The Bitcoin hash rate has hit new highs after rising more than 114% in five months, fully recovering from the Chinese ban of bitcoin mining.

The Bitcoin hash rate has made a new all-time high, fully recovering from the Chinese bitcoin mining ban this summer. The network is stronger than ever, having risen by over 114% in five months to fully recover from the more than 50% drop after the Chinese crackdown.

China started increasing its regulatory scrutiny towards the industry in April. Bitcoin Magazine reported that Beijing officials had begun examining the energy usage of local Bitcoin miners, as an “emergency notice” was sent to data center operators in the city to gauge information about cryptocurrency mining, including the amount and share of power consumed by the activity.

In May, the country banned regulated financial institutions from offering Bitcoin services, including registration, trading, clearing, and settlement. The joint statement by Chinese regulators mentioned price volatility as harmful to its citizens and something that could infringe “on the safety of people’s property” and disrupt “the normal economic and financial order.” Later that month, the country effectively started cracking down on bitcoin mining with power rationing measures and similar restrictions. As a result, the Bitcoin network hash rate began to suffer.

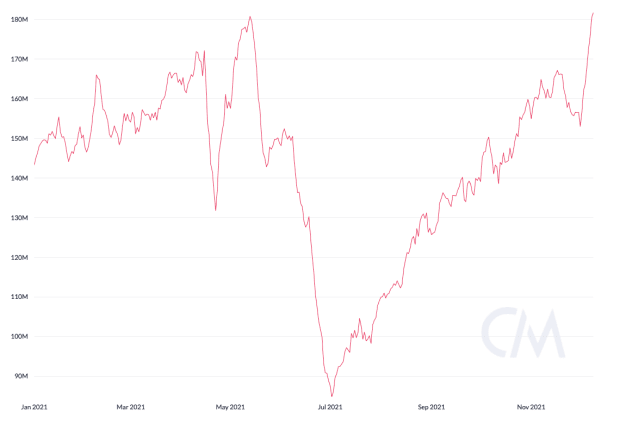

The ever-stricter regulations of the Chinese government and outright hostility towards the bitcoin mining industry led prominent companies to flee the country and move operations overseas. The measures soon began covering the broader Bitcoin ecosystem, as major internet service companies in China started censoring keywords related to bitcoin exchanges. A more general crackdown on Bitcoin led to ASIC maker Bitmain halt rig sales, a miner exodus to ensue, and hash rate to decline. In under two months, the Bitcoin hash rate 7-day moving average dropped from 180.82 exahashes per second (EH/s) to 84.79 EH/s, according to Coin Metrics data.

As miners began moving out of China and the hash rate dropped by more than 50%, North American bitcoin mining companies emerged as the winners. Publicly-traded U.S. bitcoin miners saw their daily revenue increase significantly, posing an opportunity to accumulate more bitcoin without needing to increase hash rate capacity. Bitcoin’s antifragility became evident as the hash rate started recovering by August.

Now, almost five months after the metric bottomed at around 84.79 EH/s, hash rate has soared past pre-China ban levels, and in doing so, passed an extreme and important stress test. Bitcoin’s ability to gain from disorder and chaos, conveniently adapting to even dire circumstances, was demonstrated as the network returned more robust after the country housing the most significant share of hash rate banned the activity altogether.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.