The Federal Reserve hiked 75 basis points as expected and markets across the board rallied higher with no surprising or unanticipated bad news.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

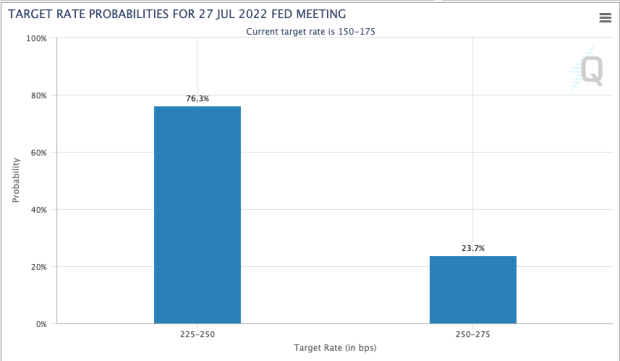

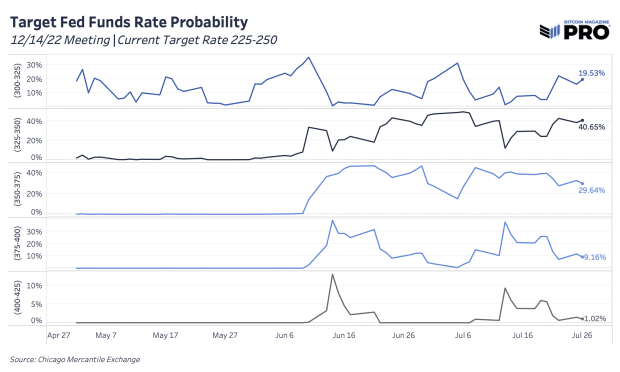

On July 27, 2022, the Federal Reserve went through with another 75-bp rate hike. This was broadly expected going into the meeting, with the market assigning a 76.3% probability of a 75-bp hike one hour prior to the meeting, with a (previously) 23.7% chance of a 100-bp (1.0%) rate hike taking place. After the meeting and press conference, the latest market data puts the most favorable odds on 100 bps of hiking left to do by the end of the year, across three more FOMC meetings.

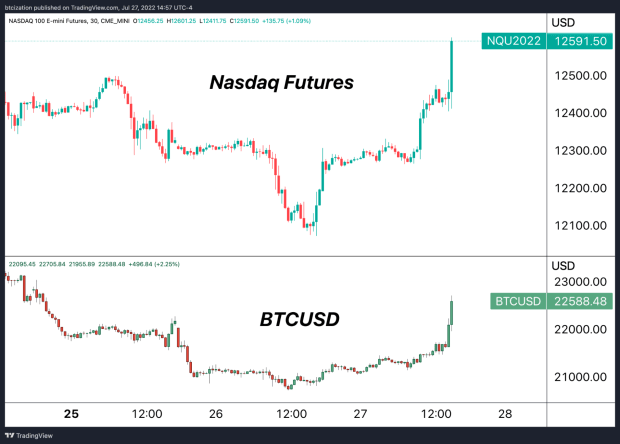

Going into the meeting today, assets such as equities and bitcoin were moving up in tandem, as the expectation of a dovish and neutral Fed relative to prior meetings increased investors’ appetite for risk.

Let’s return to the FOMC meeting and the comments made by Powell. Here are some of the most notable comments throughout the course of the press conference:

- “The labor market is extremely tight, inflation is far too high.”

- “We think we need a period of growth below potential to create some slack.”

- “We don't think we have to have a recession.”

- “Our thinking is that we want to get to moderately restrictive level by end of this year… that means 3% to 3.5%.”

- “It’s likely that the full effect of rate increases has not been felt yet.”

- “The Fed would not hesitate on a larger move [rate hikes] if need.”

- “We are looking for compelling evidence inflation coming down over next few months.”

- “Pace of rate increases will depend on data.”

- “It’s necessary to have a growth slowdown.”

- “We think we need a period of growth below potential to create some slack [in the labor market].”

- “I don’t think the US is currently in a recession.”

- “No one can be sure on whether we can achieve a soft landing.”

The comments from Powell that were particularly notable were the abandonment of Fed forward guidance in the form of future rate hikes, which is a shift from prior Fed meetings. This action gives the Fed the flexibility to pivot if/when needed in the future, which was obviously a positive sign for markets over the short term.

Looking further forward from beyond today’s meeting, the old adage of “Don’t Fight the Fed” still holds true, and despite the more bullish outcome being chosen today (a 75-bp hike rather than a 100-bp hike), the result for financial market conditions is still net tightening, which will likely take some time to be felt by markets.

Long-term investors and more active risk managers alike would do best to assess the probability of an all-time bottom being set in place for equities and crypto markets, or rather if this is yet another bear market rally.

In a previous article, “Watch Out For Bear Market Rallies,” we covered the dynamics of bear market rallies in both equity markets and in bitcoin to provide subscribers with historical context.

For readers looking for more on the state of the markets and the global economic outlook, our upcoming July Monthly Report will go into much more extensive detail on the interplay of geopolitics, monetary policy and financial markets. The report will be released to paying subscribers this following Monday.

Use the banner ad above to get 25% off a Bitcoin Magazine Pro subscription and be among the first to read the July Monthly Report or subscribe to the free version below.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.