Warren Buffett watchers know that American Express (NYSE: AXP) is one the investing legend's favorite stocks. It's been a part of the Berkshire Hathaway portfolio for 30 years, and today it's the second-largest position behind Apple, accounting for 15.2% of the total. Berkshire Hathaway owns 21.5% of American Express' outstanding shares, signifying his confidence in the company.

Buffett loves financial stocks. He's a big believer in companies that play a large role in the economy, and financial infrastructure certainly falls into that category. Specifically, he loves bank stocks, because they're cash-rich and they provide the means for the economy to work smoothly. They also typically pay dividends, which demonstrates stability and a commitment to shareholders.

Visa (NYSE: V) is the largest credit card network in the world, but it accounts for only 0.9% of the Berkshire Hathaway portfolio. However, Berkshire Hathaway owns 8.6% of Visa stock, a hefty portion.

So, which is the better Buffett stock to buy today?

Different business models

To the average shopper, Visa and American Express are more or less the same thing; they're both large credit card companies that give shoppers a convenient way to make purchases.

But they have two different models that make for some important differences. Visa's core business is a credit card network, which means it provides the financial pathways to move money between shoppers, partnering banks, and merchants. The partnering banks provide the credit that gets moved from shopper to merchant, and Visa moves the money.

Today, Visa has some new segments in small business solutions and new electronic payment options. It's the largest credit card network in the world, with 4.5 billion cards in circulation.

The main difference between Visa and American Express is that the latter acts as its own bank instead of relying on credit partners, what's called a "closed loop" model. Because it's also a bank, American Express has a broader overall business, with personal accounts and a robust business segment.

For its credit card unit, American Express has only a tiny fraction of Visa's cardmember base, or about 150 million cards in circulation. These differences lead to some interesting results for the two credit card giants.

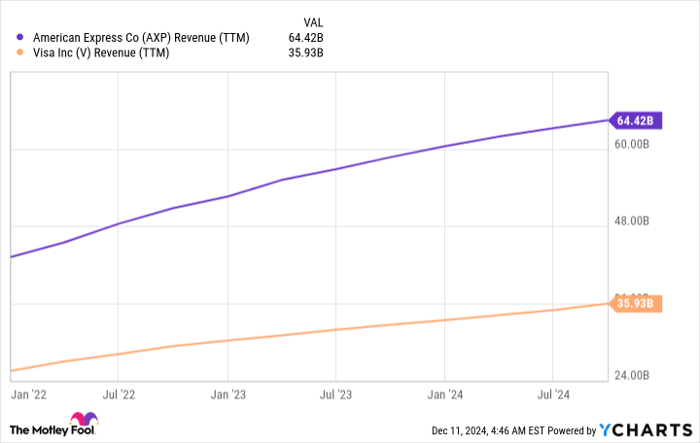

One has much higher revenue, but the other has much higher profits

Although American Express has a much smaller cardmember base, it targets an affluent and resilient clientele that can spend more than the average consumer. It also charges annual fees for many of its cards, and it has a rich rewards program for fee-paying members. Finally, it makes money through its banking segment, including lucrative net interest income on deposits.

So even though you might think of Visa as a bigger company, American Express actually makes almost double Visa's total sales.

AXP Revenue (TTM) data by YCharts

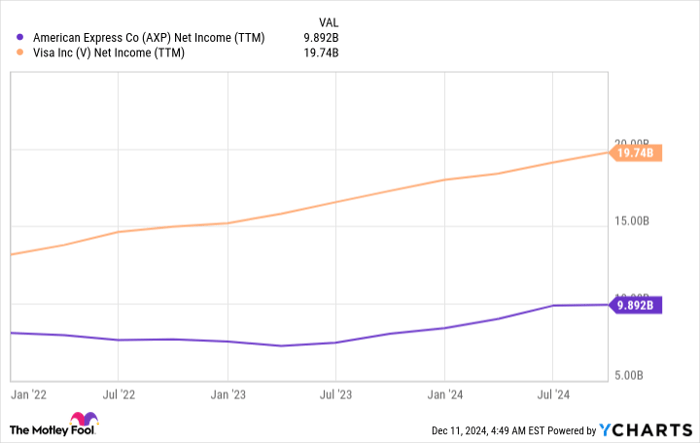

However, Visa has unmatched profit margins. Because it only acts as a gateway, it doesn't need to invest in costly expenses, and each time someone swipes a card, it gets incrementally more money without having to add to fixed costs. At the same time, it doesn't have the same exposure to credit risk as banks like American Express, and it doesn't need to make provisions for losses that come out of net income. Therefore, Visa makes much more money than American Express in profits.

AXP Net Income (TTM) data by YCharts

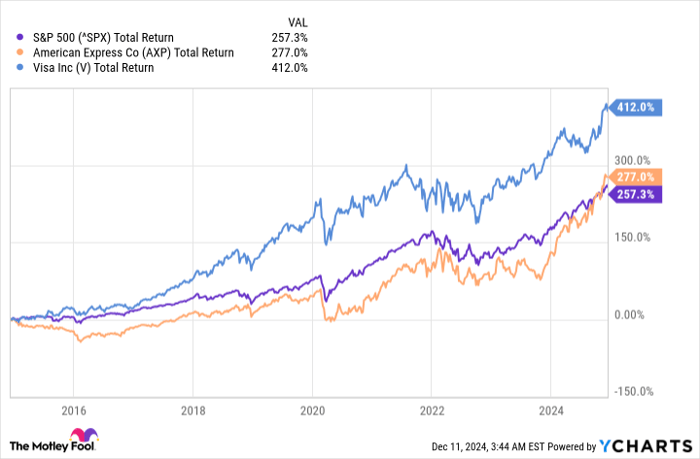

Each has outperformed at different times

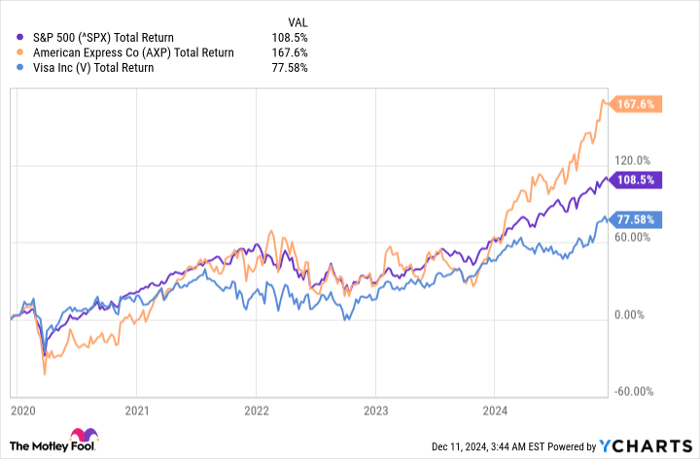

I came into this exercise thinking Visa stock had been a better investment over time. To some extent, that's true. As you go back further, Visa has been a better investment, dividends included.

However, American Express has been doing exceptionally well over the past few years thanks to a new, younger customer base and resilience when there's economic volatility.

Which is the better Buffett pick?

Both of these stocks have something worthwhile to offer investors. But it's clear that Buffett prefers American Express; he's called it out on many occasions. As an American Express stock owner, I happen to agree with him. It has a broader business base and differentiated model that attracts quality, fee-paying cardmembers. If I could only choose one, I'd stick with American Express.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $356,125!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,959!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $499,141!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

American Express is an advertising partner of Motley Fool Money. Jennifer Saibil has positions in American Express and Apple. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Visa. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.