By Warren Pies, Founder, Strategist at 3Fourteen Research

Few issues divide well respected investors as much as cryptocurrency. To hear many classic value investors tell it, crypto is Bernie Madoff with the added dimension of wasting electricity and facilitating seedy criminal activities. Others, including many famed macro investors like Paul Tudor Jones, Stan Druckenmiller and Dan Loeb, believe we are in the early innings of a new, transformative asset class—one that will cut out the traditional rent-seeking financial middlemen, directly connect economic actors and expand financial services to the far reaches of the globe. The range of predicted outcomes is staggering.

As we dig further into the crypto ecosystem, the complexity (and potential) becomes apparent. Whatever your initial impression, an approximately $2 trillion asset class should be approached with interest, respect and humility.

In this blog post, I aim to answer four discrete questions:

- Is Bitcoin a Ponzi scheme?

- Does Bitcoin threaten the U.S. dollar?

- What is the most interesting aspect of Bitcoin for speculators?

- What are our preferred Bitcoin risk management/timing tools?

In a May column for the New York Times, Paul Krugman racked his brain, wondering “Why are people willing to pay large sums for assets that don’t seem to do anything?” Krugman concluded that Bitcoin was a Ponzi scheme powered by “technobabble” and “libertarian derp.” Essentially, the Ponzi scheme argument boils down to Bitcoin having no true use case.

From our perspective, crypto—blockchain technology more broadly—has a number of potential use cases. Yet, the core Bitcoin use case is wealth mobility. More specifically, Bitcoin seems to be the perfect instrument for cross-border transfers of large sums of wealth. It is no coincidence that China and other countries with capital controls dominate Bitcoin mining globally . Where there is wealth trapped behind capital controls, Bitcoin demand will be close behind.

History is filled with examples of assets that derived value from their ability to clandestinely transfer wealth across borders. Diamonds, artwork, precious metals, rare books and other “collector’s items” all act as stores of value that can surreptitiously cross jurisdictional boundaries. Bitcoin is the logical evolution of this demand.

Consider the following:

- Proof of work ensures Bitcoin cannot be forged

- At a $750 billion market cap, liquidity abounds

- Digital transportation makes even diamonds seem comparatively cumbersome ($10 million of gold weighs just under 500 lbs)

Countries with capital controls—like China, India and South Korea—have been at the vanguard of Bitcoin suppression. Anyone who fails to see a legitimate use case for Bitcoin has not put themselves into the shoes of a citizen of such a jurisdiction. In developed markets, stable banking and property rights are taken for granted. Across the globe, however, these conditions remain the exception.

Does Bitcoin Threaten the U.S. Dollar?

Others attribute supernatural power to Bitcoin and argue that if allowed to grow, it will overtake the U.S. dollar. The upshot is that Bitcoin is too dangerous to the U.S. government and, thus, will be snuffed out by regulators. As stated, we see legitimate use cases for crypto,however, we think there is virtually zero chance that crypto will displace the U.S. dollar.

Rather than viewing Bitcoin as competition for the U.S. dollar and fiat currencies, we think it is more properly viewed as competition for (or an adjunct to) gold. In fact, counterintuitively, we view Bitcoin as supportive of the U.S. dollar. If Bitcoin facilitates asset leakage from more draconian jurisdictions (e.g., China), then these assets may find a new home. Countries with stable currencies and strong private property rights could benefit from these Bitcoin-facilitated outflows. In other words, the end goal is not to convert Chinese yuan into Bitcoin, but to get it into a more stable jurisdiction of choice. Bitcoin is a conduit for these transactions. Attractive markets (like the U.S.) are the destination.

Does this mean we see no regulatory risk? No, it doesn’t. With an emerging asset class, there is always the risk of a regulatory misstep. However, regulation in general should not be feared. Rather, regulation may equal acceptance. It clears the path for institutional adoption. While crypto is inching closer to this outcome, it is not there yet. In any event, we view Bitcoin as a negative for countries that impose strict capital controls on their citizenry and a positive for more laissez-faire jurisdictions. Bad regulation is a risk, but proper regulation could facilitate mass adoption.

Broadening Adoption

As speculators, Bitcoin interests us because it is a new asset undergoing mass institutional adoption. It is quantitatively interesting as a result of its portfolio diversification benefits (low relative to other major assets), short-term trend following properties and long-term mean reversion character. In short, it marches to its own beat with a secular tailwind at its back.

While Bitcoin is generally uncorrelated to other assets and does boost portfolio returns, there is no evidence that it provides any hedge to equities.

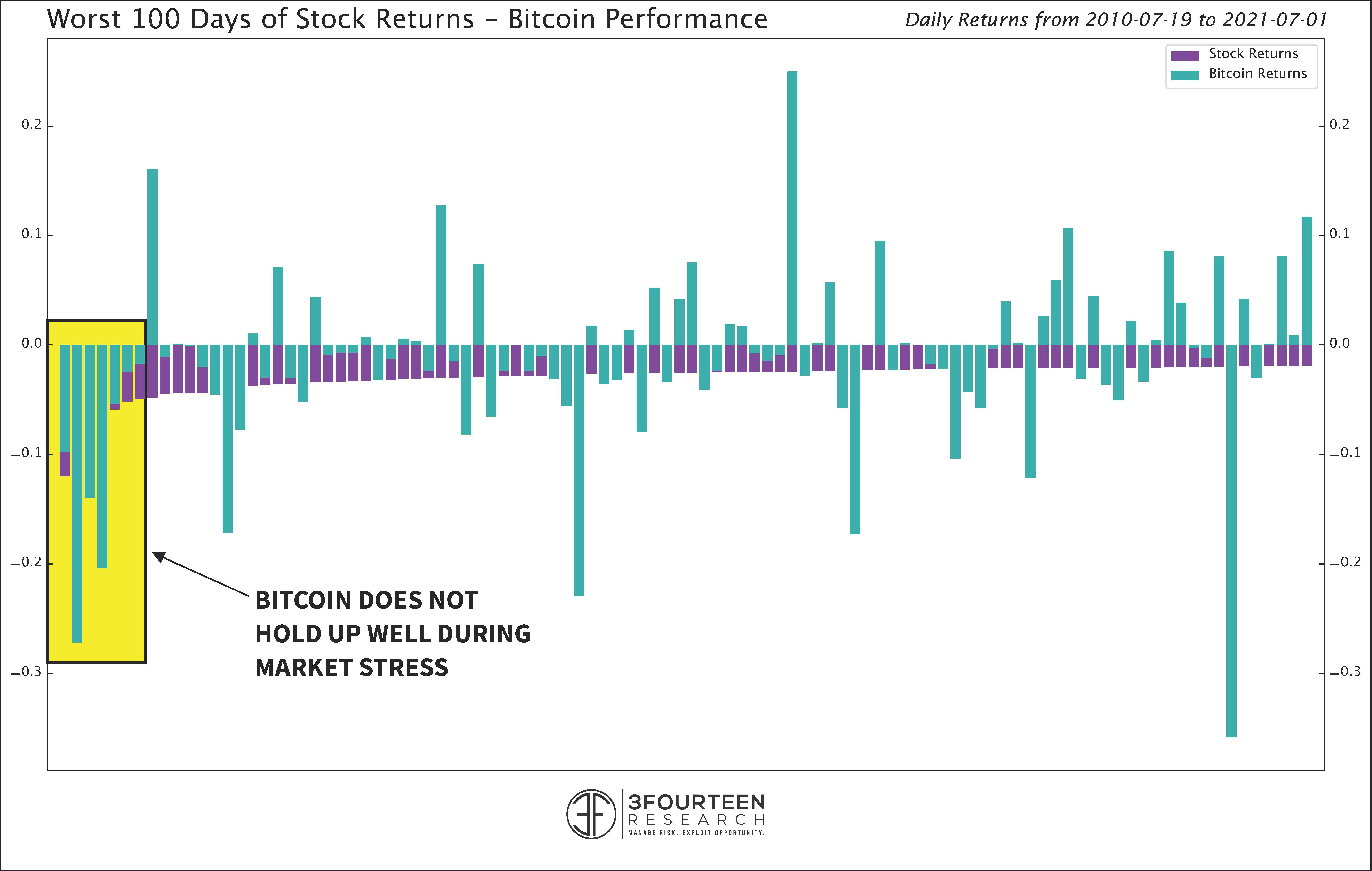

In figure 1, we plot the 100 worst equity days1 (purple bars) and Bitcoin’s returns (blue bars) on these days. Bitcoin was down on 61 of these 100 days, and on the absolute worst days (far left) Bitcoin loses big.

Figure 1: Bitcoin Performance on Worst 100 Days of Stock Returns

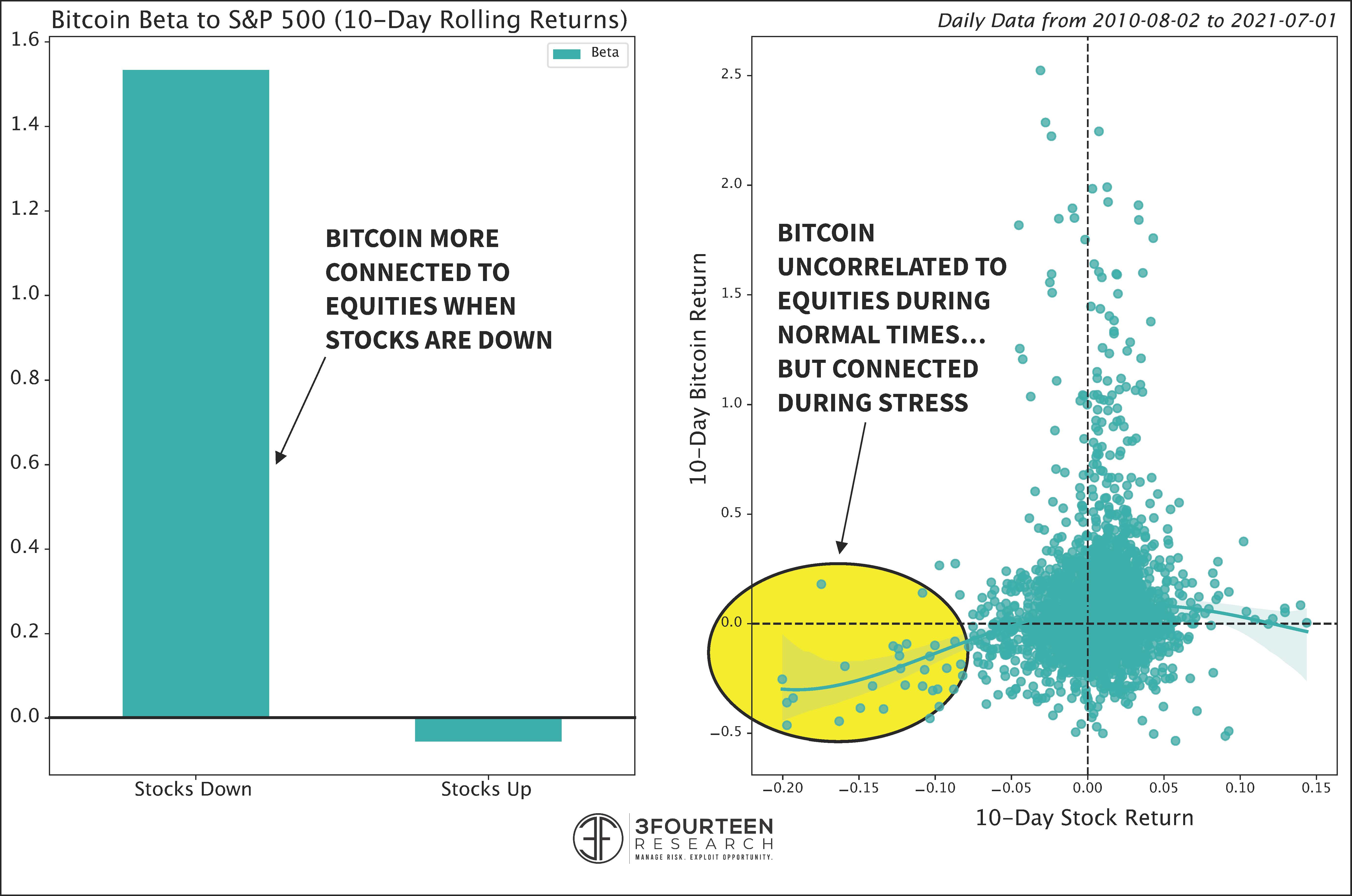

On the days equities are down, Bitcoin’s market beta is 1.5, as seen in figure 2. On up days, Bitcoin’s beta is slightly negative. Finally, the scatter plot (bottom right) compares 10-day returns for stocks and Bitcoin. During periods of equity extremes (especially to the downside) Bitcoin seems to follow the mood of the market.

Figure 2: Beta of Bitcoin vs. Stocks

So, Bitcoin may not be an equity hedge. Why, then, has it managed to receive the label of an “uncorrelated” asset? Two reasons: first, on most days, Bitcoin and the stock market move independently. It appears only during periods of acute stock market stress that the relationship shows up (see figure 2). Given the systemic nature of the equity market (i.e., equity market stress infects almost every other asset), this is not surprising. Second, Bitcoin can go through its own periods of stress, or exuberance, without seeming to impact the stock market.

Tactical Indicators

Academic research is emerging, and our testing confirms, that traditional trend following strategies work well as crypto risk management tools.

For tactical investors, 314 Research is providing some new modeling work that can help cut drawdowns substantially and preserve upside.

Underlying this model is a mix of:

- Trend breadth

- Time series slope calculations

- Raw momentum

- Flows into and out of Bitcoin as determined by its cumulative volume

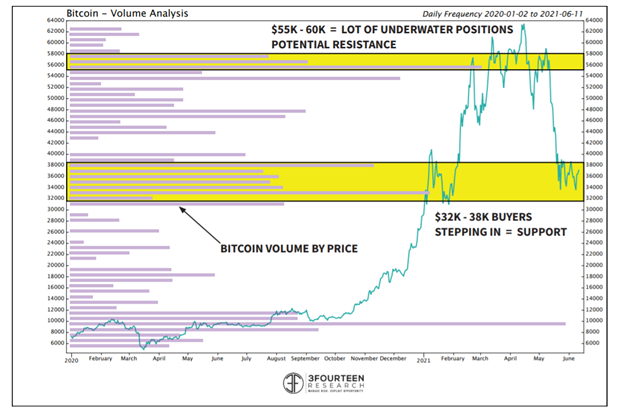

In our testing, we have found bitcoin's price corresponds to its flow and volume data. One way we use volume data is to calculate the amount of volume that has taken place at different prices. This is known as “volume by price.” In the chart below, we calculate Bitcoin’s current volume by price. At present, we see a large volume block in the $32,000–$38,000 range acting as support. If Bitcoin is able to bounce from current levels, the volume block at $55,000–$60,000 is likely to act as resistance.

Figure 3: Bitcoin Volume Analysis

If you want more information on some of the full set of tactical models, please visit 3fourteenresearch.com or reach out to me directly at warren@3fourteenresearch.com.

Originally published by WisdomTree, 7/9/21

1 7/19/2010 to 7/1/2021

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing. Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer/anti-money laundering) procedures, non-compliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset. Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent, or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to Internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different than when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility. In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy. WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor, end client or investor, and has no responsibility in connection therewith, with respect to any digital assets, crypto assets or blockchain networks.

This material contains the opinions of the author, which are subject to change, and should not be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product, and it should not be relied on as such.

Unless expressly stated otherwise, the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

WisdomTree makes no representation as to the suitability of any advisor, including the advisor providing this information, and WisdomTree does not endorse, recommend or guarantee the services of any advisor, including the advisor providing this information. WisdomTree urges each investor to carefully evaluate any advisor whom such investor may consider hiring, and such investor is responsible for monitoring the advisor’s investment performance, fees and all other aspects of such relationship. WisdomTree will not supervise or monitor the advisor’s activities or an investor’s account, nor is WisdomTree responsible for the selection or performance of an investor’s investments.

WisdomTree has no discretionary authority or control with respect to how any advisor manages an investor’s investment assets. WisdomTree disclaims any responsibility or liability for any damages arising from an investor’s decision to engage the services of an advisor, and encourages each investor hiring an advisor to ask about the advisor’s relationship with WisdomTree and whether it has any arrangements with WisdomTree or its affiliates (such as the opportunity to provide information on WisdomTree’s website), which may cause the advisor to recommend WisdomTree ETFs over other investments.

WisdomTree and Foreside Fund Services, LLC, are not affiliated with the entities mentioned

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research orinvestment adviceregarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constituteinvestment adviceor a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.