Certain retail stocks have faced difficult times recently. While the economy is generally doing well and remains near full employment, multiple years of above-normal inflation and higher interest rates have stressed consumers.

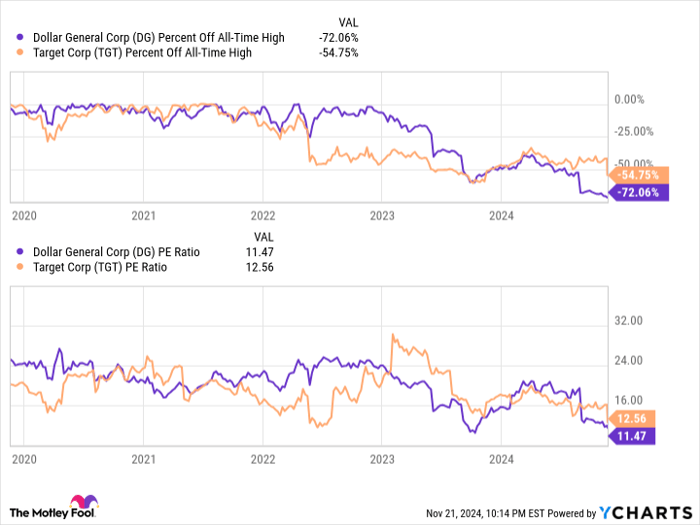

Two retail stocks that have been decimated are Target (NYSE: TGT) and Dollar General (NYSE: DG). Each is far below its all-time highs, and both appear to trade at bargain valuations. But which stock is the better bargain today?

A half-off sale

In the chart below, one can see how far each company has fallen. Target began its descent in late 2021 when many stocks related to home goods and other physical items began to feel the post-pandemic hangover. Dollar General then collapsed in early 2022 and has seen its stock fall even further. While each stock traded at a mid-20s price-to-earnings (P/E) multiple at some point during the past few years, both stocks have seen their valuations collapse, even as earnings have declined.

DG Percent Off All-Time High data by YCharts. PE Ratio = price-to-earnings ratio.

If economic conditions become more favorable, each company could see a big rebound. However, both companies are experiencing similar, though not identical, problems. Can they be overcome?

Less money, more problems

Though they have slightly different core customer profiles, Target and Dollar General are seeing their customers pull back on spending due to inflation, all while costs are rising.

Back in August, Dollar General CEO Todd Vasos noted that 60% of Dollar General's sales come from households making $35,000 or less per year. Vasos elaborated that Dollar General's weakest weeks of the prior quarter were the last weeks of each month. That suggested customers became financially stressed as their monthly budgets ran out.

Perhaps related to this stress, management also noted shrink, or theft, was a 21-point headwind to gross margins. So, even though theft has been a problem since the pandemic, Dollar General still saw higher theft relative to last year.

Target's most recent disappointing quarter showed similar headwinds. While Target's core customer is more middle-class, CEO Brian Cornell noted that its customers have been "shopping carefully," pouncing on promotions when they happen while only occasionally splurging for "important seasonal moments."

On the cost front, Cornell also noted that the company had to spend extra money rerouting inventory to West Coast ports when East Coast dockworkers threatened to go on strike. That added to costs and hurt earnings.

On the plus side, Target's shrink problem actually improved, in contrast with Dollar General's. Still, the disappointing results could also mean heightened competition. Competitor Walmart (NYSE: WMT) posted a favorable quarter, indicating customers may have strayed from Target for Walmart's generally lower prices.

Image source: Getty Images.

Which company is more likely to fix its problems?

Even though Dollar General is down more and trades at a slightly lower P/E ratio, Target appears the safer bet at this point.

While Dollar General had been considered resilient in the face of a bad economy or recession, the high-inflation economy appears to be perhaps even more damaging to its core customer than a recession, with shelter and food prices pressuring lower-income Americans in a broad fashion.

Meanwhile, Target's customers, while certainly hunting for deals, appear to be a bit more resilient and less likely to resort to theft. The shrink issue continues to be a problem that Dollar General can't quite seem to fix, whereas Target seems to be getting a better handle on things in that regard.

And while Target is coming off of a poor quarter, it has also had some good quarters here and there over the past year, with the third quarter's port issues seemingly a one-off phenomenon. Thus, Target has been able to pay down debt faster and lower its debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio, while Dollar General's debt ratio has continued to rise:

DG Financial Debt to EBITDA (TTM) data by YCharts. EBITDA = earnings before interest, taxes, depreciation, and amortization. TTM = trailing 12 months.

While a drastic improvement in the environment or Dollar General's execution could theoretically lead to more upside, Target seems like a safer bet at the moment. Its stock may be worth a look after its recent pullback.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $368,053!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,533!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,170!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 18, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Target and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.