In the investing game, the rules may no longer apply. Billionaire hedge fund manager Ray Dalio warns that the Federal Reserve has artificially propped up markets, with traditional valuation metrics no longer telling the whole story. Further, he thinks there’s a risk that the U.S. dollar will be displaced as the global reserve currency.

“The capital markets are not free markets allocating resources in the traditional ways... The economy and the markets are driven by the central banks in coordination with the central government,” Dalio explained. Even though the titan believes the unprecedented stimulus was justified, he argues these actions have consequences including an explosion of “central banks' balance sheets” as well as price-to-earnings ratios that exceed 40.

So, what should investors do? Dalio recommends investors diversify portfolios across different asset classes that tend to hold up well regardless of the economic landscape and never try to time the market.

Dalio knows his stuff. Since his first investment at the age of 12, when he purchased $300-worth of Northeast Airlines shares and tripled his money, Dalio has honed his craft. He went on to found Bridgewater Associates out of his New York City apartment, and while there were certainly rough patches, it’s now the largest hedge fund in the world with approximately $138 billion in assets as of April. Earning legendary status on Wall Street, Dalio’s current net worth stands at roughly $18 billion.

To this end, we wanted to find out more about three stocks Dalio's Bridgewater snapped up recently. After running the tickers through TipRanks’ database, we learned that each has enough analyst support to score a “Strong Buy” consensus rating.

Tencent Music Entertainment (TME)

Offering one-stop music services and solutions designed to create a complete music entertainment ecosystem, Tencent Music Entertainment has cemented its status as the biggest online music company in China by MAUs. Given its solid product offering, some members of the Street believe that big things are in store.

Dalio is among those that have been impressed by TME. Increasing its holding by a whopping 858%, Bridgewater has pulled the trigger on 620,000 shares in Q2. At 692,262 shares, the total position is valued at $9,318,000.

The billionaire isn’t the only TME fan. Writing for Oppenheimer, analyst Bo Pei believes Wall Street has underestimated the potential of its core business, which accounts for 62% of value in his new SOTP analysis. To support his stance, he cites the company’s Q2 2020 subscriber growth, with paying subscribers coming in 2% above the forecasts. TME added 4.4 million subscribers in the quarter versus 2.8 million in Q1, pushing the paying ratio to 7.2%. This reflects a year-over-year gain of 248 basis points. Pei noted, “Subscriber ARPPU also grew 8% year-over-year. Moreover, next-month subscription retention continues to increase and is over 80% now... We expect strong subscriber growth to continue in 2H and potentially accelerate on ad-supported services.”

Adding to the good news, the social entertainment segment is rebounding. Even though MAU fell by 20 million quarter-over-quarter as users returned to work, ARPPU is stabilizing, with it down 4% year-over-year versus -13% in Q1. Going forward, management expects “social entertainment MAU to bottom out in Q3, but revenue growth to accelerate on a year-over-year basis.”

What else does TME have going for it? The company renewed the Universal Music Group (UMG) licensing deal. The agreement doesn’t include any sublicensing, but it has more revenue-sharing elements than it did before. Additionally, it organized nine TME Live performances in Q2 and long-form audio licensed titles increased 300% year-over-year, with penetration of 9.4% compared to 4.6% last year.

Weighing in on these developments, Pei stated, “TME Live is transforming the multi-billion-dollar concert industry with significant monetization opportunities. New UMG licensing deal should expand margins over time.”

All of this convinced Pei to join the bulls. As a result, the analyst upgraded TME from Perform to Outperform and set a $20 price target. Based on this target, shares could climb 43% higher in the next year. (To watch Pei’s track record, click here)

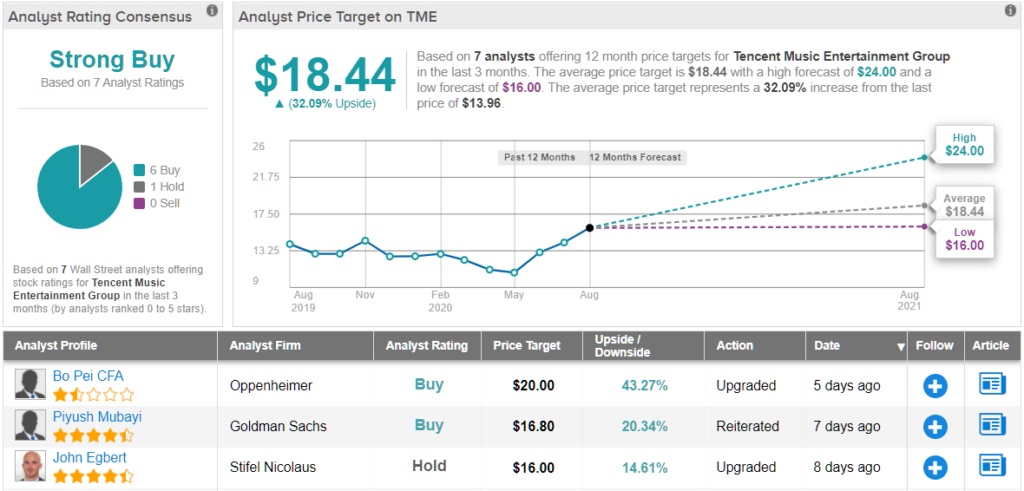

For the most part, other analysts don’t beg to differ. Out of 7 total reviews published in the last three months, 6 analysts rated the stock a Buy while only 1 said Hold. Therefore, TME is a Strong Buy. The $18.44 average price target implies 32% upside potential. (See TME stock analysis on TipRanks)

Zai Lab Ltd. (ZLAB)

Next up we have Zai Lab, which works to bring transformative medicines for cancer, autoimmune and infectious diseases to patients in China and around the world. With the launches of two of its assets going well, it’s no wonder this healthcare name is scoring attention from the Street.

Reflecting a new position for the fund, Dalio's Bridgewater bought up 63,837 shares. The value of this holding? It lands at $5,243,000.

Turning to the analyst community, Guggenheim’s Seamus Fernandez tells clients ZLAB’s total 1H20 revenues of $19.2 million blew his prediction out of the water. The strong result was driven by Zejula's second line ovarian cancer (OC) launch in China. Total sales from China, Hong Kong and Macau reached $13.8 million, besting the five-star analyst’s $7 million call.

Expounding on this, Fernandez stated, “ZLAB management highlighted that it has nearly 4x the coverage list for hospitals (touching nearly 800 to 900 hospitals with 150 sales reps) for Zejula versus its competitors (aka AstraZeneca 's Lynparza) and has deep penetration in the hospital sector within two quarters of launch of Zejula in China. ZLAB expects to receive approval for Zejula's all comers first line maintenance Ovarian Cancer indication in 1H 2021.” This approval could be a major catalyst for shares, in the analyst’s opinion.

It should be noted that the Chinese government is already requesting applications for the National Drug Reimbursement List (NDRL) for this year. ZLAB is expected to apply for Zejula's second line OC indication, with the results potentially coming in November 2020 and driving upside. “This will probably expand Zejula's reimbursement coverage in second tier Chinese cities,” Fernandez commented.

As for its other launch, Optune became commercially available at the end of June. “Optune is priced like a premium therapeutic would be with a list price of $19,000 and a net price around $11,000. This is at a modest discount price of that of the U.S. list price of around $20,000. Most patients in China are self-paying for this innovative device,” Fernandez said.

If that wasn’t enough, the company is also advancing ZL-1201, its humanized, IgG4 monoclonal antibody designed to reduce effector function that specifically targets CD47. The candidate is set to be evaluated in both solid tumors and hematological malignancies. It will also be studied as a monotherapy and a combination.

Fernandez noted, “ZLAB management commented that it is optimistic about its internal CD47 program (ZL-1201) and in June 2020 began its first-in-human Phase 1 study. They also commented that there are about 7 CD47 programs under development in China by different competitors, but none are approved yet. EpicentRx's RRx-001 and FTSV's (acquired by Gilead) Magrolimab are among the leading CD47s under investigation.” On top of this, ZLAB kicked off its first-in-human Phase 1 study of ZL-1102 as a topical treatment for chronic plaque psoriasis (CPP).

With Ripretinib's possible approval in 2021 and NCVR's TTF Phase 3 LUNAR NSCLC trial readout in 1H21 also representing key potential catalysts, the deal is sealed for Fernandez. To this end, he keeps his Buy rating as is and bumps up the price target from $105 to $111. Should his thesis play out, a potential twelve-month jump of 36% could be in the cards. (To watch Fernandez’s track record, click here)

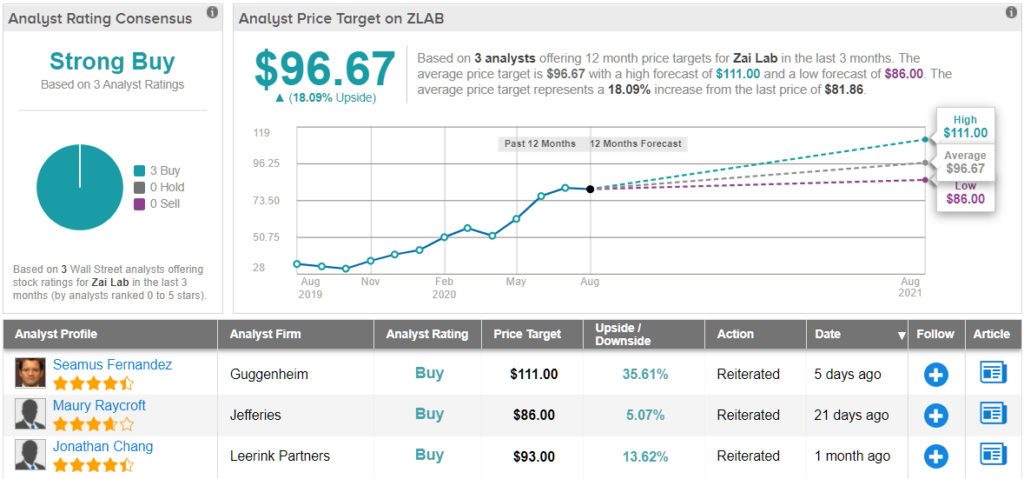

Do other analysts agree? They do. Only Buy ratings, 3, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. Based on the $96.67 average price target, shares could rise 18% in the next year. (See Zai Lab stock analysis on TipRanks)

RingCentral (RNG)

Operating as a cloud-based provider of Unified Communications-as-a-Service (UCaaS) software, RingCentral wants to meet the needs of SMBs as well as large global enterprises. On the heels of a new strategic partnership, some believe that the sky’s the limit for this company.

Ray Dalio and Bridgewater have been singing RNG’s praises. Recently, the hedge fund went in on 13,625 shares, with the cost of this new stake totaling $3,883,000.

Five-star analyst Terry Tillman, of Truist Financial, also likes what he’s seeing. He argues that its “strategic partnership with Alcatel-Lucent Enterprise (ALE) will likely extend durable strong growth for years, and higher margin growth at that.”

The collaboration kicked off with the introduction of newly branded “Rainbow Office,” which is powered by RNG and expected to become available in Q1 2021. As part of the agreement, Alcatel-Lucent channel partners and customers will have full access to RNG’s mobile-voice-phone (MVP) platform capabilities, with it also including a $100 million cash payment from RingCentral and providing exclusive access, minimum seat commitment and future commissions to Alcatel-Lucent. Both companies will also pitch in for operating expenses related to the product development and GTM motion for Rainbow Office, with these investments already accounted for in RNG’s updated 2020 guidance.

Weighing in on the implications, Tillman stated, “This deal will serve as another opportunity for RingCentral to expand sales more quickly globally, especially given Alcatel-Lucent's 40 million-plus unified communications (UC) customer base. The exclusive Rainbow Office UCaaS solution will be a complementary offering to Alcatel-Lucent's cloud portfolio with Rainbow Office being the exclusive solution for Alcetel-Lucent Enterprise. While the Alcatel-Lucent customer base varies across SMB, mid-market, and enterprise, we note that the SMB threshold for Alcatel-Lucent is roughly 250 users.”

Following this new partnership, RNG now has roughly 45% of the estimated global UCaaS market accounted for via strategic partnerships (180 million seats of a total 400 million seats). These other partnerships are with AT&T, Avaya and Atos.

“We believe RingCentral should be able to consistently grow its seat count above an expected industry growth rate of 15% - 20% over the next five years... The partnerships could represent a well in excess of $1 billion incremental revenue opportunity in our estimation. We believe all of this translates into potential ~30% compounded top-line growth longer term. This could translate into a very attractive high growth, large cap holding, in our opinion,” Tillman commented.

Reflecting another positive, the partnership could be beneficial to operating margins over time, “as the deal enables RingCentral to acquire customers at a lower cost (with most of associated S&M cost included in commission payment) while also adding customers with potentially higher lifetime value,” in Tillman’s opinion.

The analyst added, “We believe the deal which includes joint investment towards product development and sales and marketing could potentially have a more meaningful model impact in the back half of 2021 and moving into 2022 as the associated GTM motion could take six to nine months to drive meaningful adoption, comparable to other recent partnership announcements.”

Based on all of the above, Tillman reiterated his Buy rating and $367 price target. This target puts the upside potential at 26%. (To watch Tillman’s track record, click here)

Overall, the bulls have it. Over the last three months, 19 Buys and a single Hold have been issued. So, the message is clear: RNG is a Strong Buy. The $339.05 average price target suggests 17% upside potential. (See RingCentral stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.