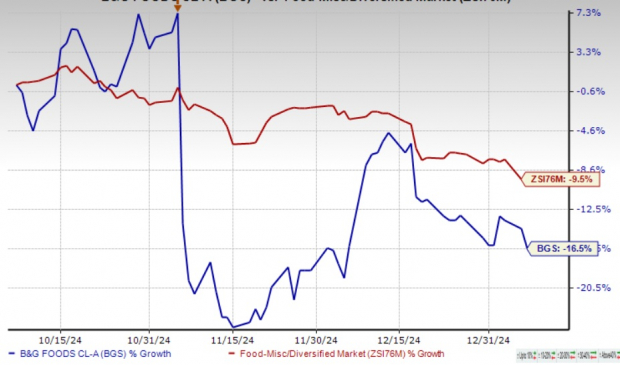

B&G Foods, Inc. BGS is navigating a turbulent operating environment due to broader macroeconomic headwinds, such as food inflation and shifts in consumer spending patterns. While the company has been focused on enhancing its portfolio through innovation and prudent acquisitions, recent performance metrics and guidance paint a concerning picture. The company’s shares have tumbled 16.5% in the past three months compared with the industry’s decline of 9.5%.

Key Concerns Surrounding BGS Stock

B&G Foods’ Foodservice sales, accounting for 15% of total revenues, declined in the third quarter of 2024, reflecting ongoing challenges in the restaurant industry. Broader macroeconomic headwinds, such as food inflation and shifts in consumer spending patterns, continue to suppress demand in both retail and foodservice channels. These structural challenges may delay a full recovery, putting downward pressure on revenues and margins.

Due to these industry-wide headwinds, B&G Foods has been witnessing soft sales for the past few quarters. The trend continued in the third quarter, wherein the top and bottom lines declined year over year. Sales were impacted by the divestiture of the Green Giant U.S. shelf-stable product line (concluded in Nov. 2023), lower unit volumes and consumer purchasing patterns influenced by high food inflation. The company’s adjusted earnings of 13 cents per share slumped 52%. Net sales of $461.1 million declined 8.3% year over year. Base business net sales fell 4.4% to $461.1 million due to lower unit volumes and currency headwinds.

Cost inflation is another concern. In the third quarter of 2024, B&G Foods’ adjusted EBITDA was $70.4 million, down from $80.4 million in the prior year, and the EBITDA margin contracted to 15.3% from 16% in the same period last year. While some deflationary tailwinds were noted in soybean oil and logistics costs, inflation persisted in key inputs such as black pepper, garlic and olive oil, straining gross margins. Sustained cost pressures without adequate pricing power may weigh on future earnings potential.

Image Source: Zacks Investment Research

B&G Foods’ Sluggish Outlook Raises Concerns

B&G Foods revised its 2024 outlook downward on its third-quarterearnings call indicating a slower-than-expected recovery in center store trends and the broader consumer environment. The company anticipates a slow recovery and stabilization only in fiscal 2025, with sequential improvement expected between the first and second halves of the year.

For fiscal 2024, management anticipates net sales in the band of $1.920-$1.950 billion compared with the earlier view of $1.945-$1.970 billion. In fiscal 2023, net sales amounted to $2,062.3 million ($2.06 billion). The company anticipates adjusted EBITDA in the range of around $295-$305 million compared with $300-$315 million projected earlier. BGS recorded an adjusted EBITDA of $318 million in fiscal 2023. Adjusted earnings per share (EPS) for fiscal 2024 are envisioned between 67 and 77 cents, lower than the earlier guided range of 70-90 cents. In fiscal 2023, BGS posted an adjusted EPS of 99 cents.

Strategic Drivers Offer Hope for BGS

B&G Foods has been emphasizing innovation across several key categories to drive growth. The introduction of premium sides and Ramen-based products under the Green Giant brand (scheduled for this fall and next spring) aligns with evolving consumer preferences for convenient, value-added food products. Similarly, Ortega, a leader in the taco sauce category, has a robust pipeline of channel innovations supported by increased marketing investments. This strategic focus on innovation ensures the company remains competitive while tapping into growth opportunities within its high-potential segments.

B&G Foods’ Spices & Flavor Solutions unit continues to be a standout performer, which offered some respite to the company’s third-quarter 2024 sales decline in all other units. B&G Foods reported a 2.6% year-over-year increase in net sales for its Spices and Flavor Solutions segment in the third quarter, demonstrating its ability to capture consumer demand in an otherwise challenging environment. This growth was bolstered by an increased preference for fresh produce and proteins, aligning with health-conscious dietary trends. With Spices and Flavor Solutions being its highest-margin segment, continued momentum here supports both revenue growth and profitability in the long term.

Final Thoughts on BGS Stock

B&G Foods is facing significant challenges, including declining foodservice sales, weak retail volumes and cost inflation that continues to erode margins. While innovation and growth in its high-margin Spices & Flavor Solutions segment offer some promise, investors may want to tread cautiously, keeping an eye on how B&G Foods navigates these hurdles in the near term. The company currently carries a Zacks Rank #4 (Sell).

Some Solid Staple Bets

We have highlighted three better-ranked stocks from the Consumer Staples sector, namely United Natural Foods, Inc. UNFI, Tyson Foods TSN and Freshpet FRPT.

United Natural currently sports a Zacks Rank of 1 (Strong Buy). UNFI delivered a trailing four-quarter earnings surprise of 553.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for United Natural’s current financial-year sales and earnings suggests growth of 0.3% and 442.9%, respectively, from the year-ago period’s reported figure.

Tyson Foods, a renowned meat product company, currently sports a Zacks Rank #1. TSN delivered a trailing four-quarter earnings surprise of 57%, on average.

The Zacks Consensus Estimate for Tyson Foods’ current financial year sales and earnings indicates growth of nearly 2% and 13.2%, respectively, from the year-ago reported number.

Freshpet, a pet food company, presently carries a Zacks Rank #2 (Buy). FRPT has a trailing four-quarter earnings surprise of 144.5%, on average.

The Zacks Consensus Estimate for Freshpet’s current financial-year sales and earnings suggests growth of 27.2% and 228.6%, respectively, from the year-ago period’s reported figure.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.