The biotech sector has been in focus in the past week on some important acquisition and collaboration deals. Quite a few regular pipeline and regulatory updates also grabbed focus in the sector this week.

Recap of the Week’s Most Important Stories:

Axsome to Acquire Jazz’s Drug: Shares of Axsome Therapeutics, Inc. AXSM surged after the company announced that it will acquire Sunosi from Jazz Pharmaceuticals JAZZ. Sunosi, a dual-acting dopamine and norepinephrine reuptake inhibitor (DNRI), is approved by the FDA to improve wakefulness in adult patients with excessive daytime sleepiness (EDS) due to narcolepsy or obstructive sleep apnea (OSA).

Per the terms, Axsome will make an upfront payment of $53 million to Jazz for the worldwide commercial, development/manufacturing and intellectual property rights to Sunosi, except for certain Asian markets. Jazz is also entitled to receive high single-digit royalty on U.S. net sales of Sunosi in the current indication and mid-single-digit royalty on Sunosi net sales in future indications.

With this acquisition, Axsome will become a commercial-stage company. This sleep disorder drug further complements Axsome’s existing pipeline candidates — AXS-05 for major depressive disorder (MDD) and AXS-07 for migraine. Both the candidates are under review in the United States.

Axsome currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IGM Biosciences Up on Sanofi Deal: Shares of clinical-stage biotechnology company, IGM Biosciences, Inc. IGMS, surged after the company announced a global collaboration agreement with Sanofi for oncology, autoimmune and inflammation targets. Per the terms, both the companies will leverage IGM’s proprietary IgM antibody technology platform to discover IgM antibody agonists against three oncology targets and three autoimmune/inflammation targets. In exchange, IGM will receive a $150 million upfront payment and potentially more than $6 billion in milestone payments. It will also get equal profits in certain major market countries and will be eligible to receive tiered royalties on net sales in the rest of world. The company will also get tiered royalties for autoimmune/inflammation targets. Sanofi has also expressed an interest in purchasing up to $100 million of IGM non-voting common stock in public financing.

Regulatory Updates From Bristol Myers: Bristol Myers Squibb BMY announced that the FDA has extended the review of the supplemental biologics license application (sBLA) for Reblozy (luspatercept-aamt). Reblozyl, a first-in-class therapeutic option, is currently approved in the United States and European Union to address transfusion-dependent anemia-associated beta thalassemia and lower-risk myelodysplastic syndromes failing an erythropoietin-stimulating agent (ESA) and requiring red blood cell transfusions. The sBLA is seeking approval for the treatment of anemia in adults with non-transfusion-dependent (NTD) beta thalassemia. The new target action date is Jun 27, 2022. The regulatory body determined a written response to an information request to constitute a major amendment and hence the target action date has been extended by three months to provide time for a full review of the submission.

Bristol Myers also announced that the European Medicines Agency (“EMA”) has validated its type II variation application for Opdivo (nivolumab) in combination with chemotherapy. The application sought approval for the neoadjuvant treatment of patients with resectable stage IB to IIIA non-small cell lung cancer (NSCLC). Consequently, the EMA has begun its centralized review procedure as the validation confirms the submission is complete.

Biogen, Ionis Discontinue Candidate: Biogen BIIB and partner Ionis Pharmaceuticals announced disappointing top-line results from an early-stage study evaluating pipeline candidate BIIB078.The candidate is an investigational antisense oligonucleotide being evaluated for C9orf72-associated amyotrophic lateral sclerosis (ALS). The phase I study was a randomized, placebo-controlled, dose-escalating trial to evaluate BIIB078 administered intrathecally to adults (n=106) with C9orf72-associated ALS. BIIB078 did not meet any secondary efficacy endpoints and did not demonstrate clinical benefit. Consequently, Biogen and Ionis decided to discontinue the development of BIIB078, including any extension studies.

Performance

Medical - Biomedical and Genetics Industry 5YR % Return

Medical - Biomedical and Genetics Industry 5YR % Return

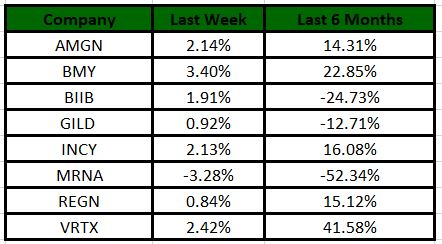

The Nasdaq Biotechnology Index has gained 0.76% in the past five trading sessions. Among the biotech giants, Bristol Myers has gained 3.40% during the period. Over the past six months, shares of Moderna have lost 52.34%. (See the last biotech stock roundup here: Biotech Stock Roundup: BMYs Drug Approval, MRNAs Vaccine Update & More)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline and regulatory updates.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the Zacks Top 10 Stocks portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB): Free Stock Analysis Report

Bristol Myers Squibb Company (BMY): Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ): Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM): Free Stock Analysis Report

IGM Biosciences, Inc. (IGMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.