Biogen Inc. BIIB and privately-held Samsung Bioepis announced that the FDA has approved their biosimilar, Byooviz (ranibizumab-nuna) referencing Roche’s RHHBY eye drug, Lucentis (ranibizumab). The biosimilar drug received approval for three approved indications of Lucentis — neovascular (wet) age-related macular degeneration (AMD), macular edema following retinal vein occlusion, and myopic choroidal neovascularization.

Byooviz becomes the first FDA-approved biosimilar of any ophthalmology drug in the United States. Byooviz was approved in Europe in August. Samsung Bioepis and Biogen already have an agreement with Roche that will allow them to start the commercialization of Byooviz in the United States from June 2022.

The FDA approval was based on analytical, non-clinical, and clinical data from a phase III study evaluating Byooviz in wet AMD patients. The late-stage study compared the efficacy, safety, pharmacokinetics, and immunogenicity of Byooviz with the reference drug, Lucentis, over 48-weeks of treatment. Data on all key endpoints from the study for Byooviz were comparable to Lucentis.

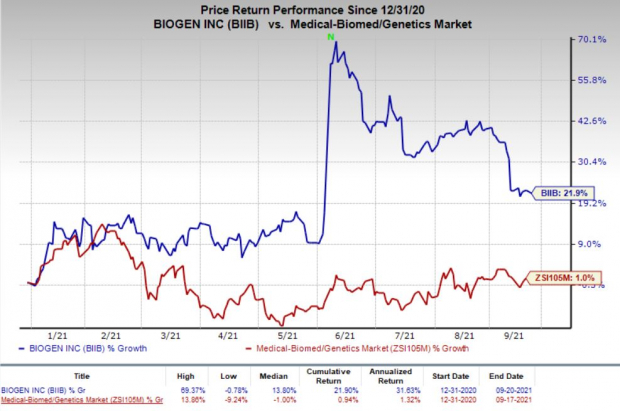

Shares of Biogen have rallied 21.9% so far this year compared with the industry’s growth of 1%.

Image Source: Zacks Investment Research

We note that the companies are also developing another ophthalmology biosimilar candidate, SB15 referencing Regeneron’s REGN Eylea. Biogen continues to develop its biosimilar portfolio and the addition of the biosimilar of blockbuster drug, Lucentis will add strength to it.

The joint venture between Biogen and Samsung Bioepis has four other biosimilar products in its portfolio — Benepali/Eticovo, Imraldi/Hadlima, and Flixabi/Renflexis. Imraldi references one of the highest-selling drugs from the pharma sector, AbbVie’s ABBV immunology drug, Humira. These biosimilar products generated more than $400 million in sales in the first half of 2021. Although the biosimilar drugs are approved in the United States, they are yet to be marketed in the United States due to commercialization restrictions due to existing patents or ongoing litigations for referenced drugs. The start of commercialization of these biosimilars in the United States is likely to boost Biogen revenues significantly.

The addition of new biosimilars to its portfolio will help Biogen to diversify its business with a renewed source of revenues while its strong positing in the multiple sclerosis market gets hit by new branded drugs as well as generic drugs of Tecfidera.

Biogen Inc. Price

Biogen Inc. price | Biogen Inc. Quote

Zacks Rank

Biogen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Roche Holding AG (RHHBY): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.