enough to kick-start the company’s stock price. The exclusive partnership provides instant credibility along with a ‘Big Data’ mindset to vehicle data, resulting in unlimited potential for third-party applications in areas such as car insurance, maintenance, EV charging, and connected vehicles.

The AWS platform gives BlackBerry IVY cloud-connectivity, scalability, and a global reach. This initiative will provide BlackBerry with a new source of recurring revenue in the automotive market, where it already has software installed in over 175 million cars.

Spark Suite

Apart from BlackBerry IVY, there are several other promising technologies emerging from BlackBerry, including Spark Suite, which combines Endpoint Management with Endpoint Security, a logical step in the evolution of mobile devices. Spark Suite provides Zero Trust, an emerging concept in cybersecurity that is becoming a necessity for enterprises as mobile devices such as wearables become the norm within the workplace.

In addition to IVY and Spark Suite, BlackBerry has several other more mature product offerings including QNX, BlackBerry AtHoc, and BlackBerry SecuSUITE. While not as exciting as BlackBerry's recent initiatives, they provide a steady and increasing revenue stream.

Wall Street’s Take

From Wall Street analysts, BlackBerry earns a Hold analyst consensus based on 3 Hold ratings. Additionally, the average price target of $8 puts the downside potential at 18.7%. (See BlackBerry stock analysis on TipRanks)

Summary and Conclusions

BlackBerry has had a turbulent past, downsizing from a $6 billion hardware company into a $1 billion software company over the last seven years. Revenue was down 20% year-over-year in the latest quarter, but much of the poor performance can be attributed to the soft auto sector resulting from the pandemic. QNX licensing fees and royalties will pick up as the global economy improves.

Despite several years of disappointing results, the company has stabilized its financial situation and appears to be positioned to capitalize on several leading-edge technology ventures, including its exclusive partnership with AWS and enterprise mobility management and security. Given the very low valuation, this could be an ideal time to invest in BlackBerry.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.