Bitcoin Cash (BCH) price soared to a 3-year peak above $600 on March 31, marking an 84% surge in the last 10-days. On-chain data trends show how new entrants looking to front-run the deflationary impact of the upcoming BCH Halving event have been pivotal to the latest price breakout.

How much higher can BCH price reach before the April 4 halving date?

Crypto investors bullish on Bitcoin Cash Halving

Bitcoin Cash (BCH) is a peer-2-peer cryptocurrency platform built in 2014 and a cheaper, light-weight alternative to Bitcoin (BTC).

Similar to BTC, the light-weight Bitcoin Cash also deploys a Proof of Work (PoW) consensus mechanism where miners are issued units of BCH as block rewards for securing and validating transactions on the network.

While Bitcoin Halving scheduled for April 20 has dominated media headlines, the next BCH halving is only a few days away, slated for April 4, 2024, and strategic investors have been positioning their trades accordingly.

Bitcoin Cash started 2024 with a relatively flat price action. But the momentum swung bullish in early February, just as the 60-day countdown to the April 4 halving rolled around.

Bitcoin Cash (BCH) price action since Feb 4 | Source: TradingView

Bitcoin Cash (BCH) price action since Feb 4 | Source: TradingView

Between Feb 4 and March 31, Bitcoin Cash price has surged 172%, signaling that crypto investors have been increasingly placing bullish bets on BCH as the April 4 Halving date draws closer.

230,000 New Investors Acquire BCH ahead of April 4 Halving Event

In further affirmation that crypto investors have been strategically aping into BCH ahead of the halving, Bitcoin Cash network has welcomed an unusually high number of new users in the last two weeks.

Santiment’s Total Amount of Holders chart below tracks real-time growth in the number of newly-funded wallets created on a cryptocurrency network. It essentially measures growth in user acquisition and active investor base.

Bitcoin Cash (BCH) Total Amount of Holders vs. Price | March 2024 | Source: Santiment

Bitcoin Cash (BCH) Total Amount of Holders vs. Price | March 2024 | Source: Santiment

The number of funded Bitcoin Cash holder wallets stood at 25.88 million at the close of March 21. But as of March 31, that figure has skyrocketed to 26.11 million unique addresses holding BCH.

This implies that users have created over 230,000 new wallets in the last 10-day alone. Such a large spike in funded wallets not only means increase in number of users, but it is also a bullish indicator of fresh capital flowing into the ecosystem.

With the halving now 5-days away, this trend could persist further in the days ahead, possibly driving price further above $600 before April 4.

Bitcoin Cash (BCH) Price Forecast: $700 rally before Halving date?

In summary, Bitcoin Cash (BCH) price is up 172% since the 60-day halving countdown began. And in the last 10-days, another 230,000 new BCH wallets have been funded. With the halving now 5-days away, capital inflows from the new entrants could drive Bitcoin Cash price towards $700 before April 4.

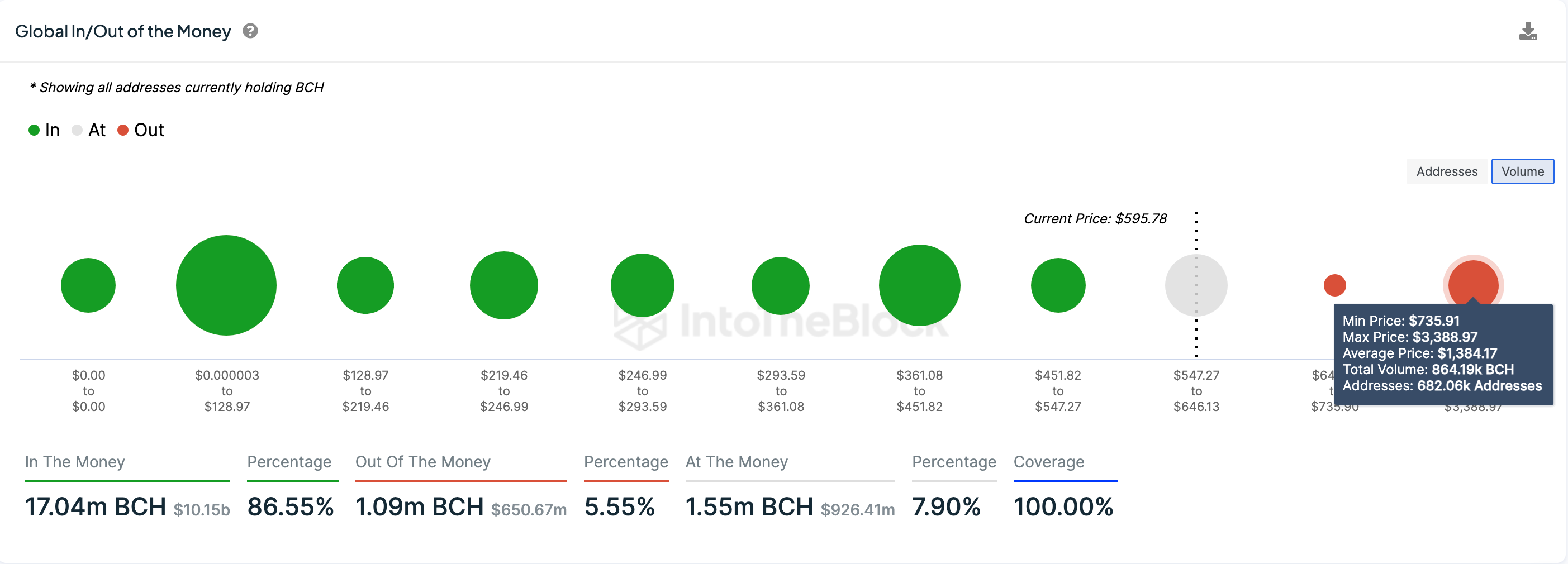

As seen above if BCH bulls can stage a decisive breakout of the initial $640 resistance, prices could surge towards $700 if the pre-halving rush continues.

Bitcoin Cash (BCH) Price Forecast | GIOM data | March 2024 | Source: IntoTheBlock

Bitcoin Cash (BCH) Price Forecast | GIOM data | March 2024 | Source: IntoTheBlock

However, it is important to note that many PoW projects often witness massive corrections after halving events. Hence, there’s a chance that strategic traders, and some miners could soon start selling as early as 48 hours before the BCH block rewards halved from 6.25 BCH to 3.125 BCH on April 4.

If this historically-proven post-halving sell-off scenario plays out, Bitcoin Cash price could witness a rapid retracement below $450.

But as seen above, the 1.61 million holders that acquired 3.21 million BCH at the maximum price of $451 could make frantic covering purchase to avoid slipping into a net-loss positions, possibly setting the stage for an instant rebound.

This article was originally posted on FX Empire

More From FXEMPIRE:

- Gold, Silver, Platinum Forecasts – Gold Pulls Back After Testing New Highs

- EUR/USD Forecast – Euro Continues to Trade in a Range

- USD/JPY Forecast – US Dollar Continues to Look Strong Against Yen

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.