Are the tides turning on Wall Street? Stocks fell in the past three trading sessions, as investors abandoned the tech heavyweights that have been at the forefront of the market’s remarkable charge forward. What’s behind the sell-off? Sky-high valuations reminiscent of the dot-com era have sparked fears of a tech bubble. To this end, investors are wondering if this pullback is just a correction, or if it is the start of a larger drawdown.

In times like these, the legends can offer some guidance. We are referring to the people that transformed the way we play the investing game, namely David Shaw.

A former Columbia University computer-science professor, Shaw founded the D. E. Shaw group at a small bookstore in New York City in 1988. Starting out with six employees and $28 million in capital, he pioneered a new investing approach, one that computerized the industry and fundamentally changed the culture of hedge funds, making way for math and science fanatics as well as musicians and English majors.

Among these misfits was Jeff Bezos, who was a senior vice president at D.E. Shaw in charge of the hedge fund’s online retail project. He was intrigued by the potential, and thus, the seeds of Amazon were planted.

As D.E. Shaw has become a $50 billion hedge fund, and Shaw’s net worth lands at $7.5 billion, we wanted to take a closer look at three stocks the fund picked up recently. Running the tickers through TipRanks’ database, we learned that each one boasts a “Strong Buy” consensus rating from the analyst community and massive upside potential.

Paratek Pharmaceuticals (PRTK)

Providing physicians with the tools they need, Paratek Pharmaceuticals hopes its solutions will generate positive outcomes and patient stories. Based on the success of its product launch, it’s no wonder Wall Street focus has locked in on this healthcare name.

Shaw is among those cheering the company. Increasing its stake by 82%, D.E. Shaw bought up 457,341 shares in the second quarter. Following the purchase, the fund’s total PRTK position lands at 1,018,465 shares and is worth $4,267,368.

Writing for H.C. Wainwright, 5-star analyst Ed Arce cites NUZYRA’s performance as a key component of his bullish thesis, noting that the company's therapy is “already on track to be one of the most successful antibiotic launches of the last decade.” The asset is a tetracycline-class antibacterial designed as a treatment for community-acquired bacterial pneumonia (CABP) and acute bacterial skin and skin structure infections (ABSSSI).

During Q2 2020, sales growth for NUZYRA continued to ramp up, with net sales coming in at $8.1 million, up 11.4% sequentially from Q1 2020, which was already up 34.9% from Q4 2019.

Weighing in on the result, Arce stated, “We find this quarter's growth particularly encouraging because not only is it all in the hospital setting—which is notoriously slow with trial and adoption of new medicines—but it was achieved during a time in which most of the U.S. was under full or partial lockdown and restricted hospital access due to the ongoing COVID-19 pandemic." The analyst added, "Management depicted the growth curve of IV and oral NUZYRA sales versus other recent antibiotic launches, based on data from IQVIA, which we believe offers a clear graphical representation of this differentiated launch, even under trying circumstances.”

On top of this, PRTK filed a supplemental NDA with the FDA to obtain an oral-only dosing label for community-acquired bacterial pneumonia (CABP). An updated label for NUZYRA could come around the end of January 2021.

“We view this as an important update that is likely to significantly boost sales momentum further, as not only will it allow Paratek to capture some of the 2020-2021 flu season demand, but critically enables the company to execute its broader strategy to expand into the community setting early next year,” Arce commented.

Summing it all up, Arce said, “Overall, we believe Paratek is on course to establishing itself as a leading, commercially successful, independent antibiotic biotech company, with a pathway to cash flow breakeven.”

To this end, Arce rates PRTK a Buy along with a $19 price target. Should his thesis play out, a potential twelve-month gain of 353% could be in the cards. (To watch Arce’s track record, click here)

Are other analysts in agreement? They are. Only Buy ratings, 4, in fact, have been issued in the last three months. Therefore, the message is clear: PRTK is a Strong Buy. Given the $14.67 average price target, shares could skyrocket 250% in the next year. (See PRTK stock analysis on TipRanks)

Eiger Biopharmaceuticals (EIGR)

Focused on the development of therapies for rare and ultra-rare diseases for which no approved drugs exist, Eiger Biopharmaceuticals wants to address the high unmet medical need. With a strong development pipeline, some believe big things are in store for EIGR.

Shaw is standing squarely with the bulls on this one. During Q2, D.E. Shaw snapped up 142,385 shares, bringing the size of the holding to 217,813 shares. After this 189% boost, the value of the position comes in at $2,250,000.

Ahead of an upcoming regulatory ruling, Ladenburg analyst Michael Higgins is also on board. The analyst tells clients that the PDUFA for Zokinvy (lonafarnib), the company's potential treatment for Progeria and Progeroid Laminopathies, is still set for November 20. Back in May, the company revealed that the FDA had accepted the application with Priority Review.

“We agree with management that an advisory committee meeting is not expected. We remind investors lonafarnib was granted Orphan Drug Designation, Breakthrough Therapy Designation and Rare Pediatric Disease Designation which allows for an expedited approval process. The Rare Pediatric Disease Designation also makes lonafarnib eligible for a priority review voucher (PRV) upon approval, which we value at ~$100 million (to be split 50/50 with the Progeria Research Foundation) based on the four most recent transactions ($80 million-$130 million). We continue to have a high level of confidence that Zokinvy will be approved, given the impressive clinical evidence (including mortality endpoint), lack of adequate treatments and safety profile,” Higgins commented.

It should be noted that the EU application for lonafarnib in progeria and progeroid laminopathies has been delayed due to COVID-related travel restrictions that prevented the EMA from completing the standard manufacturing inspections. That said, Higgins points out that the asset was already on an accelerated review, so the delay basically means the application is subject to a standard review timeline.

The analyst added, “We expect this only adds ~60 days to the review, for an early Q1 2021 decision, which should still allow synchronized worldwide launch. While its possible this review is delayed again, supporting the approval is the filings’ relatively limited size and impressive clinical evidence.”

To this end, Higgins stated, “With cash of $90.8 million, a ~$15 million quarterly burn and cash expected following Zokinvy’s PDUFA (via PRV monetization and revenues in Progeria), Eiger is well-positioned to continue to execute in developing its pipeline.”

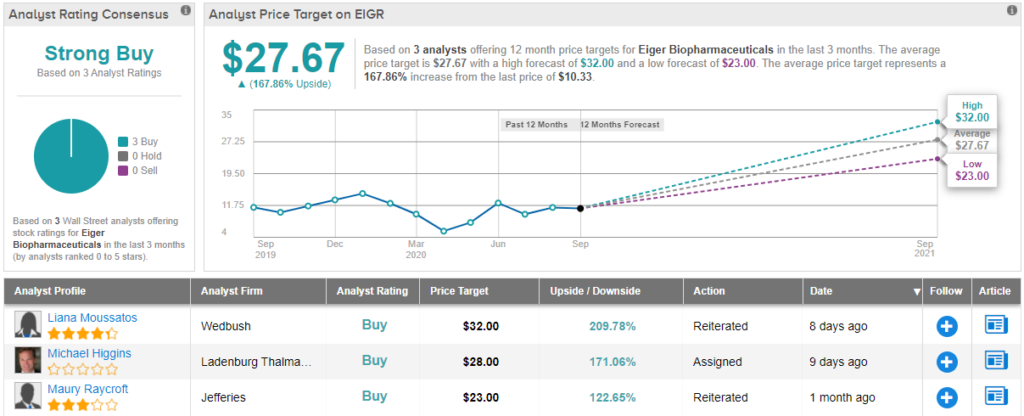

Everything EIGR has going for it keeps Higgins with the bulls. Along with a Buy rating, the analyst leaves a $28 price target on the stock. This target suggests shares could climb 171% higher in the next year. (To watch Higgins’ track record, click here)

All in all, other analysts echo Higgins’ sentiment. 3 Buys and no Holds or Sells add up to a Strong Buy consensus rating. With an average price target of $27.67, the upside potential comes in at a whopping 168%. (See EIGR stock analysis on TipRanks)

Atara Biotherapeutics (ATRA)

Developing off‑the‑shelf, allogeneic T‑cell immunotherapies, Atara Biotherapeutics believes its products could potentially transform the lives of patients with serious medical conditions. Given its promising pipeline, ATRA has received significant attention from Wall Street.

During Q2, Shaw’s fund made a major purchase. Scooping up 297,003 shares, the hedge fund’s new ATRA position is valued at $3,997,660.

Turning to the analyst community, 5-star analyst Tony Butler, of Roth Capital, tells clients that ATRA has big plans to drive value in 2020. First and foremost, the company remains on track to file the BLA for tab-cel, its off-the-shelf, allogeneic T-cell immunotherapy, in post-transplant lymphoproliferative disorder (PTLD) following solid organ transplant (SOT) or hematopoietic stem cell transplant (SCT) with the FDA in 2H20.

ATRA plans to conduct an interim analysis of the Phase 3 trial in Q3 2020, and after this analysis, there will be a preBLA meeting with the FDA, where it will discuss the data generated to date from the tab-cel program in PTLD.

Reflecting another positive, Butler pointed out, “Atara is targeting additional EBV+ ultra-rare indications to increase the market opportunity of tab-cel. For this purpose, Atara will initiate a Phase 2 trial to evaluate tab-cel in up to six EBV+ indications during 2H20.” These indications include leiomyosarcoma, lymphoproliferative disorders (LPDs) related to primary and acquired immunodeficiency, front-line PTLD and first- or second-line CNS PTLD.

On top of this, the company is set to kick off the randomized placebo-controlled portion of the allogeneic T-cell program to treat multiple sclerosis (MS). The program is in a Phase 1 trial that is being conducted in two parts. Looking at the early data, there were distinct improvements in patient outcomes based on the sustained disability improvement (SDI) score.

Expounding on this, Butler stated, “Improvement in patients' disability were particularly pronounced at doses of 20 and 40 million cell doses and Atara chose the 20 million cells dose as the go-forward dose for the randomized phase II portion of the trial. The company stated that if the data show signals indicating an improvement in disability, which can potentially mean a transformational product in the treatment paradigm of MS, then the company may choose to opt for an accelerated developmental pathway.”

It should come as no surprise, then, that Butler stayed with the bulls. To this end, he puts a Buy rating and $30 price target on the stock, suggesting 123% upside potential. (To watch Butler’s track record, click here)

In general, other analysts are on the same page. With 6 Buy ratings and 1 Hold, the word on the Street is that ATRA is a Strong Buy. The $33.60 average price target brings the upside potential to 143%. (See ATRA stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.