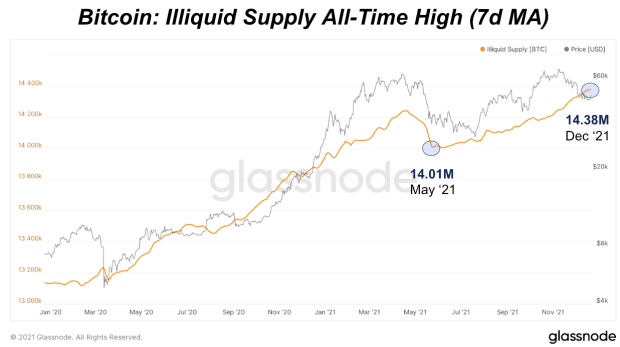

Since May 2021, the supply of illiquid bitcoin has grown by almost 371,000 BTC.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Illiquid supply continues to hit multi-year highs, adding nearly 371,000 bitcoin since the deceleration in May. Even with the recent price drawdowns sparked from long liquidations and market sell-offs, illiquid supply continues to increase signaling that more long-term holders are adding bitcoin over the last few months.

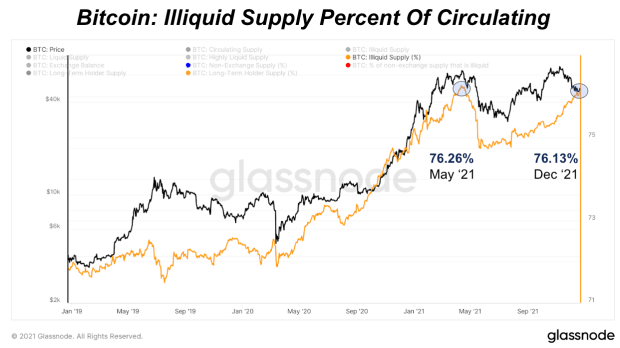

As a percentage of circulating supply, illiquid supply is 76.13% and just below the all-time high of 76.26% also seen back in May. Illiquid supply percentage of circulating supply has been a strongly correlated relationship with price over the last year.

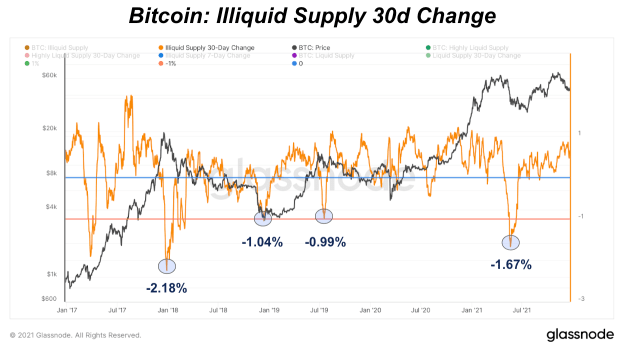

The illiquid supply trends also show that the most recent drawdowns were largely driven by the derivatives market and not so much the spot market. With every major bitcoin correction, there has been a significant deceleration in illiquid supply looking at the illiquid supply 30-day change. Typically this is a 30-day change in illiquid supply at or below -1%.

A 1% change of illiquid supply today would be 143,942 bitcoin worth just over $7 billion at a $49,000 price. We would expect a more significant, spot-driven bitcoin correction to come with a decelerating illiquid supply, which hasn't been seen over the last few months.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.