Winter is here; however, the biggest fear among crypto traders is whether crypto winter is here. No one wants to see another crypto winter as it is difficult to forget the dire consequences of the previous one. It took nearly three years for Bitcoin's price to reach another all-time high after its massive plunge in 2017. Bitcoin's price dropped nearly 10%, briefly breaking an important psychological price level at $60,000; as of this writing, it has since rebounded above the $60k mark. Many are worried what this means for the future of the BTC price and what is really driving the price down.

Why Is Bitcoin Falling?

Traders had been hoping for a strong rally since the SEC's approval of the first Bitcoin ETF, BitGo. However, BTC barely touched the $69K price level and since then, it has been in a consolidation pattern. This particular pattern was mainly due to the wait for big news out of Washington about the infrastructure deal which President Joe Biden signed last night.

Biden’s $1 trillion infrastructure deal comes with new tax-reporting requirements for digital currencies. The new budget plan also requires stricter tax reporting requirements for cryptocurrency transactions and includes revealing investors' personal information. These particular factors have triggered a sell-off in cryptocurrencies today.

In addition to this, China’s broad-based crackdown on the crypto industry, which is due to the power consumption and potential environmental fallout of Bitcoin mining, has also been weighing on the prices. Having said that, traders have started to think beyond this, since they know Bitcoin’s future is much bigger than that.

Should Investors Be Worried About Bitcoin Sell-off?

Investors and traders should consider the current sell off in the cryptocurrency space, especially in Bitcoin and Ethereum, as a blessing in disguise. The fact is that the impending reporting structures and tax vigilance on cryptocurrencies only makes the space more legitimate. This means that cryptocurrencies are here to stay forever and this space is only going to attract more investors in the future.

Another reason that investors should not be distracted by the current sell-off is that Bitcoin is also a good inflation hedge. The annual inflation rate in the U.S. surged to 6.2% in October 2021, the highest since 1990 and above the forecast of 5.8%. The coronavirus pandemic, the financial crisis of 2008 and other similar events pushed the Fed to run their dollar printing machines at maximum capacity and this has eroded the value of the dollar. In comparison, the supply of Bitcoin is limited: there are only 21 million bitcoin which can be mined.

Is This A Good Time To Buy Bitcoin?

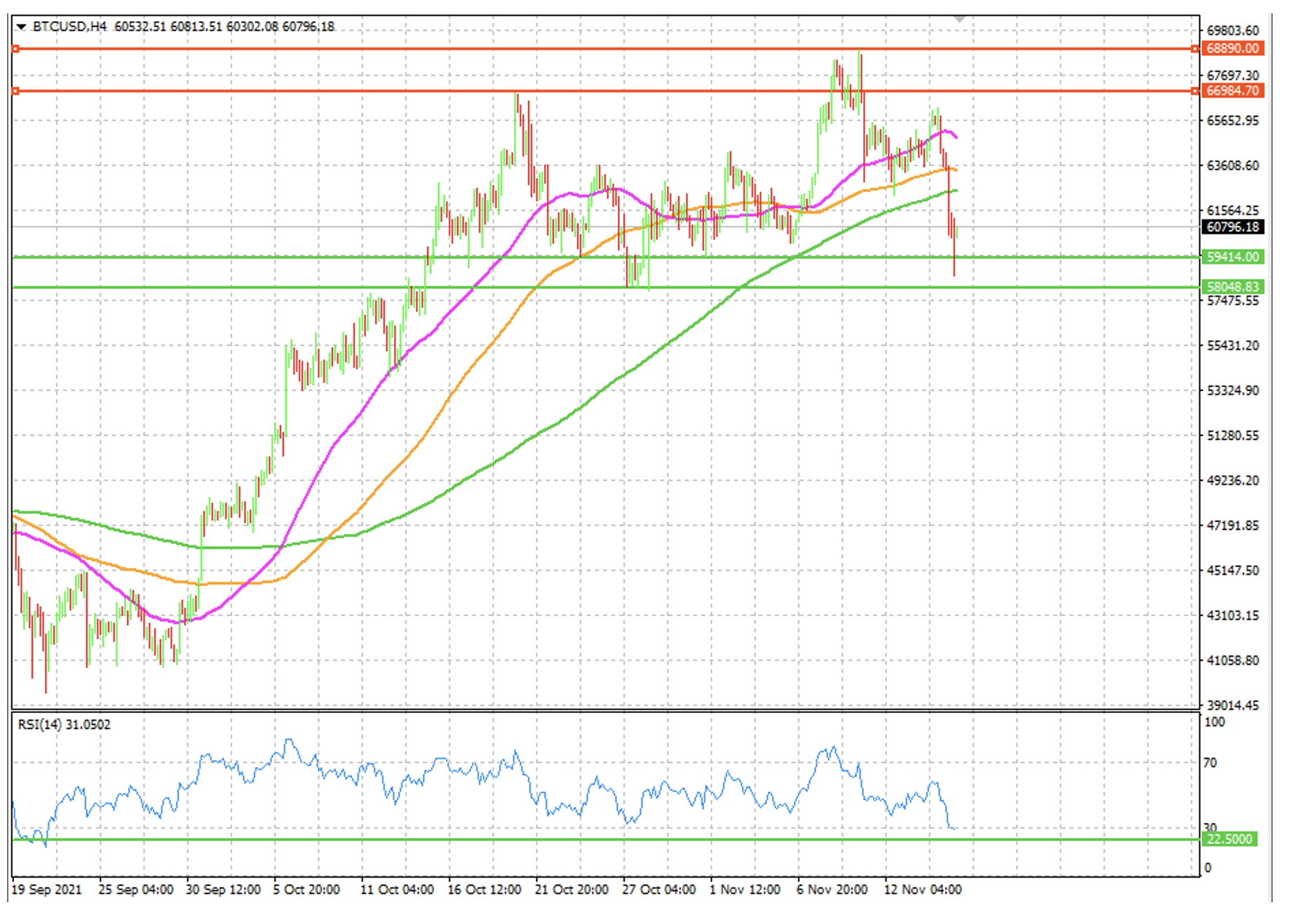

The global crypto market cap plunged nearly 8% in the last 24 hours to nearly $2.8 trillion. From a technical price perspective, the BTC price touched an important price level today (as shown in the chart below) which is the 50-day Simple Moving Average, SMA, which acts as a support. However, this doesn’t mean that the price can’t drop any further. It can continue to move towards the 100 or even 200-day SMA on the daily time frame price chart. Nevertheless, the BTC price on the intra-day time frame is completely oversold according to the Relative Strength Index, RSI, which has shown a reading of 28. Anything near 30 or below means prices are oversold and a rebound in the price is on the cards:

Source: AvaTrade

Bottom Line

Crypto winter is unlikely to take place for the time being. BTC prices usually rally during this part of the year. The impending BTC tax reporting requirement is a big deal for cryptocurrency traders and investors. However, once the dust has settled, it is more than likely that we will see the Bitcoin price rallying and the current sell-off could be the last opportunity for this year to bag some bargains.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.