Bitcoin price closed May 2024 at $67,520, reflecting a 19% growth performance during the month, however recent swings in the BTC derivatives market suggest a major leg-up towards $75,000 could follow in June 2024.

Bitcoin Regains Momentum after Ethereum ETF Show

Bitcoin price performance during the last 10 days of May 2024 was lacklustre at best, especially when compared to the traction pulled by Ethereum markets in the aftermath of the ETH spot ETF approvals.

Following the approval verdict, Bitcoin price succumbed to a 6% pullback between May 21 and May 31 as investors appear to redirect capital towards the ETH markets amid the ETF approval euphoria.

Bitcoin Price Action (BTC/USD) | TradingView

Bitcoin Price Action (BTC/USD) | TradingView

However, as the volatility surround the ETF approval cools off, Bitcoin has began to gain traction again. After weeks of underperformance BTC has already recorded a 2% surge within the first 3 days of June as it peaked at $68,884 at the time of writing at 8am GMT on June 3.

Bitcoin Buying Pressure Hits 2024 Peak

Looking beyond the price charts, Bitcoin appears to be attracting an unusual level of demand from bull traders in the derivatives markets. This move could propel Bitcoin into an upward trajectory as June 2024 unfolds.

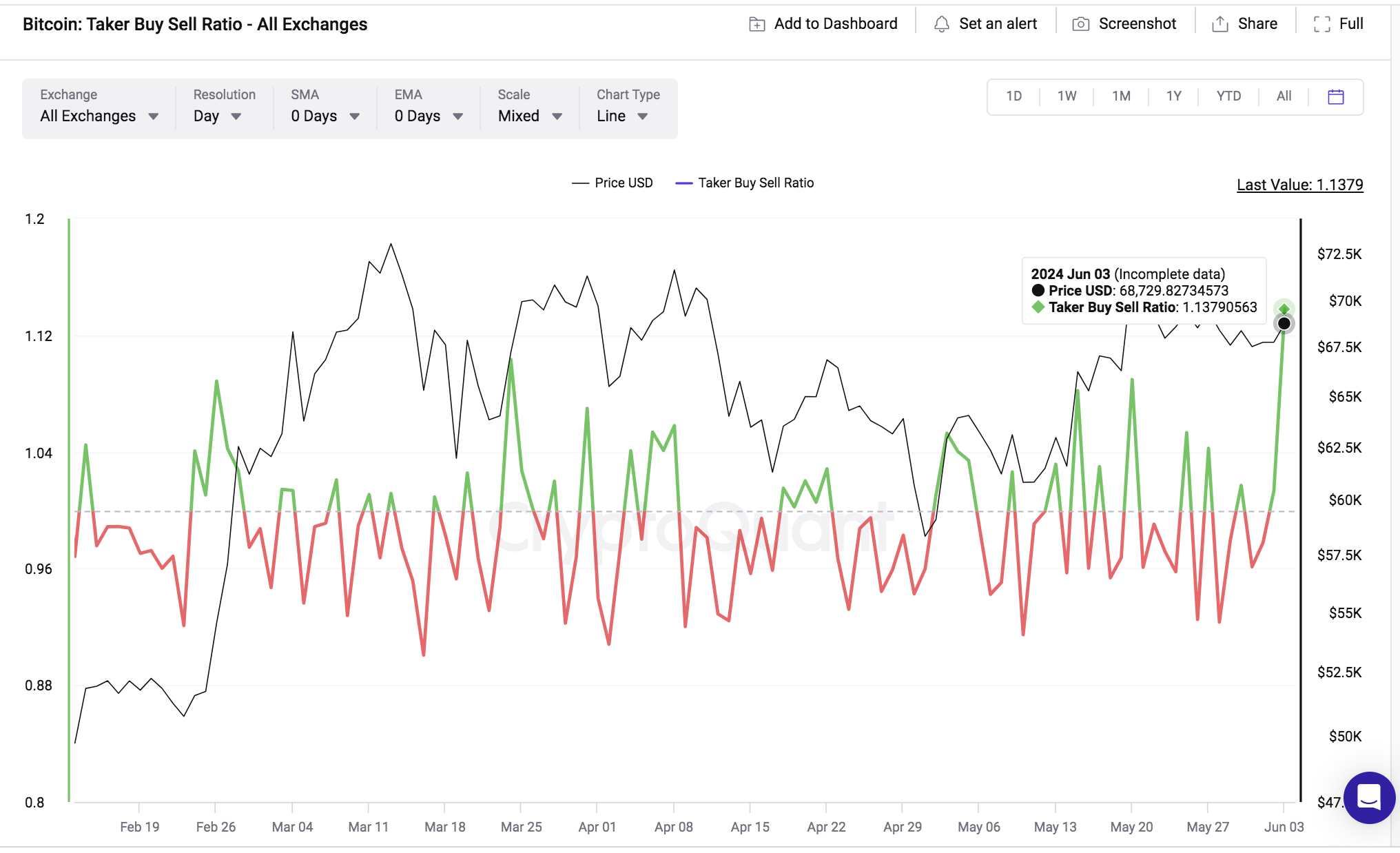

A key indication of this can be seen in CryptoQuant’s Taker Buy/Sell Ratio, which measures the volume of active BTC buy orders against active sell orders in the perpetual futures market swaps.

Bitcoin price vs. BTC Taker Buy/Sell Ratio

Bitcoin price vs. BTC Taker Buy/Sell Ratio

As seen above, Bitcoin taker buy/sell ratio has climbed towards 1.13 at the time of writing on June 3, its highest since the start of 2024.

Typically when value of the taker buy/sell ratio is greater than 1, it means that buying interest is higher than selling interest. This increased demand can drive the price up as buyers are willing to purchase at higher prices to secure their positions.

Also, the high ratio reflects strong bullish sentiment among market participants who are expecting prices to rise and are therefore more inclined to buy rather than sell.

Hence Bitcoin taker buy/sell ratio reaching a new 2024 peak of June 3 is a key indicator that BTC price could enter another leg-up toward $75,000.

Asides from the much-anticipated Ethereum ETFs official launch, the next US Non-Farm Payrolls data expected on June 7 as well as the Fed Rate announcement slated for June 12 2024 are key macro events to look forward to as the month unfolds.

Bitcoin Price Forecast: $75k Target in Focus

Bitcoin price rejected at the $69,000 resistance on Monday morning, however the taker buy/sell ratio trending at yearly peaks suggests its only a matter of time before bulls stage the next upswing towards $75,000.

Drawing insights from the Bollinger Bands technical indicator, Bitcoin bulls must close consecutive trading days above the $69,100 resistance level for the bulls to get in the driving seat.

Bitcoin Price Forecast | (BTC/USD) | TradingView

Bitcoin Price Forecast | (BTC/USD) | TradingView

With Bitcoin price already charging towards the 20-Day SMA price level, the bullish momentum could intensify in the days ahead. If the BTC price can stage another leg-up above $70,900 in the near term, bulls can set their sights on higher peaks above the $75,000 territory in June 2024.

But on the downside, if upcoming macro indices reports trigger hawkish market reactions Bitcoin price could experience a pull back towards $65,300 area. However with the mounting bullish pressure in the derivatives markets, this outcome currently looks unlikely in the near-term.

This article was originally posted on FX Empire

More From FXEMPIRE:

- Bitcoin Price Forecast – Bitcoin Continues to Look Strong

- Nasdaq 100, Dow Jones, S&P 500 News: Tech Stocks Rally as Treasury Yields Decline Amid Exchange Glitch

- NASDAQ Forecast – NASDAQ 100 Continues to See Buyers on Dips

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.